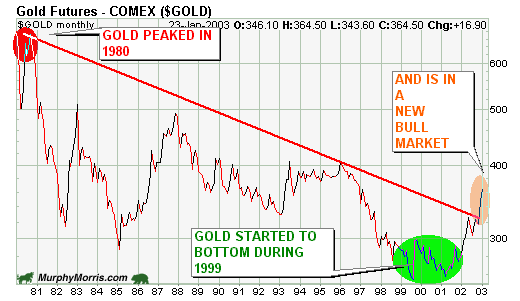

Gold -- Sharefin, 09:00:57 02/04/03 Tue Gold -- Sharefin, 09:00:57 02/04/03 Tue Researcher nails gold-price forecast James Turk uses monetary metric to forecast $434 gold The longtime editor of New Hampshire-based Freemarket Gold & Money Report, Turk instead points to monetary metrics that compare the ascent of gold, or its decline in the 1990s, to government budget spending trends, gold-reserve assets at central banks and the supply of paper money flooding the globe. On Tuesday, for instance, Russia, joining China and several other countries in a shift toward bullion-linked reserves, said its central bank will boost gold and foreign-currency holdings to $55 billion by year's end, a rise of 17 percent. Many countries in Asia that are running large trade surpluses with the United States, among them Taiwan, Japan and China, have less than 4 percent of their foreign reserves in gold, leaving plenty of room for future gold purchases. Turk, in following his early January forecast that the gold price would surpass $370 an ounce in the coming weeks, on Tuesday told me he expects the metal's price to reach $434 an ounce by the end of February, less than four weeks' time. ~~~ The researcher's forecasts are bold in their specific timing and price level. Turk's predictions depart from those found at investment banks in London and on Wall Street, where analysts are reluctant to forecast an average gold price higher than $360 an ounce or so for all of 2003. Turk is confident gold, logging inevitable gains as international investors flee the "dollar bubble," will reach $600 this summer and surpass $900 an ounce by February 2004. Fiat -- Sharefin, 08:38:41 02/04/03 Tue THE WILD WORLD OF GOLDBUGS What do you think of when you think of Goldbugs? Independent sorts, perhaps suspicious of big government? Maybe go it alone Texans? Or the gnomes of Zurich? Well how about Central Bankers? Still calm enough for you, how about Louis Farrakhan and the Nation of Islam? The world of goldbugs is a lot larger than generally portrayed. It is known in some circles that Federal Reserve chairman Alan Greenspan was once very close to Ayn Rand, the pro-free market author of The Fountainhead and Atlas Shrugged, and that at the time he did write some pro-gold tracts. Since becoming chairman of the Federal Reserve, he has certainly been quiet about gold. At least up until recently. This is how Greenspan started off a speech a few weeks back though: “Although the gold standard could hardly be portrayed as having produced a period of price tranquility, it was the case that the price level in 1929 was not much different, on net, from what it had been in 1800. But, in the two decades following the abandonment of the gold standard in 1933, the consumer price index in the United States nearly doubled. And, in the four decades after that, prices quintupled. Monetary policy, unleashed from the constraint of domestic gold convertibility, had allowed a persistent overissuance of money. As recently as a decade ago, central bankers, having witnessed more than a half-century of chronic inflation, appeared to confirm that a fiat currency was inherently subject to excess.” Has Greenspan found Goldbug religion again? Time will tell. Many in the United States and Europe may not be aware but Muslims are also strong believers in gold. Here is how Cedric Muhammad of blackelectorate.com recently wrote about Louis Farrakhan and gold: "In February of 1998, Minister Louis Farrakhan, carrying the mantle of his teacher, raised the idea and possibility of an Islamic gold standard--whereby all of the nations of the Islamic world would tie their currencies together in a monetary union establishing one currency backed by gold . . . Minister Farrakhan has been the most prominent and consistent advocate in the Muslim world for a return to a stable unit of account. The Minister has periodically, publicly and very beautifully articulated the benefits of a gold standard that would accrue to the entire world, through either the return to such by the United States of America or through the establishment of a gold-backed currency in the Muslim world. I have one videotape of a younger Minister Farrakhan doing so, relative to the United States Of America, in 1979!" If this gold run continues for very long, it looks like the goldbug wagon will have a lot more passengers than any one expects and the fuller the wagon the higher the price. That's basic supply and demand for Christians, Muslims and Central Bankers. Fiat -- Sharefin, 08:37:25 02/04/03 Tue CRITICAL DISSENT: DOLLAR OVERHANG AND THE PROSPECTS FOR INFLATION Second. Inflation sentiment is clearly biased towards deflation at present, as evidenced by the quote from Dr. Yardeni above. This is the factor that up to this point has changed the least. But our belief is that the fears of climbing inflation, once stoked, will not result in years of incubation that, say, took place in the 1960's . Too many people have very clear memories of the late 1970's- early 1980's. That period, in a sense, was an education period for individuals. It taught them what to do and what to buy when inflation strikes. What took them years to learn back then, they will be able to put into practice in just weeks this time around, once they believe inflation is a threat again.(We believe, for example, it is possible for gold to spike from its current level to $1000 per ounce in just weeks, once inflation fears take hold.) Fiat -- Sharefin, 08:34:40 02/04/03 Tue Musings The Austrian school of economics tells us that economic imbalances and distortions caused by excessive credit creation will be balanced by economic imbalances and distortions caused by credit contraction. The iron clad rule that growth caused by debt creation will be balanced by economic contraction caused by debt servicing is at the core of our economic situation in my humble opinion. We can continue the foolish process of creating more debt, or we can bite the bullet and begin to deal with the fundamental reality of excessive debt and its implications for our nation and world. Unfortunately, the current political and economic leadership is incapable of telling the people the truth, much less offering a coherent plan to deal with what's coming down the road. So be it. The storm is upon us; the ship is unprepared for it. It will not be pretty, but balance will be restored eventually. I'm just not sure if people understand what that simple sentence implies. People, as well as nations, reap what they sow. In economic terms, we have built a huge edifice based upon the ideals of economic growth fueled by debt and financial hocus pocus. That edifice is now sending chunks of itself crashing all around us with increasing frequency. In my opinion, the officially sanctioned doomer one that is, the entire debt based economy will come crashing down to earth. I take no pleasure in saying this. I fully understand the pain and anguish, the shattered hopes and dreams, this will cause. Still, I tell it like it is as one of my emailers so aptly put it. I call the chips, or in this case chunks, as I see them. Fiat -- Sharefin, 05:49:24 02/04/03 Tue The Austrian school of economics tells us that economic imbalances and distortions caused by excessive credit creation will be balanced by economic imbalances and distortions caused by credit contraction. The iron clad rule that growth caused by debt creation will be balanced by economic contraction caused by debt servicing is at the core of our economic situation in my humble opinion. We can continue the foolish process of creating more debt, or we can bite the bullet and begin to deal with the fundamental reality of excessive debt and its implications for our nation and world. Unfortunately, the current political and economic leadership is incapable of telling the people the truth, much less offering a coherent plan to deal with what's coming down the road. So be it. The storm is upon us; the ship is unprepared for it. It will not be pretty, but balance will be restored eventually. I'm just not sure if people understand what that simple sentence implies. People, as well as nations, reap what they sow. In economic terms, we have built a huge edifice based upon the ideals of economic growth fueled by debt and financial hocus pocus. That edifice is now sending chunks of itself crashing all around us with increasing frequency. In my opinion, the officially sanctioned doomer one that is, the entire debt based economy will come crashing down to earth. I take no pleasure in saying this. I fully understand the pain and anguish, the shattered hopes and dreams, this will cause. Still, I tell it like it is as one of my emailers so aptly put it. I call the chips, or in this case chunks, as I see them.  Gold -- Sharefin, 05:31:43 02/04/03 Tue Gold -- Sharefin, 05:31:43 02/04/03 Tue WHY PRECHTERIAN THEORY IS WRONG ON GOLD The important point for gold in all this is whether Elliott Wave theory shows the 20 year bear market from 1980 to 2000 to be ended, or is gold's bear market merely correcting, and doomed to be resumed eventually finishing at a lower price down the road? If the last two years of price action has formed a solid impulsive wave up, then the bear market is over. If, however, the price action is forming a corrective wave up, then the bear market is to be resumed. The foremost practitioner of Elliott Wave theory, Robert Prechter, has stated for the past two years now that gold is merely correcting. The wave pattern up throughout 2001 and 2002, he maintains, is not impulsive. It is a corrective wave only, and the 20 year bear market will continue on in the deflationary Kondratieff winter, with gold eventually selling for under $200. I am not a card carrying expert in Elliott Wave theory, but I do understand its basics, having read most of Prechter's books and having charted countless wave patterns of the Dow, the S&P, the Dollar, Gold, and Silver, etc. in the markets for the past seven years. I have the utmost respect for Robert Prechter. His work over the past 25 years in formulating a cogent exposition of Elliott's theory of price movement is a masterpiece of clarity and understanding. He has integrated it all into the Kondratieff Cycle theory, and has added a vast array of prescient insights to further the body of knowledge that Elliott began. This has enlightened us all in many ways. But that being said, the primary question is whether gold's bear market is over. The question is whether the wave pattern for 2001 and 2002 is impulsive or corrective. Is Mr. Prechter right, or has he perhaps succumbed to a flawed analysis of what is taking place today? I believe it is the latter, that he has made a wrong call on gold, and that the price action of the past two years is indeed impulsive.  If we consider the above price pattern as a double bottom, then impulse Wave (1) up begins in April of 2001 at $255 and takes us to about $290 during the month of May 2001. Correction Wave (2) then commences and takes prices down to $265 by July of 2001. From there, a subdivided impulse Wave (3) begins and takes prices to $330 in June of 2002. From there, correction Wave (4) commences and takes prices back to $298 in August of 2002. From there, impulse Wave (5) begins and takes prices to the $360-$370 range that we are now in. This is as clear a 5-wave pattern as any chart technician could ever ask for. It is a perfect 5-minor waves up, which will form major Wave 1. The entirety of major Wave 1 is either ending now (and due for a correction), or it is still unfolding with its fifth segment perhaps due for some more upside movement, maybe even as high as the $400-$410 area before correcting down, and then heading up again for major waves 3, 4 and 5. This is James Sinclair's reading on it, and it makes for a powerfully bullish case in a technical sense. ~~~~ Gold's Bullish Fundamentals This is why gold has such powerful potential at this juncture in history. Its fundamentals are incredibly bullish: 1) There is a deficit every year in production, so the supply and demand ratio is favorable. 2) The Fed has indicated that it will print up paper dollars and drop them out of airplanes if necessary to avoid deflation. 3) Our nation is running the largest trade deficit in history. 4) Congress has embarked upon massive deficit spending. 5) American citizens are in debt up to their eyebrows. 6) Many major banks are involved in highly dangerous derivative trades that could come unwound. 7) Terrorism grows with every year to wreak havoc in the minds of investors and create a world rife with insecurity. 8) Third-world countries are honoring their debts like Hollywood stars honor their marriages. 9) We are no longer a producer nation, but a mass of pampered consumers with a gang of counterfeiters leading us from Washington. 10) The dollar has entered a bear market that should extend for several years. The chain of bullish fundamentals acquires new ominous links with each passing month. It points to $500-$600 gold near-term, and quite possibly much higher long-term. But still, there has always remained in the back of many investors minds who follow Elliott Wave analysis, a fear of the bearish scenario that deflation portends. With Prechterian newsletters shouting every week for the past two years that "Gold is topping," and maintaining that the upward waves of 2001 and 2002 are "clearly corrective," these investors have remained pulverized on the sidelines, and some of them even short in the market. In my opinion, this is clearly wrong. The chart above (when combined with all the fundamentals of gold) strongly indicates that the upward waves of 2001 and 2002 are NOT corrective; they are impulsive. The bottom for gold is in. We have a bull market. It will be volatile and messy. It will involve corrections that drive us to despair. And it will climb an endless wall of worry. But we have the beginnings of a classic bull market. Gold -- Sharefin, 05:19:46 02/04/03 Tue Blanchard Commentary Not long ago, Gold Fields Mineral Services, Ltd. published its Gold Survey 2002--Update 2. The report began with the following: "Dehedging in 2002 added to demand for the third consecutive year with a record 352-tonne decline in net outstanding producer positions." When producers de-hedge, or close out short positions, they add demand to the market, since they can close out their short positions only by delivering gold in repayment of the borrowed gold. In 2002, global de-hedging, or the net amount of short positions that were closed out by the world's gold producers, added 11.3 million ounces of gold demand. Obviously, in a market in which all of the major gold producing nations combined, on an annual basis, produce less than 65 million ounces, 11 million ounces is a big number. Of that 11.3 million ounces, 5 million ounces represented short covering by Barrick that took place in only 6 months (from April through July, 2002). Even in normal circumstances, the size of Barrick's position would have been large enough to have a significant impact on price. That impact is magnified by the fact that "the gold market has suffered massive loss of liquidity, giving up roughly 60% of its trading volume over the past few years. This lowered liquidity has been reflected in more pronounced moves..." (Precious Metals Advisory, CPM Group, January 22, 2003). However, what we have seen is just the beginning. The expected increase in investment demand that would produce a breakout in the price of gold is predicated both on the granting of the injunction against Barrick and J.P. Morgan and also on the idea that investors find very few attractive places to put their money. + The dollar has declined 9.2% since its February 2002 peak and many analysts still consider it to be overvalued, conscious of the fact that it is still 22.8% higher than its 1996 low and that, in this environment, money can be expected to flow out of U.S. dollar-denominated investments and into gold and other tangible assets. None of the analysts show much enthusiasm for the euro, pound sterling, yen or any other currency. + Interest rates are very low, but few analysts believe that we will see a major rally in rates over the next 12 months, giving little incentive to investors who would like to park their savings in money market funds. + The $7 trillion in losses that stock investors have suffered since 2000, along with the revelations of accounting, legal and ethical improprieties, have made shareholders deeply suspicious that the markets are rigged against them. Investors took more money out of stock mutual funds in 2002 than they moved into them, according to Lipper, the mutual fund analysis firm. + This has been the longest bear market since the 1940s and the equal of the 1973-74 cycle as the steepest of the post-WWII period. Threats of war, disappointing earnings and continued worries about the economy suggest that markets may get worse before they get better. Corporate earnings are deteriorating, economists are reducing their growth forecasts, a war with Iraq is on the horizon, and the bottom in the stock market may be quite a way off. + The outlook is bleak for most of the major industrial economies and for international financial markets. + All of this is being played out against a background of military and political uncertainty and the constant threat of terrorism in the United States and Europe. During such times as these, Harry Markowitz, a Nobel Laureate in Economics and the "father of modern portfolio theory," said that the function of gold and other tangible assets was to serve as a Defensive Asset Class--one that consisted of assets whose appreciation could be expected to be proportionate to the depreciation in financial assets during periods of economic, financial, political and military turmoil. Based on increases in prices of tangible assets, and the renewal of investment demand for those assets, we appear to be at the very beginning of the stage of the economic cycle for which Dr. Markowitz prescribed gold and other tangible assets as the safe haven of choice for investors. Gold -- Sharefin, 22:51:22 02/03/03 Mon Gold at 7-yr peak in Asia, platinum blasts higher Gold vaulted to a seven-year high in Asian morning trade on Tuesday as speculators poured money into gold futures on the Tokyo Commodity Exchange ahead of a key speech by U.S. Secretary of State Colin Powell. Platinum (XPT=) also surged, topping $700 an ounce to forge a new 23-year high as funds and speculators piled into TOCOM, encouraged by supply concerns and forecasts of increased fuel-cell demand. Gold was bid as high as $374.25 an ounce -- a summit not scaled since December 1996 -- before easing back to $373.75/374.50 by 0200 GMT. That compared with a bid price of $371.10 last quoted in New York. Koji Suzuki, a commodities analyst at Itochu Futures Corp, said Japanese investors were increasingly nervous at the prospect of a U.S.-led attack on Iraq. "On top of that, the yen has softened on speculation over a new Bank of Japan governor," he said, referring to talk that a proponent of inflation targeting was likely to take charge of the central bank. ~~~ On Monday, TOCOM logged its busiest day in its half-century history as speculators flocked to precious metals and energy contracts. Open interest for TOCOM gold soared, jumping to 451,136 lots from 428,996 lots the day before. A lot is one kg. ~~~ PLATINUM ON A ROLL Speculative and fund buying on TOCOM pushed platinum as high as $705/710 an ounce by 0200 GMT, a level not seen since March 1980 when the white metal hit $1,047.50. It was last quoted in New York at $698/708. Platinum was fetching $705/710 an ounce at 0200 GMT, up from $698/708 last quoted in New York. Platinum, used mainly in automobile catalysts and in jewellery, has gained more than 17 percent this year, supported by increasing demand from the auto sector, a global supply deficit and fears of output disruptions in top producing countries. Last week, the metal got a boost from a call by U.S. President George W. Bush for greater research into fuel-cell technology, which relies on platinum to create electricity without pollution. Fiat -- Sharefin, 21:40:00 02/03/03 Mon Why the lousy market? It's the Fed, stupid Iraq is dominating and will dominate the headlines in the days ahead, but Iraq is not the real cause of our economic malaise. As the Iraq battle looms, the battle of the stock-market bubble lingers. The policies of its founding father, Federal Reserve Chairman Alan Greenspan, continue to inflict widespread pain. But to judge by the headlines in the mainstream financial media, all our troubles fall at the doorstep of Saddam. While news of his "departure" cannot come soon enough, it's high time that Alan Greenspan's pivotal role in our problems made headlines as well. For those readers new to the Contrarian Chronicles, I'd like to review my thoughts about our chief central banker. The bubble that was fomented under his watch during the 1990s precipitated the wild misallocation of capital and recklessness on the part of individuals who believed that Greenspan would save them. While this illusion held sway, people believed in flights of fancy like Internet stocks, stock splits, "beat the number," etc. The fervor of their belief was ultimately expressed in the Nasdaq reaching its 5,048.62 peak in March 2000. The unwinding of that wild orgy is still our problem, exacerbated by a Fed and government still determined to fight off the "destructive side of capitalism." Capitalism is the best economic system around, but it does come with bad times that follow good times. Of course, those bad times help set the stage for the next round of good times. Trying to stop the destructive side of capitalism only leads to huge problems. In the 1990s, the Fed believed it was an omnipotent central planning agency, capable of steering us from good times to better times. Regrettably, lots of people checked their thinking caps and common sense at the door, as they willingly suspended disbelief. So, to that extent, they were not blameless. The butcher of monetary policy However, more should be expected of Fed officials. Sadly, Alan Greenspan refused to stand up like an adult and, in the words of one of his great predecessors, William McChesney Martin, "Take away the punch bowl." (Martin was Fed chairman from 1951 to 1970 -- the longest tenure ever in the post.) The excess capacity, reckless behavior and accumulation of debt spawned by a bubble that Greenspan fed are still the problems that plague us. Only time will cure those problems. Attempts by Fed heads such as Mr. More-Beer McTeer (aka Robert McTeer, president of the Dallas Federal Reserve Bank) to minimize them, by telling people to continue consuming, will only make the situation worse. Fiat -- Sharefin, 21:13:07 02/03/03 Mon Joy Ride to Global Collapse Here's a prediction for you. In the next two decades millions of Americans will begin a serious search for an alternative to the gasoline-powered automobile. It is not going to be a happy search. If you think trying to wean gun owners from their passion for firearms is a hornet's nest, try talking to the great majority of us about reining in our passion for the automobile. Lordy! And yet, most of us agree there is a problem, vaguely phrased as, "There are too many other people out there clogging up the highways and slowing me down." Otherwise our attitude is similar to the rabid firearms bumper sticker: "You'll get my car when you pry my cold, dead fingers from around the steering wheel." No one is talking to us about giving up cars today - even though there is hard scientific evidence that the freewheeling automotive world we know today will have totally vanished within the lifetime of most of us now living. A few idealists are talking about maybe getting us to constrain our use a little bit. None of them are running for any position of political influence in this country. They would be lucky to get their family's vote. We don't want to hear it. Auto mania is not confined to Americans. The love affair is international and now grows fastest in the nations of the Second and Third World. Humanity burns 70 million barrels of oil a day. At the present rate of increase, it is projected we'll be burning 100 million in 20 years. But we'll never get there. We are close to that peak of global production which was foreseen almost half a century ago by Dr. M. King Hubbert, the foremost petroleum geologist of his day. (See link at the end of this column.) The descent from that peak only takes a few decades. We know that petroleum is a finite resource. But even as gasoline prices begin to creep upward some time in the not-too-distant future we won't curtail our driving until real supply shortages absolutely force the issue. Take a look at an ugly future scenario: The sudden, agonizing death of the private automobile is a wall that global society will hit full speed, pedal to the metal when a global petroleum crisis finally catches up with us. We will not accept any solutions that will soften the impact until the real shortage hits us at some time (early) in the next century. If we continue to fail to take any reasonable steps to prepare for it, and it comes upon us thus, the constriction of the petroleum base of our global economy is quite likely to begin a plunging, bucking, gasping downward spiral towards a deep and lasting depression-with-inflation that could virtually end modern times as we now know them.  Gold -- Sharefin, 21:05:26 02/03/03 Mon The Case for Gold - James Grant The metal will do well in a time when inflation is heading up and short-term interest rates are negative. Don't be misled by those who say commodity prices will stay low. ~~~~ The paradox of gold is that it can be the finest speculation and the poorest investment. Though indestructible and lovely to behold, the barbarous relic earns no interest. And--what is much, much worse--it earns no interest on interest. Gold was the right thing to bury in A.D. 680 and the wrong thing not to dig up and invest in Microsoft at a split-adjusted price of 18 cents a share in March 1986 A.D. (Today, 17 years later, the price is $51, a 283 bagger, as Peter Lynch might say.) Knowing when danger is advancing and receding is the rarest insight in investing, and it helps to explain the paucity of sextillion-dollar fortunes in The Forbes 400 list. Now, walking out of the Fed into the bracing winter cold, one is faced with the question: Is risk advancing or receding? I say it's advancing. Nominal interest rates are low, government bond buyers are complacent and central banks are easy. Much to the dismay of finance ministries in Japan and Europe, the dollar exchange rate is falling against the yen and the euro. This is not because the Fed is objectively tight. For the first time in a decade the "real" federal funds rate is negative (i.e., a 1.25% funds rate minus the 2.4% year-over-year gain in the December consumer price index is a negative 1.15%). Ben S. Bernanke, one of Alan Greenspan's new hires at the Federal Reserve Board, reminded a Washington audience in November that the Fed has a marvelous invention for fighting deflation. This device is called a "printing press," said Bernanke, one of America's foremost monetary economists. With it the government can "produce as many U.S. dollars as it wishes, at essentially no cost." On Jan. 9 an auction of ten-year Japanese government bonds was 18.6 times oversubscribed, although their coupon was only 0.9%. For perspective, Haruhiko Kuroda, one of the top contenders to take over the governorship of the Bank of Japan when the job becomes vacant in March, has pledged to print enough yen to push his nation's inflation rate to 3%. And nobody believes him. I believe him, and I believe Bernanke. And I also believe that the First Eagle SoGen Gold Fund and the Tocqueville Gold Fund (to name only two of the better-performing gold mutual funds) will go on delivering a better return than the interest-bearing securities of the governments that run the printing presses. Gold -- Sharefin, 19:50:38 02/03/03 Mon Silver versus Gold Gold tends to out-perform silver during those periods when confidence in the US$ is falling and/or the US economy is weak. When the US$ is strengthening and/or the prospects for the US economy look bright, silver tends to out-perform gold. Also, once a trend in the silver/gold ratio has been established it tends to last for a decade. Gold -- Sharefin, 06:54:15 02/03/03 Mon Gold fever thrives on uncertain times: Be wary War. Crazed dictators. Smallpox. War with crazed dictators who may have smallpox. What more could a gold investor ask for? Gold prices have soared to a five-year high above $365, propelled by fears of war with Iraq. But gold has been rising since mid-2001. Is this gold rally the real deal, or just war jitters? Quite possibly, a mixture of both. Fear has accelerated the rise in gold prices recently. Basic supply and demand imbalances may push gold higher in the long term. If you're thinking of gold-digging, wait until the Iraqi crisis plays out. If peace breaks out, you'll get the chance to buy at lower prices. Gold is the currency of last resort. Investors buy gold when faith in the government falters. You can generally trade gold for food or shelter even when the government has collapsed. Gold also rises when governments print too much money, and inflation rises. But inflation is deader than a dinosaur: The consumer-price index rose just 2.4 percent last year. What is pushing up gold prices? Let's start with the stock market. The Standard & Poor's 500-stock index has tumbled more than 40 percent since its March 2000 peak, and some investors don't trust paper profits anymore. "Gold is something you can hold in your hand and peg its value," says Gary Adkins, a gold dealer in Edina, Minn. Then there's global unrest. Nothing makes investors quite as skittish as war, particularly when nuclear or biological weapons could be used. They buy gold as a hedge against disaster. Some estimates put gold's "war premium" at $24 to $30 an ounce. If war no longer is a factor, that premium could vanish, and gold prices could fall. "Gold peaked the day the bombing started in the first Gulf War," says Mark Johnson, manager of USAA Precious Metals & Minerals fund. The dollar's decline on foreign exchange markets helps gold, too. Priced in U.S. dollars, gold has become cheaper for foreign investors to buy. Gold -- Sharefin, 06:49:12 02/03/03 Mon Output Drop, Less Hedging Good For Gold-Newmont The gold price looks poised for steady gains over the next few years as mining companies reduce output, while stepping up efforts to pay down their hedge books, said Wayne Murdy, chief executive of Newmont Mining Corp. (NEM), the world's largest gold producer. "Various reports are suggesting that mine production could fall between 2% and 4% annually over the next few years," Murdy told Dow Jones Newswires over the weekend. Mining companies drastically scaled back their efforts to find new pockets of gold in the late 1990s as the price of bullion tumbled to less than $255 a troy ounce in 1999 from over $400/oz in 1996. "I believe that the industry spent roughly $4 billion on exploration in 1996, but this amount fell to only $1 billion in 2000," Murdy said. Because so many picks and shovels were idled in the late 1990s, the supplies now hitting the market are smaller. "This situation cannot be turned around overnight," said Murdy, explaining that the duration from making a new discovery to actually bringing that metal onto the market can be as long as seven years. Newmont is expected to have chiseled some 7.5 million ounces of gold out of its mines in 2002. Murdy said output in 2003 is expected to be slightly lower than the 2002 level due mainly to the selling off of some non-core operations. Big Hedge Reversal Another factor that has Murdy bullish on the gold price is the growing reluctance within the industry to hedge future production. During the industry's lean years of the late 1990s, many mining companies locked in prices for huge chunks of their future production by selling forward contracts that obligated them to deliver gold at a set date in the future. This hedging strategy protected the miners from a further drop in the gold price, but the downside has been that these companies are now unable to fully benefit from the recent surge in the gold price. Last year Murdy orchestrated a $4 billion deal that allowed Newmont to acquire Australia's Normandy Mining and Canada's Franco-Nevada Mining, and in the process transform his company into the world's largest gold miner. However, this transaction, which Institutional Investor magazine named its "Deal of the Year", left Newmont saddled with Normandy's bulging hedge book of some 10 million ounces - a somewhat ironic turn of events considering Newmont has always been known for its "zero hedging" policy. Staying true to its reputation as a non-hedger, Newmont has been working hard to dispose of Normandy's hedge book. "Our third quarter projections call for this hedge book to be reduced to 5.5 million ounces by the end of this year. We see this hedge book as a liability and I would like nothing better than to be completely done with it," Murdy said. Newmont has no exact timeframe for completely eliminating this hedge book, but Murdy hopes to have it dow ~~~~ Looking ahead, Murdy is very bullish on gold prices. In addition to reduced production and smaller hedge books, he says the sluggish global economy, low interest rates, a weaker U.S. dollar and a possible war with Iraq all point to higher prices. "My crystal ball is no better than anyone else's," said Murdy, declining to make any specific price predictions. "But the situation for gold over the next several years looks very positive." Gold -- Sharefin, 06:46:32 02/03/03 Mon Why is the Gold price going up - vigorously - and what makes it do so? - pdf file We were asked the question, " What makes the gold price rise?", and the answers are not difficult to detail, but we realised that we were being asked the wrong question. The wrong question because a list of factors would be like a pile of bricks. One can't see what the house will look like, unless you see the Architect's plan of the house, as well. Likewise, it is the interaction and impact of different factors, as well as the timing and the proportion, relative to the rest of the factors, that will decide the shape of the bull market, the price levels achievable as well as the extent of the bull market, and gold's future. Most readers have been taught that gold is a commodity, a relic of simple brutish days when, man was too backward to develop a sophisticated monetary system, such as the one we have today. Simply put gold id thought of as a "Barbarous Relic"! We can only warn those who think that way, to walk carefully, because they don't understand the road they're on. First we will describe the bricks of the gold world, which have contributed to this recent price rise. Later, we will describe these, we hope, in a way that will bring perspective to you and an inkling of where the price is headed. Gold -- Sharefin, 06:43:15 02/03/03 Mon Monthly Mutual Funds: Going For The Gold: Precious-Metal Funds Glow Amid Continued Anxieties; Wrong Step For Latecomers? GOLD IS ON A ROLL again, and the metal's renewed glitter is proving hard for some investors to resist. Beaten up by three years of stock-market declines, these investors have hunted high and low for something -- anything -- that might win them back some of their big losses. And gold certainly seems to fit the bill. Gold funds outpaced every other fund category in 2002 with a gain of more than 63%, compared with a loss of 22.4% for the average diversified U.S. stock fund and a drop of 22.1% for the Standard & Poor's 500-stock index. That stellar 2002 return propelled gold funds to the top of the performance charts for any fund category in the latest three- and five-year calendar periods as well. With gold prices pushing still higher in 2003, gold funds have continued to shine this year, gaining an average of 1.57% through Wednesday. While gold portfolios remain among the smaller fund groups in terms of assets, investors added $829 million in new money to their gold-fund holdings last year, according to fund tracker Lipper Inc. At the same time, investors were cashing in shares of stock funds in general, withdrawing a net $27.1 billion, according to the Investment Company Institute. Gold -- Sharefin, 06:40:27 02/03/03 Mon Russian gold, forex reserves could hit $55 bln in 2003 The Central Bank of Russia's gold and foreign-exchange reserves could total approximately $55 billion at the end of 2003. "I don't think the reserves will grow as fast as they did last year because how much foreign exchange enters Russia depends so much on oil prices," Oleg Vyugin, a CB first deputy chairman, told Interfax. "We'd venture to say that the reserves will be about $55 billion," Vyugin forecast. He recalled that in 2002, the gold and forex reserves grew $11.17 billion to $47.79 billion.  Gold -- Sharefin, 06:39:02 02/03/03 Mon Gold -- Sharefin, 06:39:02 02/03/03 Mon Gold - Insurance For 2003 And Beyond There are four basic reasons investors reject gold as an investment. First, as an asset class it is very small relative to other financial instruments. This restricts its ability to function as a store of wealth in modern economies. Second, for the past twenty years gold and most gold equities have underperformed equities and bonds by a wide margin. This factor is very important with the new generation of investors. Third, investing in gold has been associated with manias and stock frauds. This factor is very important with many veteran investors who have had painful gold investing experiences. The fourth reason is a fear that the Central banks having no further use for their gold will dump it onto the market and destroy gold prices. Against these arguments, there are four basic reasons to own gold. First, a devaluing dollar will cause gold prices to rise. By definition if the dollar is going to fall something must go up. Gold is one of the obvious candidates. Second, the demand supply outlook for gold continues to be very strong. Global demand is approximately 3500 tonnes per year with production at 2500 tonnes. The difference is made up of scrap and Central bank sales. Third, the global level of political and economic turmoil makes gold an attractive store of value. This applies to countries with unstable banking systems including obvious candidates like Argentina and Japan. Fourth, gold is quite likely to play some role in any future realignment of the international reserve currency. Given the pressures on the US monetary authorities to finance deficits, fund a global war on terrorism, fund military campaigns like Iraq and to continue to stimulate consumer spending in the US, it is difficult to imagine that the dollar's reserve currency status will not be challenged over the next ten years. In the following discussion, it goes without saying that there is no absolute certainty in my arguments for gold. There are risks on all counts. We could even face a situation in which there is significant deflation that triggers a fall in nominal gold prices. However, I think it is also time for the critics of gold to answer investors concerns about how to protect capital. The oracles and denizens of Wall Street continue to offer platitudes about the long term virtues of equity investing despite the fact that we are now heading into a possible fourth year of negative returns. ~~~~ Conclusion The case for investing in gold is very strong based strictly on the foregoing discussion. This is particularly true in comparison to the outlook for other financial assets. Equities are for the most part still on high valuations and companies will have difficulty maintaining current earnings given the economic outlook. Bonds are at historically low yields and only offer further capital appreciation in a dire economic scenario. Cash has almost no yield and is subject to currency volatility. On this basis alone, gold is an attractive investment candidate. Additional Considerations The foregoing discussion has left untouched a number of potentially explosive controversies in the gold market. The financial press has reported a lawsuit against JP Morgan and Barrick Gold involving their hedging activities. The suit alleges collusion to maintain low prices. Rumours continue to circulate about potentially substantial losses at JP Morgan and Citigroup because of their gold hedging positions. Some sceptics have even questioned whether the Central banks actually still hold all of their gold in bullion form. They are rumoured to have loaned out some gold to short sellers. We neither intend to enter into this debate nor are we basing our investment recommendation on substance to any of these rumours. We will however make two observations. First, gold has been in a bear market for 22 years and shorting gold has been a “sure thing.” In such a market it would be very unusual if some market participants did not overplay their hand. Second, the banks involved in the gold derivatives business have been shown to bend the rules on investment research and tax structures for Enron, Worldcom and other corporations. It would be reasonable to assume that they may also have been aggressive in their gold derivative activities. Gold -- Sharefin, 05:21:58 02/03/03 Mon NEWMONT: MORE QUESTIONS THAN ANSWERS Is it possible that a walk out by the International Operating Engineers Union #3 now in Negotiations with Newmont Gold could shut down 1/3 of North America's Gold Production indefinitely? Has this Union recognized the potential impact of run away gold prices on the financial affairs of Newmont Mining? Does this Union understand the implications of Newmont's gold derivative hedge position that Newmont inherited from the acquisition of Normandy? Gold -- Sharefin, 23:44:56 02/02/03 Sun Gold: Indians get it right AS world gold prices recently breezed past the $370 (per troy ounce) mark, it is likely to have left behind a trail of unhappy investors. For few investors would have foreseen in January 2002 that gold would be among the best performing investments in the coming year, appreciating by 33 per cent in a single year. In reality, it has taken a potent cocktail of adverse circumstances to rekindle interest in gold. Potent cocktail: Fears of a conflagration in Iraq alone may not have been enough to spark a gold price rally. The earlier edition of the Gulf War, in 1991, barely caused a ripple in gold prices. Poor performance of the leading stock markets of the world, too, may not have done it. For if this was the case, gold prices should have begun their uptrend in 2000, when the stock markets abruptly shifted gear, from a 23 per cent positive return (measured by the S&P Global 1200 index) in 1999 to a 12 per cent negative return in 2000. Yet gold prices remained stuck in a narrow band between $270 and $310 for whole of 2000, actually losing value through the year. The prospect of economic recession in several parts of the world too may not have been enough to trigger the gold price rally. Gold prices barely appreciated during the Asian economic crisis of the 1990s. But this time round, all of these events have occurred at practically the same time. On the one hand, 2002 was the third successive year of decline in the major stock markets of the world. With interest rates plunging to their lowest level in several decades (a 40-year low in the US), investors disappointed with equities could not turn to bonds for better returns. On the other, the weakening US dollar has waned the attractiveness of the US as a haven for institutional investors and central banks looking to stash their assets. Therefore, it is the drought of attractive investment avenues, topped by war fears, which has persuaded investors to look for a safe haven in gold.  Gold -- Sharefin, 23:37:21 02/02/03 Sun Gold -- Sharefin, 23:37:21 02/02/03 Sun Hedging In Gold Funds Can Bring In Frozen Assets To Markets As the government of India develops better asset management skills, I would expect that the effective utilisation of our two most valuable assets - people and gold - would improve considerably, pushing economic growth to a permanently higher orbit. Getting the most out of it, our people require a permanent and clear commitment to education. While no finance minister has yet been able to consider this effectively, the good news is that the market is taking charge. Education is set to become the next boom industry. Equally, there are considerable rumblings in the market of plans to create value out of our second most valuable asset gold. Various estimates put India's gold holdings at 13,000 to 30,000 tonne. At today's prices, the value of these gold holdings would be $165 to 375 billion - that is 25 times our celebrated foreign currency reserves. The vast bulk of this asset is not managed at all - in other words, earns no financial return. To get an estimate of the wastage, let us assume by magic that all of our gold could be sold off and the proceeds invested in US government securities - this would produce an income of 3.5 to $7.5 billion (17,000 to 40,000 crore) a year, sufficient at the high-end to cover the government's annual budget deficit. Gold -- Sharefin, 23:24:55 02/02/03 Sun Gold Stocks' Glitter Seen Undimmed Canadian gold-mining stocks haven't hit the ceiling yet, analysts say, even though surging bullion prices and war fears have already lifted them about 20 percent in the past year. ~~~ "We are only at the beginning of a multiyear bull market for bullion," said John Ing, president of Maison Placements Canada. Improving supply-demand fundamentals, a weakening U.S. dollar and growing world political tensions allowed medium-sized Canadian gold companies Nevsun Resources Ltd. and Goldcorp Inc. to offer investors some of the best returns in 2002, while heavyweights failed to rack up the same gains because they rely more on hedge positions. Hedging lets companies bet on changing prices, but a rising gold price can make it tough to fulfill hedging contracts. ~~~ Lingering worries over corporate outlooks and a possible U.S.-led war with Iraq have been dogging the market and keeping equities in a tight trading range. Gold stocks could get a lift on Wednesday when Secretary of State Colin Powell is expected to unveil "information and intelligence" about Iraq's alleged attempts to hide its weapons of mass destruction. "I think the war issue is a nuisance because it just puts noise into what is a fundamentally strong rationale for higher gold prices," said George Topping, an analyst with Sprott Securities Inc, who estimates a $10 to $15 an ounce war premium being factored into the price of gold. ~~~ Analysts remain excited about the outlook for gold stocks as general economic and market conditions point to further strengthen the sector, "The weak U.S. dollar, the low interest rates and the sort of choppy, sloppy equity market backdrop are all still intact," said Robert Spector, senior economist and strategist with Merrill Lynch Canada. "Tack on the geopolitical concerns and the very favorable supply conditions out of the mining area and that all bodes very well for gold." Gold -- Sharefin, 23:20:52 02/02/03 Sun FED-Musings on the Eve of the Gold Suppression The meeting of the Federal Reserve's Open Market Committee took place on July 6-7, 1993, just a few weeks before the gold price suppression began on August 5, 1993. The transcript refers to the market situation after a very recent twenty percent increase in the price of gold. In addition, it mentions the desire for a low gold price and how it can be achieved. ~~~~ We should not draw too far reaching conclusions based on the FED-transcripts. They do not tell us who is organizing the gold price suppression and how. The first of the meetings took place before the suppression began, and the FED-meetings are not the place where the gold price suppression is being organized. Furthermore, the ultimate cause to start the suppression is not mentioned, presumably problems of short-sellers after the most recent rise of the gold price. Apparently it was the initial goal to keep the price of gold under the psychologically important round decimal number 400.  Gold -- Sharefin, 22:29:39 02/02/03 Sun Prospecting with Gold Mutual Funds - Using The K-Ratio Barron's Gold Mining Index - Handy & Harmon Gold Price - K-Ratio Charts Periodic Ponzi Update PPU -- $hifty, 22:27:09 02/02/03 Sun Preiodic Ponzi Update PPU Periodic Ponzi Update PPU Nasdaq 1,320.91 + Dow 8,053.81 = 9,374.72 divide by 2 = 4,687.36 Ponzi Down 49.21 from last week. Thanks for the link RossL ! Go GATA ! Go GOLD ! $hifty  Gold -- Sharefin, 22:03:42 02/02/03 Sun Japan surprises with intervention admission Japan's Ministry of Finance intervened in the foreign exchange market this month to weaken the yen, but did not tell investors until monthly data on Friday uncovered the transactions. The Bank of Japan used some Y678bn ($5.6bn) in a series of actions to buy dollars for yen to stem the Japanese currency's appreciation. An official on Friday said the move was designed to stabilise the yen rather than actively weaken it. Despite the weakness of Japan's economy, the dollar's renewed slide has led the yen to strengthen in spite of officials' attempts to talk it lower. The Japanese currency has gained some 6 per cent in the past two months, prompting concerns about the damage a stronger currency will do to exporters' balance sheets and its possible impact on Japan's struggle against deflation. ~~~ Analysts said the covert nature of the BoJ's actions was a surprise. The bank, which holds massive reserves, has frequently intervened publicly in the market to limit yen strength and last acted in a series of moves between May and June last year. Gold -- Sharefin, 21:50:30 02/02/03 Sun Investors on a Gold Rush Bill Bowler, a 77-year-old Baptist pastor in Tucson, has been listening to the alarming news from Iraq and North Korea and watching the stock markets swoon. And every time another headline screams war and another certificate of deposit comes due, he adds to the hoard of gold in his safe-deposit box. Most of his and his wife's retirement savings are now in gold. Such a big bet on gold is risky, financial advisers say. But Bowler is unmoved by the warnings. "I feel safer with my investment in gold," he said. "I can take it out and look at it and see it." Gold is the pessimist's investment of choice: It rises when the dollars slides, the stock market sinks, the economy slumps and the world descends into war. ~~~ "Gold has been around for 5,000 years as a store of value, and during times of crisis people tend to move toward gold as a golden anchor," said Michael Checkan, president of Asset Strategies International Inc., a Rockville firm that sells precious metals and foreign currency to individual investors.  Gold -- Sharefin, 21:35:09 02/02/03 Sun Gold -- Sharefin, 21:35:09 02/02/03 Sun Has every cloud got a gold lining? The precious metal might seem a cure for share gloom but all that glitters ... In times of uncertainty, one thing is virtually guaranteed - that the price of gold will rise. And as war with Iraq threatens and share prices continue to fall, this is exactly what is happening. --- What a bearish article.... Gold -- Sharefin, 00:10:43 02/02/03 Sun MEDIA RELEASE New gold investment product Gold Corporation, a statutory authority of the Government of Western Australia and operator of The Perth Mint, today announced its intention to issue a new gold investment product. The Perth Mint Gold Quoted Product ("PMG") would be a gold bullion product tradeable on the Australian Stock Exchange (“ASX”) and aimed at Australians seeking a convenient way to invest in physical gold, the Corporation said. The PMG would be structured as a call warrant under ASX Business Rules. Gold Corporation said it would make an application to the ASX to have the product quoted so investors could purchase PMGs through brokers. The non-leveraged PMG would be fully backed by gold owned by Gold Corporation, and its ASX price is intended to track closely the international spot gold price. The Corporation said a PMG holder would have the right to exercise the PMG and call for physical delivery of the underlying gold at any time before the PMG's expiry. A Product Disclosure Statement will be made available to investors on release of the PMG. Gold Corporation expects The Product Disclosure Statement to be released by 28 February 2003. Interested investors should read the Product Disclosure Statement, which will be available at www.perthmint.com.au on the release date. The Corporation said it would continue to offer The Perth Mint's existing precious metal depository investment products in addition to the new PMG. Further information: Michael Kile, Manager, Business Development, Tel.(08) 9421 7401. The Perth Mint Buildings, 310 Hay Street, East Perth, Western Australia 6004 Postal Address: GPO Box M924, Perth, Western Australia 6001 --- This new trading vechile looks to be a boon to Australian Goldbugs - not only will you be able to trade this vechile via bids on the buy/sell (narrow spreads) but you can also use it for taking delivery. Imagine buying gold as easy as buying a share & you don't have to take delivery but can on-trade it if you wish. You'll also be able to preplace buy/sell bids in the expectation that if the price moves tou your price then you'll get filled. Seems like the ease of fiat with the backing & ownership of physical when desired. And backed by the integrity of the Perth Mint. What more could a goldbug want. Gold -- Sharefin, 23:04:52 02/01/03 Sat Kinross, TVX, Echo Bay Gold Merger Approved Kinross Gold Corp said on Friday that shareholders of TVX Gold Inc. and Echo Bay Mines had approved the three-way merger of the Canadian miners, which will create the world's seventh-largest gold producer with output of 2 million ounces annually. The new entity, which will operate under the Kinross name, will begin trading on both the Toronto Stock Exchange (TSX) and New York Stock Exchange on Monday and will reflect the three-for-one common share consolidation approved this week by Kinross shareholders. Gold -- Sharefin, 23:02:37 02/01/03 Sat War talk proves profitable for AngloGold ANGLOGOLD expects towering gold prices to continue through 2003 as the United States dollar continues to sag and international tensions rise. ~~~~ "We can mark gold price movements almost directly in relation to public statements by (US) President (George) Bush," Mr Williams said. "We can track the gold price almost equally tightly over the three-month period against movements in the US dollar." Gold -- Sharefin, 22:56:07 02/01/03 Sat Newmont CEO Murdy to Tell Colorado Mining Conference - Gold's Future Tied To Corporate Social Responsibility Gold has regained much of its luster during the past year, with gold prices rising from near record lows to more than $350 per ounce. Following a lengthy period of consolidation, falling gold prices, and mine closures, the gold industry and gold stocks in particular have performed well in the post 9-11 economy. But will gold continue to glitter in the years ahead? Only if companies practice corporate social responsibility in the communities in which they operate, according to Wayne Murdy, Chairman and CEO of Newmont Mining Corporation, the world's largest gold producer. Murdy is expected to tell a gathering of hundreds of mining professionals about the necessity of obtaining a social license to conduct operations within local communities, in addition to obtaining the required permits and governmental authorizations. Principles of sustainable development must govern future operations. ~~~ The conference will feature sessions on mining in Colorado, with speakers discussing the future of traditional industries such as coal, limestone and metals. A Mine Operations forum will also include a progress report on the effort to develop cost-effective technologies for oil shale development on Colorado's western slope. A Public Perceptions Forum will include presentations by industry leaders, environmental groups, and the news media on how current opinion shapes policies that impact mining. The International Session will include the latest ranking by mining industry experts of countries for new mineral development. Mining in America includes Mining in the Americas; experts on trade will discuss the prospect for new mineral development in Latin America. Finally, the environmental/reclamation session will discuss the current bonding crisis that could potentially impede new mineral development, and other challenges that may cloud mining's future. Gold -- Sharefin, 22:49:12 02/01/03 Sat Gold Bugs Look To History This is a chart to cheer gold bugs and confirm their sister deflationists in their convictions. It shows the relationship between the prices of gold and equities. Note, the pessimists say, the decades of the two previous descents of that ratio from a peak: the 1930s and the 1970s.  Christopher Wood, emerging markets analyst for CLSA, a unit of Credit Lyonnais, who supplied us with the numbers, believes strongly that "gold is at the very beginning of a multiyear bull market that will take the yellow metal many times higher than its present level." The reason Wood gives: "Gold is the only real hedge against the massive financial excesses that still prevail in the western world." Fiat -- Sharefin, 22:45:31 02/01/03 Sat Party's over, says pioneer analyst A pioneering market technician says a fresh bout of intense stock market selling is on its way. Lowry's Reports' Paul F. Desmond is revered for his examinations of supply and demand forces that shape stock market activity. His work on identifying bear-market bottoms and new bull markets coined the term "90-90 downside days" and won the prestigious Charles Dow award. Desmond's work demonstrates that severe downside days, in which 90 percent of all volume and total points gained and lost on the New York Stock Exchange are in the red, must precede a bear-market bottom. Essentially, Desmond says the three-month party is almost certainly over for stock-market optimists. Gold -- Sharefin, 22:42:43 02/01/03 Sat INDIA'S GOLD IMPORTS FALLING BY OVER 60 TONNES A MONTH A London-based metal consultancy is optimistic of a good recovery in the gold sector in the first half of 2003 if gold prices ease back below US$310 per ounce. Gold Fields Mineral Services (GFMS) director Paul Walker told a seminar here that "imports to India have fallen from 600 tonnes recorded during 2001 to 400 tonnes recorded last year." Attributing the current gold price rise to tensions between the US and Iraq, he said there was a decline of up to 60 tonnes of gold per month in imports to India. Gold -- Sharefin, 22:40:41 02/01/03 Sat Imports fall 50% as gold turns dearer With gold prices touching new lifetime highs last week, gold imports have fallen by almost 50%. Bankers say that over the past month-and-a-half, India has imported just about 75 tonne of gold, which is half of what it imported during the same period last year, reports CNBC India. Soaring prices of the yellow metal have slowed demand, despite the wedding season in North India. In fact, people are queuing up to sell their gold. In South India, where people are known to hold on to their gold, people are offloading their gold stocks. The falling imports and increasing retail selling indicates a change in the Indian mindset, where people are using the yellow metal to store value and use it to make profits. Scotia Mocatta MD Sunil Kashyap said, "In the South, there have been continuous years of drought. So, a lot of farmers who during the periods of bountiful harvests have bought gold to store up their wealth, have now come into the market to sell gold to tide over this time of drought. It's just an indication that people who do store value can use it to sell and get value back." Gold -- Sharefin, 22:34:00 02/01/03 Sat States to impose uniform 1% sales tax on gold Diversion of bullion trade to select centres of the country could be a thing of the past with states deciding to impose a uniform sales tax rate of 1 per cent on gold from Friday. These include major gold trading centres, like Gujarat, Rajasthan, Delhi, Haryana, Uttar Pradesh, Tamil Nadu and Maharashtra, which were hitherto levying sales tax below the 1 per cent floor rate. Gold demand in the country, the worlds largest consumer, is pegged at 855 tonne annually. Official imports account for about 535 tonne. The rest of the supplies come from illegal channels and its huge household and religious institutional reserves estimated at 10,000 tonnes. Gold -- Sharefin, 22:30:08 02/01/03 Sat Gold on the rise again Falling stock markets and increasing worries about a war with Iraq have once again given gold prices a lift. And leading African gold firm, AngloGold - the world's second largest producer of gold - has said it expects prices to rise still further this year.  Investors have been buying gold largely because the main alternative, the US dollar, remains weak and global stock markets have been in the doldrums for quite some time now. ~~~ "Gold will always have a historical intrinsic value. If the world goes into global meltdown people will trade as they did many hundreds of years ago," Thebulliondesk.com analyst James Moore said. After years at the margins of the modern financial system, gold has made a strong comeback as a safe investment in times of international tension. "People have moved back to it because of its traditional, safe-haven value. We have seen an influx of ordinary people and bigger investors who have been absent from the market for about 10-15 years," Mr Moore said. Gold -- Sharefin, 22:24:45 02/01/03 Sat AngloGold sees higher gold price in year ahead South Africa's top gold producer AngloGold (ANGJ.J) said on Friday it saw a higher gold price in the year ahead, and a revival in the physical market once volatility subsides. "All of the factors that have been positive for gold in 2002 remain firmly in play and there is good reason to expect higher gold prices in the year ahead," AngloGold Marketing Director Kelvin Williams said in a statement. Although the physical market had shown weakness in 2002, the company expected a revival in the year ahead. "As is the case in all periods of rising gold prices and gold price volatility, the physical market should revive once the price returns to a stable trading range for a period of time," Williams said. "However, with further volatility expected in 2003, a resurgence of physical demand should not be expected immediately." Fiat vs Gold -- Sharefin, 22:12:40 02/01/03 Sat Greenspan Comes Home to Gold The chastened man is again grasping his golden compass. Gold traded above $370 per ounce this week, for the first time in six years. Anxiety about war with Iraq has no doubt contributed to gold's surge - but a look at history suggests that gold may be telling us as much about Alan Greenspan as it is about Saddam Hussein The last time that gold was above $370 was December 6, 1996. Students of military history won't find that date significant, but Fed-watchers will. That was the day following Alan Greenspan's speech in which he first warned of "irrational exuberance" in the stock market. And it was the day that Alan Greenspan took America off the gold standard. What? Didn't Franklin Roosevelt abrogate gold convertibility in 1933? And didn't Richard Nixon close the Treasury's gold window for good in 1971? All true - but nevertheless, from the time he took the chair of the Board of Governors of the Federal Reserve System in 1987 to that speech in 1996, Alan Greenspan had implicitly returned America to a gold standard. The chart below proves it. From 1987 to 1996, the Fed funds rate very closely tracked the 2-year moving average of the gold price. We may never know the exact thought process, but this much is clear: For that decade, when the gold price was rising, Greenspan was raising the federal funds interest rate, just as though he regarded gold as a leading indicator of inflationary risk. Conversely, when the gold price was falling, Greenspan eased.  ~~~ Today Alan Greenspan is huddling in a foxhole, and he's almost out of ammunition. The man who had been lauded for slaying inflation is now under pressure to stave off continued deflation. And even after an historic fusillade of rate-cuts that have left the Fed's gun nearly empty, unemployment is over 6% and still rising, investors are worrying about a double-dip recession, and asset markets are in shambles. So what does a man do when he is running out of bullets? He picks his targets very carefully - and that means focusing on fighting deflation. And what does a man do when he's huddling in a foxhole? He gets religion - and for Greenspan that means coming home to gold. That was the message of a remarkable speech by Alan Greenspan last month, missing by only two weeks the sixth anniversary of his "irrational exuberance" speech. The press didn't really pick up on the importance of this speech, because we've all become accustomed to thinking of gold as a "barbarous relic," to use Keynes' famous phrase. But the fact is that from the very first sentence of the speech, we can see that Greenspan has rediscovered his golden compass - a compass he admits pointed true even in the speculative "bubble" of 1929: Although the gold standard could hardly be portrayed as having produced a period of price tranquility, it was the case that the price level in 1929 was not much different, on net, from what it had been in 1800. Later in the same speech Greenspan acknowledged, for literally the first time, the urgent danger of deflation. That's the very thing that the falling price of gold was warning Greenspan about in 1997 - now he knows he was wrong not to listen. Fiat -- Sharefin, 19:02:48 02/01/03 Sat What's a Few Zeroes Among Friends? So you support the impending war against Iraq, eh? Ok. That will be $2,500, please. Don't worry about sending a check just yet. We will payroll deduct. Oh, and that's just for this year. Then we have to rebuild Iraq, of course. Though we will need another $15,000 from you for that effort, the good news is that it will be spread out over the next decade or so. For now, we'll just add it to your share of the national debt, which is - let's see now - about $387,500 as of today. And then there will be interest on the debt, of course. That totals $19,375 per year on your share of the current balance, assuming 5% interest. As usual, we won't be bothering you to pay off any of the principal for the foreseeable future.  Iraq War in Late February/Early March -- Joe, 13:22:44 02/01/03 Sat Iraq War in Late February/Early March -- Joe, 13:22:44 02/01/03 Sat One rumor is the first two days of the war will see a massive air campaign which includes the use of countless cruise missles that will take out power/water/many other targets and leave the Iraqis dazed and in awe of us. Joe F. Rocks! Growth Stock Investor & Market Strategist Gold -- Sharefin, 19:43:54 01/31/03 Fri Arch Crawford "Heads UP" Arch Crawford has been ranked as one of the very top market timers for years now. In spite of the fact that he uses astrology, among other technical analysis tools, he has a large readership on Wall Street because of his track record, and often appears on the financial shows such as CNBC (as recently as this month). Here is his statement about February 16th: "Our sensibilities are tweaked to call this one of the worst days EVER (16th) in international relations, and a good day to be short stocks, long gold, oil & commodities. If you still have friends or relatives with bomb shelters left over from the 1960's (or Y2K), it may be time to restock the dried foods and oil the automatic weapons!" War -- Sharefin, 19:33:20 01/31/03 Fri Iraq Turns Spotlight on Israel at U.N. Arms Body Iraq accused Israel on Thursday of harboring biological, chemical and nuclear weapons -- turning the spotlight on the Jewish state at the main United Nations arms control body. Iraqi ambassador Samir Al-Nima and Israel's Yaakov Levy also traded insults over their countries' leaders during speeches to the Geneva-based U.N. Conference on Disarmament. Syria and Algeria joined in the heated debate at the 66-member forum, while the U.S. delegation kept quiet during attacks on Israel, its close ally. --- The insanity grows....  War -- Sharefin, 19:24:00 01/31/03 Fri War -- Sharefin, 19:24:00 01/31/03 Fri The Biggest Threat To Peace Which country really poses the greatest danger to world peace in 2003? TIME asks for readers' views Who really poses the greatest danger to world peace? Iraq and North Korea are certainly high on President Bush's list though Iraq is still working hard to deny him a reason to attack. A 12,000-page report on its nuclear, chemical and biological programs has been given to the United Nations but Bush and his dependable friend Tony Blair say they have "solid evidence" that Saddam is lying and have called for weapons inspection teams to step up their work. Meanwhile, as the fuel rods go in and UN inspectors go away, the specter of a nuclear-armed North Korea is keeping the reclusive regime on everybody's radar. Washington and Pyongyang are talking tough but is the biggest danger to peace closer to home? European antagonism towards Bush's robust stance is now being mirrored in the U.S., with even those he might normally consider his allies now urging caution. So TIME asks you: which country poses the greatest danger to world peace in 2003? ----- Current results have the USA winning by a clear streak at 84%. War -- Sharefin, 18:45:53 01/31/03 Fri North Korea says nuclear war possible at 'any moment' North Korea said on Thursday that US military threats made nuclear war possible at any moment, and blamed Washington for an acute electricity shortage stemming from a freeze on the communist state's atomic energy programme.  Gold -- Sharefin, 18:09:05 01/31/03 Fri Gold -- Sharefin, 18:09:05 01/31/03 Fri Daytraders forum for the US Markets, gold & goldstocks. Investors Exchange Fiat -- Sharefin, 22:51:36 01/30/03 Thu Chartists say eurostocks face abyss as levels breached The number of European stock indices breaching October's multi-year lows piled up on Wednesday as shares sank, leaving technical analysts in no doubt that more pain is in store for the region's war-weary investors. "The fact we've dropped below these levels pretty much means that the market is re-establishing the downtrend that began when the dotcom bubble burst in 2000," said Steven Wesiak, a pan-European technical analyst at ABN Amro in Amsterdam.  Gold -- Sharefin, 22:20:02 01/30/03 Thu Gold -- Sharefin, 22:20:02 01/30/03 Thu Telfer funding yet to be secured Newcrest reported that its received gold price for the December period eased to A$596/oz (A$600/oz), which translated to a nauseous cash price of A$484/oz when removing accounting provisions raised at 30 June for surplus hedging contracts. Spot gold is currently trading at around A$620/oz, and averaged A$570/oz in the December quarter and A$576/oz in the first half of the 2002/03 financial year as against Newcrest's pre-provisioned received prices of A$484/oz and A$503/oz, respectively. With the group's total production costs rising to A$390/oz (A$376/oz), that latest achieved gold price on sales won't do cashflows any favours. “Free cashflows will be limited,” said Perth-based Brierley. “Because of the A$106 million provision made in the final 2001/02 accounts, this will have a limited effect on reported profits.” All gold production from the December period was delivered into hedge contracts, leaving about 5.53 million ounces still hedged and giving the company a position equating to about 20 percent of current reserves and 11 percent of resources. The mark-to-market value of the hedge book didn't look pretty, blowing out to negative A$939 million as at 31 December (consisting of minus A$633 million for gold, minus A$247 million for currency and minus A$59 million for copper). --- Newcrest have a current market cap of A$2,127 million with a hedge book under A$947 million. Wonder how they'll feel at US$500 gold. Oops!!! Gold -- Sharefin, 21:34:35 01/30/03 Thu Four Ways to Play New Gold Rush Gold has become the color of hope for paralyzed investors in the past year. Since the start of 2002, shares of the public companies that dig the stuff out of the earth have marched forward 50% to 300% to the drumbeat of war as all the major equity indexes have plunged. It has become the investment of choice, not just for wizened old men on park benches and 'fraidy cats in the Adirondacks, but for everyday professionals saving for retirement, daytrading speculators and sober fund managers seeking a hedge against uncertainty. Whether in the form of 100-ounce bars, futures, stocks or coins, the metal has come to be seen as the antistock of the post-dot-com world. It's a combination of security blanket, insurance policy and Lotto ticket. The metal with moxie. A Prebubble Buying Opportunity But the market for gold around the world is looking ever more like the market for technology stocks, circa 1997. Though not quite there, it seems on the verge of becoming the topic of soccer mom conversation, like stock tips at cocktail parties back in the day. Gold is not at all in a bubble stage. The physical material has gone from $250 an ounce to $360 an ounce in the past few years, hardly a massive move for a commodity priced at $800 in 1980. But it is certainly heading in that direction, and at $368.40 an ounce, it hit a six-year high last Friday. All 10 of the top-performing mutual funds in 2002 were gold or precious-metals sector funds, and they're doing well again so far this year. ~~~~ Gold's Value? The Price of Fear Indeed, what I find fascinating about gold is that even after a solid two-year run, it is still embraced by some of the most bearish and skeptical of professional equity investors and observers, such as James Grant, Bill Fleckenstein and Jean-Marie Eveillard. These are the sort of folks who demand high levels of intrinsic value when they buy shares of public companies, but are willing to embrace ownership of a clod of yellowish ore that has no real intrinsic value at all. What is the value of gold? Its price is said to be the single most widely disseminated bit of information in the world, and yet it is worth only whatever market participants say it's worth at any given time. Its pricing is a psychological event, untethered to perceived scarcity or its tremendous usefulness as a conductor of electricity. Think of it, instead, as the price of fear. As Eveillard put it in an interview last week, the value of gold depends in large part on the ebb and flow of distrust that people have for paper currency, not for its worth as a commodity. Consider that new Federal Reserve Board Governor Ben Bernanke in November openly backed the wholesale printing of money as a way to stave off potential deflation. Gold -- Sharefin, 21:23:09 01/30/03 Thu Gold prices soar, people sell yellow metal Rising gold prices may have forced people to put off their buying for now. But it has certainly brought a stream of sellers back to the shops in Mumbai. People in the city are lining up at jewellery stores, not to look at latest designs, but to make money out of rising gold prices. Last November, 10 gms of gold was worth Rs 5,000 in Mumbai, which at the beginning of January, shot up to Rs 5,250 and now it is almost Rs 6,000. "We needed some money for our son's education, so we thought this is the best time to sell gold," said Anant Desai, a person who sold gold. "This is not the time to buy gold, this is the time sell gold," remarked Mahesh Pandya, a person who sold gold.  Gold -- Sharefin, 21:21:52 01/30/03 Thu Gold -- Sharefin, 21:21:52 01/30/03 Thu Gold surge not over - Gold Fields “It is the opinion of your management team that the gold market holds significant promise to the upside, underpinned by the continued structural weakness of the United States Dollar and global equity markets,” said Ian Cockerill, Gold Fields chief executive in the company's address to shareholders. He added that , to “a lesser extent”, the political troubles regarding Iraq were also helping the gold price. “It is also quite clear that gold appears to have retained its age old reputation as a viable alternative investment during periods of economic uncertainty. This is a trend we see continuing for some time,” Cockerill added.  Gold -- Sharefin, 21:20:38 01/30/03 Thu Gold -- Sharefin, 21:20:38 01/30/03 Thu Gold surge not over - Gold Fields “It is the opinion of your management team that the gold market holds significant promise to the upside, underpinned by the continued structural weakness of the United States Dollar and global equity markets,” said Ian Cockerill, Gold Fields chief executive in the company's address to shareholders. He added that , to “a lesser extent”, the political troubles regarding Iraq were also helping the gold price. “It is also quite clear that gold appears to have retained its age old reputation as a viable alternative investment during periods of economic uncertainty. This is a trend we see continuing for some time,” Cockerill added.  Gold -- Sharefin, 20:59:43 01/30/03 Thu Gold -- Sharefin, 20:59:43 01/30/03 Thu Sinclair Strikes Back Jim Sinclair, 'Mr Gold' to hard core followers of the gold market everywhere, has lashed out at critic John Clemmow, resource specialist at Investec London. In response to an essay filed by Sinclair on a number of gold sites on Monday, Clemmow said Sinclair's explanation of the disparity between bullion moves and the resultant leverage in gold shares was due to speculative short selling of equities by funds was way off the mark. "Mr Sinclair has his view, but I'm afraid once again he is completely wrong," said Clemmow. Here is Jim Sinclair's response:  Gold -- Sharefin, 20:56:29 01/30/03 Thu Gold -- Sharefin, 20:56:29 01/30/03 Thu Goldcorp's McEwen eyes gold price of US$800 Long-term growth cycle Gold is on its way to US$800, predicts Rod McEwen chief executive of Goldcorp Inc. Yes, you just read that correctly: US$800, or well over double the current price. Of course, he's not trying to say that gold will hit US$800 sometime soon. He's thinking gold might hit that price at some point in the next decade or so. And he's not alone. Mr. McEwen's bullish views on gold reflects a common belief among gold bugs. Gold hit a historical high of about US$850 back in January, 1980. Since then, gold has fallen as low as US$252 in August, 1999 and US$255 in April, 2001. Gold has been trending upwards since hitting that 2001 low, and gold bugs are wondering if we're witnessing a growth phase that will chug along for another decade or so. Indeed, Mr. McEwen, who yesterday was in New York conducting road-show presentations, explained in a telephone interview that he believes gold is about three years into a long-term growth cycle. Gold closed yesterday at US$366.30, down US$3.70 though earlier this week it hit its highest price in six years. Gold has already 7% this year after jumping almost 25% in 2002. Expectations of war in Iraq, weak equity markets and a U.S. dollar dropping against the euro has been fuelling gold's recent gains. Rising oil prices have also triggered fears of inflation, and gold's intrinsic value is often seen as a way to preserve wealth. Mr. McEwen believes gold is on an upward trend to test the historical high of US$850 achieved in January, 1980. "We seem to be in the early stages of a bull market for gold which probably has a duration of 10 to 12 years. We're already three years into it," he said. Gold -- Sharefin, 20:34:06 01/30/03 Thu SILVER: A SMALL OR TINY MARKET? This editorial focuses on five measures of the silver market size. They are "Physical Silver Demand" "Physical Silver Bullion Stocks" "Silver Stock Market Capitalization" "Mutual Funds Focusing on Silver" "Physical Ounces of Silver per Population" Gold -- Sharefin, 20:28:28 01/30/03 Thu Indian gold imports fall by 30% Even if gold imports to India sharply declined by over 30 per cent last year following soaring international prices, a London-based metal consultancy is optimistic of a good recovery in the first half of 2003 if the gold prices ease back below $ 310 per ounce. Gold Fields Mineral Services (GFMS) Director, Paul Walker, told a seminar here "imports to India have fallen from 600 tonnes recorded during 2001 to 400 tonnes recorded last year." Viewing the current gold price rise situation due to US-Iraq conflict, he said there was a decline of up to 60 tonnes of gold per month in imports to India. He said, however, the demand was likely to go up within the first half of this year if international prices stabilize. Gold -- Sharefin, 20:15:28 01/30/03 Thu World's most successful fund manager endorses GATA The most successful mutual fund manager in the world, John Embry, vice president of equities for RBC Global Investment Management and manager of Royal Bank of Canada's precious metals fund, sounded exactly like GATA Chairman Bill Murphy in a long interview on national television in Canada this week. Embry was interviewed on ROB-TV's "Market Call" program, and made these comments: -- Gold Fields Mineral Service is an agent of the bullion banks, and he doesn't believe half of what they say. -- The central banks' gold short position is certainly at least 10,000 tonnes, and GATA's assertion of 15,000 tonnes is defensible. The recent disclosure of the loss of gold by Portugal's central bank was very significant. -- GATA has done "outstanding research" in exposing the gold short position of the central banks, and the people of GATA are "not lunatics" but "smart, diligent guys." (We happily would have settled for "not ALL lunatics.") -- By virtue of its derivative position in gold, J.P. Morgan Chase has been at the center of a manipulation of the gold price, though Embry added that he wasn't sure of Barrick Gold's role in that manipulation. Barrick, Embry said, might have been doing no more than aggressively hedging its product. -- The gold price also has been manipulated by the U.S. government. This manipulation doesn't bother Embry so much in principle, since he considers gold more of a currency than a commodity and currencies are commonly manipulated by governments. But in suppressing the gold price for so long, the U.S. government allowed speculators to pile on and "created a monster," driving the gold price down below the cost of production and giving the gold price an explosive potential few people realize. -- Gold should easily rise above $400 per ounce, given the "toxic derivatives" around it. -- Embry also expects an explosion in the price of silver. -- The junior gold producers are most promising for price appreciation, the hedged major producers least promising. Gold -- Sharefin, 20:01:06 01/30/03 Thu Gold trade needs ombudsman: Tarapore Consumers in India are losing as much as upto Rs 8,000 crore annually due to the questionable quality of gold and there is an urgent need for consumer protection in this area, said former RBI deputy governor, SS Tarapore, in his keynote speech at the London Bullion Market Association-Indian Bullion Market Development Forum. The poor quality of gold sold in India throws up need for a gold Ombudsman for consumer complaints. Customs levy of Rs 250 per gram needs to be removed. Gold needs to be treated like dollar, yen or sterling, not like other metals. Total freeing of gold import-export trade and abolition of import duty on gold was a pre-condition for meaningful capital account convertibility, he added. Tarapore said the government should allow banks to trade on bullion exchanges to create the right environment. Also, facility of imports by individual non resident Indians (NRI) should end. This would help curb money laundering. Gold should be part of baggage of returning to India and subject to customs duty. “The October 2002 RBI measure to merge forex and gold open positions is a step in the right direction. There is an urgent need to bring bullion banks and non-bank entities trading in gold on a level playing field,” said Tarapore. Gold -- Sharefin, 19:37:12 01/30/03 Thu THE DOW IN SILVER OUNCES: STOCKS VERSUS SILVER For several years I have been harping about the Dow in Gold Dollars (DiG$). Why? Because valuing stocks in terms of gold gives us a superbly reliable indicator of the trends in both stocks and gold. When we spot extreme highs or lows in the DiG$, it tells us that we can safely switch from one to the other and ride a trend for a long time. DOW IN GOLD DOLLARS The DiG$ is simply the amount of gold, expressed in statutory "dollars of gold"1, needed to buy the entire Dow Jones Industrial Average. (A gold dollar equals about 1/20 troy ounce.) For the past 100+ years the DiG$ has ranged from a value of G$20.86 (equals 1.01 troy ounce of gold) at bottoms to G$925.88 (equals 44.79 ounces) at the extreme top in 1999. The DiG$ also gives us one unchanging measure of the Dow back over that century. Look at these numbers Gold -- Sharefin, 19:31:36 01/30/03 Thu The Classical Economists on Gold With the dollar down and gold up, both trends obviously related to growing fear of economic troubles ahead, the question again arises: why shouldn't the dollar itself be defined as a fixed quantity of gold? It would be if the views of the classical liberal tradition held sway. This tradition stands solidly behind a commodity money standard, like silver or gold, as the very embodiment of sound money. ~~~ The case for commodity money in general, and for silver and gold in particular, was established, authoritatively, long ago. It is true that the subtleness and some errors of the classical economists' thought are partially responsible for the present-day ideological reversal in quasi-total support of paper money. However, there is no excuse, even not the sheer ignorance, for completely erasing what the classicals said in defense of gold from contemporary textbooks in monetary theory. Gold -- Sharefin, 19:28:45 01/30/03 Thu GOLDBUGS AND GREEDBUGS What to do? There is the goldbug approach and the greedbug approach. --- Bullion vs leveraged paper.... Fiat -- Sharefin, 19:00:17 01/30/03 Thu U.S. M-2 money supply up $27.0 billion - Jan 20 week M1 up 18.7b M2 up 27.0b M3 up 31.7b  Gold -- Sharefin, 18:57:15 01/30/03 Thu Gold -- Sharefin, 18:57:15 01/30/03 Thu The Restructure of the Monetary System JES says: Right now there is no tie between gold's market value, treasury gold and the US dollar other than as another asset of reserve status. That means just another asset held by the US Treasury on behalf of the United States. In order to answer your question, we need to review a few concepts and a little history. ~~~ I look for this to happen when and if the US dollar trades at .76 as measured by the USDX. If it is not applied, then I believe we will have two head and shoulder formations in the USDX and two necklines breaks which duplicate the charts of both Enron and GE. The price objective then for the dollar will be .62 USDX. If gold rises above the key level of $529, the opportunity to act in a positive mode utilizing gold in a dollar relationship is lost. Assuming a pre-emptive remonetization of gold as it pertains to the US dollar, the effect on the free market for gold will be to cause it to halt is price appreciation or price depreciation at the point when the Federal Reserve Gold Certificate ratio is reintroduced in its modernized form. Gold then will trade above and below that point as a measure of the five fundamental elements that have always been causal to bull or bear market in the metal. Assuming that this method is adopted before gold trades above $529, then I would envision gold trading above or below by $50. If this method is not adopted before gold trades above $529, subsequent market developments will prevent its use. The world will break down into three currency blocks, The US Dollar block, The Dinar and Gold block, and the Euro. Economic power and political influence will shift away from the Dollar Block towards the Gold, the Gold Dinar, the Arab big six Euro/Gold Dinar and the Euro in that order of percentage gain. --- Sharefin says..... JES is a smart man & knows the gold markets like the back of his hands. Maybe better than anyone else. But this does not relegate his words as gospel nor does it mean that they & only they shall be right. No offence Jim but opinions are opinions. If 0.76 equates with $529 Where does this relate with the Dow et al? - maybe Dow 6000 Ok then what happens when the Dow falls to 4000-3000 And what if debts & derivatives take the Dow down to under 1000 al la Prechter? To use Jim's words "The horse is too far out of the barn". It's not just M3 growth but derivatives & debt & not only American but across the whole globe. Methinks gold has a far bigger race to be run & that we're just out of the starting box. That this race will become a bigger game than the Nasdaq where the whole world gets to play. Let the games begin........ Gold -- Sharefin, 18:42:55 01/30/03 Thu Why gold is gaining in a world awash with dollars THE largest collection of warplanes ever assembled is airborne. Their bomb bays are burgeoning. Each flight is approaching its target for a co-ordinated strike. Their targets are not Baghdad or Basra, but the major metropolitan areas of the United States. But wait. These are US air force planes. So why are they flying a mission that has US cities and citizens as targets? Have scientists working for Saddam Hussein developed a drug and rendered America's air force insane? Or has George Dubya finally flipped and ordered the extermination of all potential Democratic presidential candidates and voters? Inspection of the bomb bays shows they are not filled with conventional weapons or weapons of mass destruction: No, the planes are crammed with bundles of greyish-green paper carrying the portrait of a dead president on one side and the words "In God We Trust" on the obverse. These are dollar bills. Why, you may well ask, is the US being threatened with a massive bombardment with its own currency? Is it a Marxist plot? Karl Marx said that the way to overthrow capitalism was first to destroy its money. On the contrary, these planes are in the sky 24/7 on "Deflation Watch" and their purpose is to save American capitalism. A terrible fear-provoking thought is gaining ground among the guardians of the US economy. It is that the man in the street, who for decades has enabled the economy to remain on a long, upward path by consuming more than he produces, may be reaching the limit of his capacity for excess consumption and its corollary debt. ~~~ The dollar has been able to remain fundamentally and seriously overvalued for years because the rest of the world was gullible enough to believe that the US economy would always outperform and thus its bonds and shares deserved a premium rating. Some 75 per cent of central bank reserves, plus a great deal of non-US private wealth, is held in US dollar assets. Now that the Fed has declared it will "print" as many dollars as it takes to combat deflation, holders of US dollar assets would have to be extraordinarily naïve not to realise that an unlimited increase in the supply of US dollars means dollars will inevitably be worth less. Thus, far from attracting the 80 per cent of world savings required to maintain the dollar's value, fear of the bomb bays being opened and the world being showered in paper dollars is likely to cause liquidation of dollar investments. In a deflationary world every country thinks its currency overvalued and, although the demise of fixed exchange rates has removed "beggar-thy-neighbour" competitive devaluations, if countries resort to the printing press to try and avert deflation all of their currencies become debased. There is one standard against which this debasement of currencies can be measured and one asset which investors can own to protect themselves: That standard and that asset is gold. Gold -- Sharefin, 18:18:26 01/30/03 Thu Gold Could Turn Out to Be Hero of the Day HEARING that the US may attack Iraq has become an everyday episode, and recent surges in the gold price are playing victim to this explanation. In the past three months gold has risen 17,58%. However can the sudden rush in the yellow metal be simply explained as a function of war? I think not. The Bank of Japan has once again announced that it will sell off its currency to protect an export-led recovery. The Japanese finance minister is aware of the implications of an appreciating yen, and if he wasn't Sony, Toyota, Toshiba and Fujitsu would make sure that he was. A further appreciation of the yen would be negative for the Japanese economy. Finance Minister Masajuro Shiokwa, who is comfortable to see a weakening yen, was quoted as saying it is favourable to see the foreign exchange rate reflect the state of the economy. The last time the Bank of Japan intervened was on June 28, when more than $30bn was put up for sale in seven days. While scholars of economics will lecture on the demerits of intervention because it does not work the Bank of Japan has made it a stated policy. It has refined its intervention to an art form, taking advantage of US holidays when trading volumes are low so that it can maximise its effect on the market. ~~~~~~ With a ridiculously bulging US trade deficit estimated at about $300bn it makes no sense to remain on this path as it will only create problems for the US down the road. With the US running a current account deficit at record levels, about $1bn a day is needed to fund such a gap. This is feeding concern that capital inflows are potentially at risk. In its current state the dollar could further depreciate, and yet abandonment of the strong dollar policy could lead to free fall out of the pan into the fire. In order for the dollar to weaken, the euro or the yen need to strengthen, although both have indicated that they are opposed to this. Something needs to give. Ask yourself: what is the alternative? Enter gold. There is a strong inverse correlation between the dollar and gold. As gold is priced in dollars, the weakness of the dollar against the euro and the yen makes it cheaper for investors who hold those currencies to buy gold. Such demand increases the price of gold. And no I don't hear any objections. As the pressure builds among the largest currencies, it is likely that gold which could be become the fourth currency could be hailed the hero of the day. Fiat -- Sharefin, 15:59:51 01/30/03 Thu Top 25 annual corporate losses The following is a list of the 25 largest corporate losses for completed fiscal years over the past 50 years. The list shows the $98.696 billion fiscal 2002 loss announced on Wednesday by AOL Time Warner Inc. was the largest in the past 50 years. ***AOL Time Warner - 98.69 JDS Uniphase - 56.12 General Motors - 23.5 Lucent Technologies - 16.2 NTL Inc - 14.24 Verisign - 13.36 AT&T Corp - 13.08 Tyco International - 9.41 Intl Business Machines - 8.1 I2 Technologies - 7.75 At Home - 7.44 Ford Motor - 7.39 Raytech - 7.06 CIT Group - 6.69 Webmd Corp - 6.68 Liberty Media - 6.2 Corning - 5.49 CMGI Inc - 5.49 Level 3 Commun - 4.79 PSINET - 4.96 ***AOL Time Warner 4.92 Agere Systems - 4.62 UnitedGlobalCom - 4.49 TEXACO - 4.41 Redback Networks - 4.12 Qwest Communication - 4.02 ---- Amazing to think that AOL Time Warner in just one year lost more money than the value of all gold mining companies in the world. Cretins.... Gold -- Sharefin, 15:48:44 01/30/03 Thu "State of the Gold Market" Many of these "experts" are talking about the bull run in gold as if it's transient, overdone and unsustainable. Anyone who says that has immediately disqualified themselves from being taken seriously by myself for one simple reason. Look at what's happening to the US dollar (As I have predicted). If you look at the price of gold when the US dollar index was 120 and now the price of gold when the US Dollar index is now below 100, you will find that gold has done only a few percentage points more than maintain a perfect inverse correlation. What does this say? It says a couple of things. First of all it tells me that gold is indeed again being viewed as a currency. It also tells me that it still appears to be managed under a "stealth gold standard." A lot of people talk about the market being ready to soar. While I think that's certainly possible given the certainty of war in IRAQ, I think the most likely case is that gold will continue to be a proxy for a short position in the US dollar. ~~~ You cannot understand the gold market today if you do not understand the currency markets and the geopolitical environment, Period. Throw out your charts and books full of data and start reading global international news if you want to understand the gold market today. Gold is trading as the alternative to fiat currencies and an inverse proxy for the US dollar index. It's just that simple in my opinion. Before I finish up here... I have a couple of thoughts to consider going forward. The first thought is that from all the reading I do... I'm concerned that at some point gold is going to get mixed up with the T word. In other words, The government wants to know what everyone is doing with their money and physical gold is not traceable, or not easy to trace. That combined with the fact that the government is going to have a big problem if the price of gold goes through the roof gives very strong motivations for restricting ownership and calling it a terrorist tool. I've read a lot that is pointing my opinion in that direction... be forewarned. The second thought is that I've been saying for years that if China was smart they would be exchanging their huge hoards of US dollars for gold and doing it quietly. I think that may be in process. I'm here to tell you that if China dumped its US dollar reserves en masse for gold, it would have a worse effect than a thermonuclear warhead on the US economy. We would experience stagflation the likes of which the US has never seen... be forewarned on that as well.  Fiat vs Gold -- Sharefin, 23:47:47 01/29/03 Wed Fiat vs Gold -- Sharefin, 23:47:47 01/29/03 Wed Gold: Cover or Cover-up? No sooner had gold hit the first in its recent series of new six-year highs than Canada's Financial Post quoted a Toronto gold analyst: "Gold...has a huge image problem. ... It's time to stop talking about central banks and hedging strategies, and start focusing on supply, demand and the flow of capital." S. Maich, Hot, but still not respectable - Gold's image problem, December 20, 2002. Huh? The central banks are the swing suppliers, often through leasing rather than outright sales. Does anyone suggest talking about oil prices without mentioning OPEC? A recent article in Mineweb (T. Wood, Challenges mount for Gata as gold price rises, December 16, 2002) struck the same theme, describing a segment of the Toronto gold community as distressed by GATA's sometimes aggressive tactics. Ironically, the article shed its largest tears for John Embry, the Toronto gold guru most closely identified with support for GATA's views, much to the alleged chagrin of his employer, Royal Bank of Canada. But as manager of the Royal Precious Metals Fund, Mr. Embry -- like many GATA supporters -- posted some pretty impressive investment results in 2002. ~~~ More on Gold Derivatives. Criticism of my December 4 commentary in The Gartman Letter produced at least one beneficial result: online publication of an updated analysis by Frank Veneroso et al., Gold Derivatives, Gold Lending, Official Management of the Gold Price and the Current State of the Gold Market, May 17, 2002 (www.gata.org/Veneroso1202.html; also www.financialsense.com/editorials/veneroso.htm). While this new piece makes no fundamental change in his methodology or estimate of total gold lending by the central banks (i.e., the total short physical position), it does contain three new points worthy of mention. First, as the title suggests, Mr. Veneroso publicly opines for the first time that the central banks have been deliberately manipulating gold prices. Heretofore, he has confined his analysis to objective estimates of the size of the total short physical position. Second, he suggests that while aggregate short positions -- particularly those of gold producers -- in the futures and forward markets may have been substantially reduced, aggregate gold loans by central banks have not. Indeed, they have continued to grow, and cannot be reduced as long as physical demand for fabrication and bar hoarding exceeds new mine supply, scrap recovery and official sales. Accordingly, any reduction in aggregate short positions in the futures and forward markets has resulted from intervention by the official sector, which, as he puts it, "has quietly taken the gold shorts from private speculators and producers and transferred them to their books. In other words, the official sector has intervened to prevent an explosive gold derivative crisis." Third, he reports from contacts in the hedge fund industry, "a growing belief that the gold market is being managed by the official sector and that this management will at some point fail." This perception in itself constitutes a "challenge" to the central banks, and citing recent comments from the Bundesbank about its willingness to consider selling more gold, Mr. Veneroso foresees the possibility of "further official statements or actions that might be construed as part of an attempt to manage the gold price." He adds: "One or more of these statements or actions may be so extreme as to shock the market." As promised in my December 4 commentary, the chart summarizing the semi-annual statistics on gold derivatives from the Bank for International Settlements has been updated by Mike Bolser to include the separate figures for forwards and swaps and for options as of June 30, 2002, as reported in table 22A of the BIS Quarterly Review released December 9, 2002. As noted previously, total gold derivatives rose 21% in the first half of 2002, from a notional $231 billion at the end of December 2001 to $279 billion at the end of June 2002. Of this $48 billion increase, forwards and swaps accounted for $17 billion and options for $31 billion. While the increase in options was almost twice that in forwards and swaps, the latter increase is particularly noteworthy in light of the reported reductions in producer hedgebooks. Nor can these increases be readily explained as just more gilding of producer hedgebooks. For example, with respect to reducing the Normandy hedgebook which it acquired in early 2002, Newmont appears to have taken a rather different approach than it used in 2001 to reduce its own. According to its third quarter 2002 Form 10-Q, the Normandy hedgebook is being reduced as aggressively as possible through a combination of scheduled and accelerated deliveries together with "opportunistic" buy-backs whenever possible. These practices, especially if other producers are taking the same route, should reduce total forwards and swaps. Indeed, if gold producers account for most of this category, scheduled deliveries alone in the absence of new forward sales should bring down the total, and to the extent there is any systemic double counting or other overlap, total forwards and swaps should decline even faster. According to a recent piece from Mitsui gold analyst Andy Smith, figures from several recent surveys indicate that total producer hedgebooks of over 3000 tonnes at the start of 2002 declined to under 2700 tonnes by the end of the third quarter. The failure of these reductions to make even a dent in total reported derivatives suggests that producer hedging is a relatively small portion of total forwards and swaps reported by the BIS, which at a notional $118 billion as of mid-year 2002 exceeded 12,000 tonnes when converted at the average gold price for the preceding six months. In other words, the bulk of this business appears attributable to neither producers nor fabricators but rather to the gold carry trade, primarily banks funding other activities. In these circumstances, the continued growth of forwards and swaps and the large increase in options are consistent with: (1) leasing of additional gold by the central banks to meet physical demand that exceeds available supply at current prices; and (2) transferring risk from the bullion banks to the central banks through derivatives of all types as appropriate in particular cases, bearing in mind that some of the largest bullion banks are parts of banks generally considered too large to fail. Among these is J.P. Morgan Chase (JPM), with gold derivatives amounting to a notional $41 billion (or approximately 4000 tonnes at $320/oz.) as of September 30, 2002, according to figures from the Office of the Comptroller of the Currency. See GOLD MARKET REGRESSION CHARTS. While failing to shrink total gold derivatives or even total forwards and swaps, ongoing reductions in producer hedgebooks have deprived the central banks of the principal fig leaf they used to cover their suppression of gold prices through the gold carry trade. Still, it appears that the central banks are continuing to hemorrhage gold. Basic principles of triage would suggest that at this point the central banks should try to manage gold prices higher so as to reduce and eventually stop unwanted outflows from their vaults while at the same time trying to prevent any explosion in gold prices that could cause a gold derivatives crisis.  Gold -- Sharefin, 23:21:58 01/29/03 Wed Gold -- Sharefin, 23:21:58 01/29/03 Wed Barrick Files Libel Notice Against Blanchard Barrick Gold Corp , the world's No. 2 gold producer, launched libel proceedings in Canada on Wednesday, seeking "substantial damages" against U.S. bullion dealer Blanchard & Co. for published remarks that Barrick says harmed its reputation and business interests. Toronto-based Barrick said it served a libel notice on Blanchard, which bills itself as America's biggest physical gold dealer, and its chief executive, Donald Doyle Jr., on Wednesday for a series of statements published since mid-December. Barrick's decision to go after Blanchard for defamation follows an anti-trust lawsuit filed by New Orleans-based Blanchard that alleges Barrick and investment banker J.P Morgan Chase made $2 billion in short-selling profits by suppressing the gold price at the expense of investors. Barrick has dismissed the allegations in the lawsuit as ludicious and without merit. Gold -- Sharefin, 23:14:49 01/29/03 Wed Rising gold price fuels dubious product offers All that glitters Dubious precious-metal offers proliferate as price rises The commercial airing on CNBC offers an amazing deal - a gold-coin replica of the rare 1933 $20 Double Eagle, marked down from $39.95 to just $19.95. Call the 800-number and ask about the coin's gold content, and the call-center rep will fast refer you to the National Collector's Mint's own toll-free number. Call that number and you'll recall why all that glitters isn't. The company rep said the coin is plated with 10 millionths of an inch of 24-carat gold -- for a total of two-thirds of a gram. Yet that claimed total weight is as much a fabrication as the coins themselves, gold dealers said. The true content of such microscopic plating, they said, would be nearer to one one-hundredth of a gram - or about 13 cents worth at Tuesday's closing spot-gold price. "A prime motivator is greed,"Gold Newsletter publisher Brien Lundin said of the allure of such ads. "That's one of the buttons they're trying to push," The dubious advertising campaign that the nation's leading investing TV channel accepted is but a harbinger of the misleading offers that are bound to proliferate should gold continue its rise beyond a six-year high of $368 an ounce. ~~~~ That gold mania occurred during a period of hyperinflation and the worst recession since the Great Depression. Another now appears to be building due solely to the greatest loss of national self-confidence since the Russians beat the U.S. into space with Sputnik in 1957. Knowledgeable precious-metal investors have fared well during gold's recent run-up. Yet the steadfast insistence of many that gold will hit $1,000 an ounce because the global economy is collapsing illustrates what an emotionally charged investment gold actually is. It's gold's emotional appeal - a seductiveness dating to the dawn of civilization - that threatens to financially sap a whole new generation enthralled by its glimmer should the world sleep a little easier anytime soon. Gold -- Sharefin, 22:55:16 01/29/03 Wed Gold stocks versus gold Profiting from an intermarket spread Right now, gold bulls are feeling really good about things. Which means that most everyone else is feeling quite bad about things. That said, gold is on a tear. Not for any fundamental reason, but because investors are concerned about world affairs, and apparently as a defence mechanism, prefer to hold gold than US dollars or euros. December gold futures are up from US$315 to US$360 in the last month or so. At the same time, the gold and silver index (symbol XAU) is up from 62 to 74. On a relative basis, the XAU is outperforming -- a 19% gain versus a 14% gain -- which is interesting, because the XAU represents a basket of gold stocks rather than the metal itself. And many investors believe that over the last while, gold stocks have actually been lagging the performance of gold. The reality lies somewhere in between. For one thing, says Lawrence McMillan, president of www.optionsstrategist.com, the XAU's stronger numbers are illusory. "If we measure the moves in standard deviations, which is the proper way to measure such things, then we incorporate volatility -- the facet of performance that is often ignored." Looking at it from that perspective, the 20-day historical volatility of December gold futures is 15%, versus a 20-day historical volatility of 40% for the XAU. According to McMillan, given the volatility number, the XAU would be expected to advance further, percentage-wise, than the gold futures when both are trending in the same direction. When you incorporate volatility into the equation, "gold futures have risen about three standard deviations, while XAU is up only about 1.5." That explains the discrepancy and why there have been so many articles about how gold stocks are lagging. Gold -- Sharefin, 22:50:40 01/29/03 Wed Gold Up On Currency, Bush's Speech London gold edged higher Wednesday morning in response to renewed concerns over a potential war against Iraq and a slide in the dollar against the euro. President Bush's State-Of-Nation address confirmed the U.S.'s commitment to disarming Iraq, by peaceful or forceful means, and in doing so reaffirmed gold's safe haven stature. Dealers said the gold market now seems to have largely priced in the onset of war with only the timing of military action left as an unknown. "Talk of war, especially if supported by fresh intelligence on weapons of mass destruction will keep the gold price supported although the uncertainty of the timetable for military action may delay any move higher for now," said John Reade, analyst at UBS Warburg. But the burden of the threat of war has has been difficult to avoid by the dollar and again it is currency that is helping to drive spot prices higher Wednesday morning. At 1057 GMT the euro stood at $1.0877, up $0.0046 on the day. Dealers in London said that fresh interest in bullion in the wake of greater recognition for the metal in the national press and concerns over waning stock markets by private investors has also spurred the recent gains for gold and another push higher can be expected short term. Rory McVeigh, London-based dealer with Mistubishi Corp, said he expected to see another wave of buying from the open of the Comex market in New York, which should help the spot price hold above $370/oz. He felt the performance of the stock market would also have a bearing on gold once again as investors bail out of falling stock in search of more sturdy assets. Gold -- Sharefin, 22:48:41 01/29/03 Wed GOLD PRICES TO STAY OVER US$370 IN CASE OF IRAQI WAR: GFMS London-based Gold Fields Mineral Services has forecast gold prices to stay above $370 per ounce if the US-Iraqi crisis blows up into a lengthy war, affecting gold jewellery demand in price sensitive markets like India. Releasing its latest survey, GFMS, an independent consulting company specialising in the analysis of precious metals markets, said "if the Iraqi crisis blows up into a lengthy war, we could easily see the market over $370." ~~~ Tumbling equity markets and US dollar losing ground in forex markets were also attributed to diversion of investors' funds in precious metals. Price rise is likely to hit gold offtake in the price sensitive markets including India and Middle East, GFMS pointed out, saying "if we dont see prices easing back to more like $330 and instead they hold at over $350, we could easily see fabrication during 1st half of 2003 slumping below last year's low levels." According GFMS, total gold fabrication had declined by over 10 per cent during 2002, mainly as the price rise led to a slump in jewellery fabrication in markets like Middle East and India.  Gold -- Sharefin, 22:46:19 01/29/03 Wed Gold -- Sharefin, 22:46:19 01/29/03 Wed Indian brides go for gold, despite prices India, the world's largest gold consumer, is in the grip of a wedding fever as fears of war in Iraq push the precious metal beyond the reach of many aspiring brides. London-based Gold Fields Mineral Services forecasts that gold prices will stay high if the US-Iraqi crisis explodes into a lengthy war, hitting jewellery demand in the price-sensitive Indian market. Domestic prices shot to a record high of Rs 18,300 an ounce last week due to the war fears and traders predicted little change because retail sellers were eager to book profits at these high levels. But flourishing match-making agencies, with millions of eligible singles as registered clients, said the predictions would not hit the ongoing Hindu wedding season. "People with a wedding in the family are rushing to exchange their old jewellery for new so they do not have to cough up too much at these high rates," said D. Krishnamurthy of the Chennai-based Astro Matrimonials Services. He said the trend was visible both in Chennai as well as in Mumbai, the headquarters of India's bullion market and the country's commercial heart. "People are buying less, exchanging old for new and digging up ancestral gold, because how can there be a marriage without gold being gifted?" said Krishnamurthi. The annual Hindu wedding market is estimated to be worth a staggering Rs 300 billion with gold ornaments as gifts to brides gobbling up more than half the expenditure. The World Gold Council said despite the skyward journey of gold prices, Indian imports of the precious metal were up not only because of weddings but also as they offered better investment value. Matrimonial portal, www.Shaadi.com, said wedding bells were ringing furiously across India without a thought to gold slipping out of the reach of the middle class. "Only yesterday we successfully arranged 10 marriages," said Shaadi spokeswoman Vandana Asija. "The Hindu marriage season is in full swing and it will last until May and in no way are the soaring prices affecting nuptials because we Indians cannot think of a wedding without gold," she said. "There are more marriages this year than ever before ... and then there are some who are rushing weddings fearing the prices (of gold) could further soar," Asija said. "And in case war in Iraq occurs and gold prices shoot beyond the pocket of the middle class then people will use other alternatives such as gold-plated jewellery," she added. ~~~ "Gold is like whiskey, people will drink even if liquor costs more," Chanda added. Gold -- Sharefin, 22:42:52 01/29/03 Wed Foreign stocks OK? If they're gold mines The Aden Forecast, edited by Pamela and Mary-Anne Aden out of Costa Rica, is even more explicit about foreign stock markets despite being very negative on the dollar. "World stock markets move together and this bear market is an international one," they wrote recently. "...The major trend is down and all of the world's stock indices remain below their moving averages. This means stocks are headed lower. The bottom line is, stay safe and stay on the sidelines. We think you'll be glad you did." "Seven lean years?" asks Vivian Lewis of Global Investing. She worries: "We need a locomotive soon, a major economy which can pull the rest of the world out of its current funk and malaise." Neither Australia nor Canada is powerful enough, she writes, although both are benefiting from "a regional commodity boom." Both Lewis and the Aden sisters reach the same conclusion. "Buy gold stocks," Lewis writes. "South African gold companies like Gold Fields are now truly global players and unlike some of the other players, they do not go in for forward selling." [i.e. they can profit from a gold price move.] Fiat -- Sharefin, 05:54:01 01/29/03 Wed The Fed official who cried 'bubble' long before it burst LAST summer, Fed Chairman Alan Greenspan claimed "it was very difficult to definitively identify" the late-1990s stock bubble until it was too late to do anything about it. Perhaps it was, for Alan. But one of his colleagues in the sanctum sanctorum of U.S. monetary policy saw the bubble early, saw it for what it was and urged Greenspan and the other money shamans to attack it. "Apparently I am not as convinced as others that the problems to which we ultimately will have to react will be consumer prices," Jerry L. Jordan admonished his colleagues on the Federal Open Market Committee on Nov. 11, 1997. "The problem may ... be ... in asset [stock] markets, as suggested by historical episodes in this country, notably in the 1920s, and in Japan in the late 1980s." We know what Jordan said because the Fed's hermetic deliberations are taped and delivered up as transcripts five years after the fact. The 1997 texts surfaced Thursday, and they show that, at least in the middle stages of stock mania, Jordan repeatedly warned of a coming bubble, to no effect. "I see a growing chance that the 1990s will be viewed at least as one of, if not the, most prosperous decade of the century," Jordan told Greenspan on May 20, 1997, a day when the Dow Jones industrial average rose 76 points to close at 7,303. "There are some scholars who say that errors made starting in 1927 sowed the seeds of what happened in 1929 and [the Depression] afterward," he added. "I find some of the analysis of what occurred and how it looked and felt in that period rather compelling ... I expect to end my career in the next decade, and I don't want it to be labeled 'the Great Contraction.' "  Gold -- Sharefin, 05:33:17 01/29/03 Wed Gold -- Sharefin, 05:33:17 01/29/03 Wed Do You Want to Fight Back Against The Outrageous Short Position In Gold Shares? Why sit back and be taken advantage of? Why let the wise guys who have fought the up-move in gold from their derivative trading desks also damage your gold share position without doing something to help yourself? This gold community should stop taking the hits and stop walking away unhappy. The short positions that exist in almost every gold share, in sizes of shares sold short, are beyond reason. In some companies, the short is so big that I firmly believe the entire float has been shorted. I have explained this phenomenon to you. It has robbed you of a proper valuation of your shares in light of the strong, and soon to be stronger, gold price. Gold is going over $400 - do you want to see your gold shares languish? Well, if you do nothing and let yourself be taken advantage of, then you do not deserve anything better. My suggestion to you is get moving and nail the culprits that are picking your pockets. There is something that you can do that is as effective as RAID on a BUG, but you have to do it now: Take Physical Delivery of Your Share Certificates Immediately!  Gold -- Sharefin, 05:01:35 01/29/03 Wed Gold -- Sharefin, 05:01:35 01/29/03 Wed The BIG Squeeze The gold camp is divided into several investor classes. There are mainly four categories when it comes to investing in gold. They are as follows: *True Believers *Nonbelievers, Hedgers & Short-Sellers *Momentum Traders *Clueless John Q's ~~~ Nonbelievers, Hedgers & Short Sellers This leads me to the next class of investors, which are the Nonbelievers, Hedgers, and Short-Sellers. This group includes governments and their central banks, hedged mining companies, hedge funds, bullion banks, and many Wall Street Investment banks. This group can be hostile towards gold and silver because it represents real money that competes with the fiat/credit-based paper system. This group views gold and silver as barbaric relics of the past. Governments don't like gold because it represents freedom from the debt-based money system it imposes on its citizens. Gold is discipline and governments don't like discipline or anything that inhibits their ability to tax its citizens directly through the tax system or indirectly through the debasement of the currency. As shown in these graphs below, the supply of money and credit have expanded by close to $2 trillion since the beginning of 2000. The result of the expansion of money and credit and a ballooning trade deficit is one reason why the dollar has lost over 20% of its value over the last 12 months. The depreciating dollar is one of three major storm fronts that contribute to The Perfect Financial Storm™ when all three-storm fronts merge. Added to governments and their central banks, the list of Nonbelievers also includes much of Wall Street, which doesn't believe in gold, does not understand it, and feels that it competes directly with its ability to sell paper assets to investors. Wall Street's investment banks, bullion banks and hedge fund community are short the metal and the metals stocks. As shown in the table below, they are responsible for creating an enormous short position in the precious metals stocks. They are short major unhedged gold producers, junior gold producers and silver mining stocks. You can see this in the short positions that have built up in all major categories of precious metals stocks -- whether it is the majors or the juniors. What these short-sellers don't understand is that this universe of gold and silver stocks is very small. The total value of all precious metals stocks is less than the market value of Coca-Cola. One would have to wonder, especially in the case of juniors and silver mining stocks, how they will cover their short positions when the ten-sigma event I see coming hits the morning newsstand. There are just too many financial and political storms rapidly building in force and they are in danger of colliding. To be short the metals at this time not only smacks of hubris, arrogance and stupidity, but is also equally suicidal. Many have wondered why the precious metals stocks have lagged behind the rise in bullion. [See James Sinclair Editorial 01/27/03] The huge short position in metals stocks goes a long way towards explaining the difference. However, there are two sides to any short sale. Once a stock is sold short, the short seller eventually has to cover that short position by buying back that stock. It is going to be the covering of this huge short position that is going to send the price of precious metals stocks up like a NASA space launch, especially if a ten-sigma event occurs. Ten-sigma's don't appear on the charts until after they have occurred. The attacks on 9-11 weren't' readable on any chart. The repercussions of September 11th were visible only after the event occurred, not before. Gold investors, especially the True Believers, hold on to their shares. Therefore, liquidity is reduced. That is why you see metals stocks soar when investors rush to buy, because they drive demand up when supply is limited. Unfortunately for the hedge funds who are short the metals stocks the gold share, believers aren't dumb like the technical traders who buy the actual bullion in the futures pit. For years now, the Smart Money commercials have been outsmarting the gold and silver traders by going long and short opposite the technical traders. Given the scarcity of precious metals, especially silver, the technical traders don't realize they could start wining the battle by simply demanding delivery of their bullion positions. By taking gold and silver off the exchange, the game would be over very quickly. Instead, the technical traders get bushwhacked every time by the shorts who have greater financial staying power and enjoy special exchange privileges. Sun-Tzu once wrote that the simplest battle strategy is the most effective to deploy and execute. If only silver and gold traders would understand the position of the short-sellers, they could win the war in one battle by demanding delivery of the metal and taking it off the exchange. I have seen the short positions in silver and gold equal ten times the amount of paper shorts. It is the short sellers' worst nightmare that one day bullion investors would see the weak link that has robbed them of their profits. One day this will be obvious and I believe that "one day" is coming soon thanks to the Internet. Gold -- Sharefin, 22:55:13 01/28/03 Tue The gold rush has started, but will it last? With equities in turmoil, investors are retreating to an old-fashioned store of wealth Gordon Brown must be sick of hearing that the gold price has gone up yet again. In 1999 the Chancellor decided to sell off more than half of Britain's official gold reserves of 715 tonnes. The subsequent auctions raised about $3.5bn (£2.1bn at today's price). But the gold price has since soared from $261 an ounce to this week's Iraq-inspired peak of $371, at which level those 395 tonnes would have fetched about $4.7bn Judging by the number of calls financial advisers have been receiving from their clients, Mr Brown is not alone in feeling that he has missed out on a classic hedge against uncertainty, wars and falling stock markets. But Evy Hambro, director of the highly successful Merrill Lynch Gold & General unit trust, said: "Gold is still relatively cheap, but where the price ends up is anyone's guess." ~~~ Mr Hambro said: "The gold market is currently testing a whole range of prices to see where it will go. But it is below its 20-year average price and in most commodity bull markets the price goes from well below average to well above. ~~~ Mr Hambro at Merrill Lynch said: "Having been a forgotten asset, gold is coming back on to investors' radar screens initially as a fringe side-bet and eventually as a mainstream holding. The rate at which this evolution to mainstream asset occurs, if at all, will be critical. "Investors have now had three years of negative returns in the equity market, and even the most stoical are getting demoralised. After torture like this, an investment in gold or gold shares starts to look quite sensible." The Merrill Lynch view is backed by some advisers to private investors. Graham Neale, a director of the London stockbroker Killik & Co, said: "I think gold looks quite attractive. We are going to see the price being volatile, because of expectations about when, if and how long the Iraq war will be. But the long-term fundamentals are quite strong." Mr Neale pointed to the need for the US and European countries to inflate their economies, which he thought would weaken the dollar, euro and sterling. He added: "The risks are a faster than expected resolution to either the Iraq conflict or the US and Europe's economic problems." Gold -- Sharefin, 22:35:57 01/28/03 Tue Vancouver Resource Investment Conference Vancouver was amazing; the turnout was great - although next year it'll be outstanding. There were two thousand assorted gold bugs, stock boosters, newbies, newsletter writers and idealists, milling around the trade show area and attending the excellent panel discussions and presentations. With gold going to new highs during the day and the Dow sinking below 8,000 for the first time since last October, the Monday session that Michael Nystrom and I attended was the perfect setting for reinforcing what we believe and how we see the future developing. There was palpable tension over geo-political issues in the air; there was some excellent discussion on this topic in the second to last panel of the conference last night, where the most amount of passion was displayed in terms of "controversial issues." But I'll get back to this later. ~~~ There was a huge amount of data given to the audience regarding very specific stocks, mainly gold exploration companies - but other metals and diamonds stocks were mentioned sporadically throughout. One of the big "take homes" for me was just how this advisory industry works in and of itself. There is a lot of boostering in the mining & exploration business, and investors need to beware (paranoid may be the best term actually!). Learning how to apply visceral instincts to deciphering what is being said by whom and why - is possibly one of the investors' most important tools in this space. Of course investors also need to do their homework, and thoroughly. Gold exploration and mining stocks are hugely speculative. It is very easy, having lived through the entire Internet phenomenon as CEO of my own company, from 1994 to 2002, to see a new speculative bubble inflating in the gold industry. The new dot.bombs will be mining stocks in the years ahead. Some of these stocks will return 1000% +, and many of them will be pure hype with absolutely no substance. If you are entering into this space for the first time as an investor you really need to go and study the history of financial markets, the "bubble phenomenon" and how to navigate your emotions through the quagmire of constant change, uncertainty, elation and devastation - I experienced all this, and more, as an entrepreneur in the greatest financial bubble of all time! This time around, I'm much better prepared, but I studied hard and soaked up information from all sources to reach this point - don't be lazy. Learn how to think for yourself. ~~~~ Me: "Where do you see the US Dollar going by the end of the year, where do you see the POG (Price of Gold) ending the year, and where do you see the POG topping out" Bob: "….it's just guess work…I think we go $1,000+ in the next 3 years. I think its going to go in fits and starts and I think its important to know the back story of gold right now…..the hedge situation, the derivative situation in this market. In the last gold cycle the word was, "The Gold is there," whereas in this cycle "The Gold is gone." I really don't think the central banks have the gold, its gone!" Bob said more than this, but this was the most important aspect of what he said. The central banks of most of the industrialized world have sold their gold, later I'll discuss a little about GATA and why. Bob did not give a number for the US Dollar at year-end - he is not a currency trader, but he said we are very early in a "big picture swing." ~~~ Bill then went on to discuss the basic movements of the POG over time, the supply shortfall in gold production, central bank gold lending, the rise in mining stocks being in the thousands of percents for certain stocks going forward, and various other issues. He stated that now the gold cartel is unraveling. The bullion business is on fire. The smart money is buying gold as they know GATA are right. Bill stated that at GATA they are waiting for what he called a Commercial Signal Failure. This is panic buying by commercial banks to cover their short positions, when this happens there will be a massive spike in the POG. ~~~ GATA's day has arrived! Vancouver was the moment in history when the Biggest Story in the World was finally told……..and heard. The outcome of this event will reverberate around the financial world and affect global events for years to come, it may be hard to notice at first - but the cat is out of the bag and now the real battle will begin. No doubt events will get far messier before they are eventually cleaned up. Email Chatter -- Sharefin, 22:14:57 01/28/03 Tue Funny thing. Yesterday, I asked my commodities broker who is a mover for people from all over the world with A.G. Edwards to give me a quote on how much it would cost to take delivery to my doorstep of 100 oz. of Comex Gold. He said his company could only deliver a depository receipt against a bank who would then deliver, but that Comex, now split into three parts, doesn't actually have any gold. ??? Gold -- Sharefin, 21:55:38 01/28/03 Tue China Central Bank intervenes to rein in gold prices China's central bank, seen intervening recently in Shanghai's gold exchange to curb sky-high prices, is expected to allow trade to return to normal after the Lunar New Year holiday next month, traders said on Tuesday. Domestic gold prices rose to such dizzying heights that the central People's Bank of China sold some of its precious metal to cool prices which had risen above world levels due to a demand spike before the important annual holiday, they said. But demand for gold should slacken after the February 1-7 holiday and prices would stabilise, traders said. The central bank attempted to rein in prices to help domestic gold processors curb rising production costs and prevent firms from importing gold illegally to cash in on spreads between domestic and global prices, they said. "The central bank is unlikely to intervene if everything goes back to normal after the New Year," said a floor trader. "The government will still want to let the market determine prices." The central bank sold nearly 600 kg of gold just before the market closed last Wednesday, pushing prices down by more than one yuan to around 96 yuan ($11.6) per gramme, although prices and volumes still closed at record highs. "The central bank intervened several times in the past few weeks because prices went too high," said a second floor trader. ~~~~ Some traders said the central bank used gold from its reserves to intervene. At the end of 2002, China's gold reserves were 19.29 million ounces (546.9 million grammes), up from 16.08 million ounces at the end of November. "The central bank has the right to intervene," an exchange official said, declining further comment. Traders said the central bank, the sole intermediary between gold buyers and sellers until the exchange opened in October, has maintained some control in hopes of keeping end-products affordable for consumers by controlling raw material prices. "If domestic prices rise way above global markets, the government is afraid that some companies might import illegally and refine it to standard gold to sell domestically," the second trader said. Gold smuggling is common in the country, especially in the south, as China's annual gold demand of 250-300 tonnes (8.8-10.6 million ounces) well exceeds the estimated 190 tonnes it was expected to produce last year, officials said last year. ($1=8.276 Yuan) Fiat -- Sharefin, 21:53:22 01/28/03 Tue Debt, Deflation, Depressions and Delusions: In the Retail Ledger of January, 1928 an article runs, "Babson Fears End of Prosperity: Can't Last Forever, He Says in His Year's Message to Business. (Jan. 17)." Put your business and your personal affairs on a safe foundation. Get out of debt, wholly if possible, otherwise, reduce your indebtedness as much as possible. There is no reason why the wheel of fortune will not continue to turn for many generations as it has in the past. Panics and depressions may some day be eliminated, but little has yet been done to bring such a millennium about. The Federal Reserve system may have put banks in an impregnable position, but it has not changed human nature. People are in debt today to an extent never before. Sooner or later the dam will break, to be followed by unemployment, failures and hard times. Gold -- Sharefin, 21:25:08 01/28/03 Tue India Gold-Imports grind to a halt as prices soar BOMBAY, Jan 27 (Reuters) - India, the world's largest gold buyer, has virtually stopped importing the yellow metal in the face of soaring world prices, which have pushed local prices to record highs, traders said on Monday. India has been importing a mere 200 to 300 bars (of 116.64 grams) a day since Friday, compared with about 10,000 bars a day a year earlier, and would not increase buying unless prices fell significantly, they said. "Hardly any buying is taking place at current prices as traders are just sitting quietly and watching price movements," said Suresh Hundia, president of the Bombay Bullion Association. Gold -- Sharefin, 21:16:10 01/28/03 Tue Gold climbs atop US debt mountain The new year has seen gold smash through long held price and investment records; bullion is perched at seven year highs and the 6.77 million ounce net long position of speculators on the New York Commodities Exchange - the ‘longs' are betting on a rising gold price - is the highest since February 1996. There are as many explanations offered for the rise in the price of gold as there are commentators, although imminent war in Iraq and a terminally weak dollar are the two most prevalent rationalizations for the good fortunes of bullion. If indeed, the prospect of an all-out war in Iraq is the primary driver behind the gold price, some punters fear an end to rising tensions in the region will cause an almighty crash in bullion. A weak dollar, however, could prop the price up for some time to come as the currencies myriad structural weaknesses are worked out of the system. So which is the dominant factor behind the rising price? Some of the sharpest minds in the gold business - AngloGold chief executive Bobby Godsell and US analyst Jim Sinclar among them - believe the so-called war premium in the gold price is not as high as other would believe. Sinclair told us earlier this year the Iraqi contagion was worth only “18 to 20 points” in the gold price. The woeful performance of the dollar against the Euro and a host of other competing currencies, including the rand, provides a more sober perspective on where bullion in likely to end up. According to a note published yesterday by HSBC, the case for a more fundamentally based push behind the gold price, lies in the massive corporate largesse in the US over the last decade and the ripple effect of mountains of debt which threaten to swamp the dollar. With gold entrenching its position as a rival currency to the dollar, the bad news for the US currency is proving bullish indeed. ~~~~~ The HSBC view “The reasons why the US has a cautious stance on the US economy is strongly linked to debt,” said the HSBC report. In it, the group's US economist Ian Morris says the debt build-up in the in the second half of the 1990s has, “at an aggregate level, not been reduced at all, even if the worst offenders of the era have gone bankrupt or forced to reduce debt through asset fire-sales”. An example of the debt problem facing business is the telecommunications sector alone, which according to a Fortune article last year, is facing a debt burden of $2 trillion. Morris says interest costs remain exceptionally high across the board, taking a disproportionate slice of company earnings. He says despite the fuss made about balance sheet restructuring and debt-cutting, sapping debt servicing charges remained virtually unchanged during last year. “Typically, post-recession periods tend to be associated with debt reduction that successfully reduces interest costs. It has not happened this time round, suggesting this phase is still to come. Indeed, this is exactly what we are expecting. If true, the economy will continue stagnating, as strong expansions occur when demand for debt is strong and accelerating, and this is very unlikely to be the case in 2003,” says Morris. The upshot is that retained profits across the broader market are low, in fact too low to fund any fixed investment or employment expansion. Add to this, Morris says, that more sectors are making losses than at any time since 1947 and the difficulty of operating across the entire economic spectrum becomes painfully clear. It is against this backdrop that corporates are scrabbling to cut debt, which will lower inflation according to HSBC. The trend is not corporate specific, however, with US consumers also eschewing investment in mutual funds in favour of reducing household debt. Unconventional means “Stagnant sub-trend growth and lower inflation and the fear of deflation, suggests that interest rates will decline further over the medium term, despite being at 40-year lows. Given short term interest rates are already a stone's throw away from zero, fear of a ‘liquidity trap' may grow and with that, attention in unconventional money policy options is likely to rise,” says Morris. HSBC says there remains a risk that the US could use debasement of the currency as one of the unconventional tools at its disposal to resuscitate the economy. “Any prospects of monetary debasement could lead to a much more significant wave of gold buying through capital preservation strategies,” says HSBC. A general wave of consensus among investment professionals, including those at Commerzbank and Dresdner Kleinwort Wasserstein, suggests capital preservation in the face of freefalling equity markets will be the strategy of choice for investors across the globe. Good news for safe haven gold and highly rated government bonds. Gold -- Sharefin, 21:12:45 01/28/03 Tue Long liquidation threatens to lasso gold price PERTH - Who would have thought 12 months ago that the gold price would burst through US$370 an ounce? Almost unbelievably, in the space of four weeks in calendar 2003 bullion has surged by more than US$30/oz. Equally unbelievable, the US$370/oz-plus mark equates to a whopping US$115/oz or 45 percent above its historic lows of a couple of years back. With Wall Street and the US dollar under continuing pressure and war in Iraq apparently a matter of time, gold bulls are charging. “It is certainly conceivable that gold could be challenging the peaks of the 1993 and 1996 rallies before this quarter has ended,” according to a leading global gold analyst. In both those rallies gold broke through US$400/oz, albeit fleetingly. But it is worth noting what happened in those two periods as it may provide aggressive hedge funds with an indicator as to the behaviour of the price this year. There have been only two occasions in the past 10 years that the net long position of Comex stocks has been at the current level (almost 200 tonnes). They were during the price peaks of 1993 and 1996. “Given the sharp rise in gold prices and in speculative long positions, the market appears vulnerable to long liquidation - a mirror reaction of the short-covering rallies experienced from 1997 through to 2001,” suggested associate director of metals and mining at Macquarie Bank, Kamal Naqvi.  Gold -- Sharefin, 21:08:40 01/28/03 Tue Gold -- Sharefin, 21:08:40 01/28/03 Tue Expensive gold or cheap stocks? VANCOUVER -- If the gold conference circuit is a sentiment barometer, then bullish is too timid a word for the mood here. The Cambridge House investment conference is easily the busiest we've seen in the last three years, with a full complement of companies exhibiting, thronging crowds, oh, and don't forget, voracious promoters. So what seems to be on everyone's mind? A valuation dilemma and concern about “dead fish” - dubious projects achieving uncommon favour with investors. Most everyone Mineweb spoke to was struggling to make sense of gold equities' lethargic response to the rampant gold price. By most measures gold stocks seem attractively priced, but they could be signalling that the gold price has got ahead of itself. -------------- Time a few commentators stopped talking & started thinking. What will happen to most all producers on gold taking out $400 & then $500? Most goldbugs are now familiar with Jim Sinclair & his writings on derivatives & hedges & how it will effect gold producers? Indeed goldbugs (me(:-))) & lots of others were discussing the coming problems along with GATA for the last few years and even before GATA was formed. Jim has gained a popular audience and has well described the coming problems & now the majority of goldbugs are aware of what is coming along with higher gold prices. Most goldbugs are also aware that gold is rising not because of Iraq but because of the financial meltdown we've embarked upon. So far 10 trillion (give or take a few) has been wiped out & there's still double that left to remove from the table. Gold is signalling that this move is just in front of us. So why would any sane buyer want to buy gold producers who will most probably have a hedging problem/nightmare on higher gold prices that coincide timing-wise with the financial fiat meltdown. ***Gold stock buyers have lost their confidence in higher stock prices yet they've not lost their confidence in higher gold prices.*** Think about it & invest wisely. By the time gold has risen past $600 the Dow will be heading below 6000 points & derivatives will have become a nightmare. Gold producers will be hamstrung with their hedges & goldstocks will be afflicted with the same malady as the general share markets. Gold is telling a story yet the fiat holders of gold have yet to wake up. Only now are they starting to complain about what is going on. Had they thought this through months ago they would have switched from stocks to physical. Once the switch for physical is tripped the only way you will purchase physical is at much higher prices. Why? Well there's only so much available & there's many investors with millions who will be wanting to purchase. The answers to the goldbugs questions is there all waiting to for all to see. Stop, think, wonder why & react... but don't be last in line at the cue. Gold -- Sharefin, 20:41:35 01/28/03 Tue Investors choose minerals over paper Vancouver crowd swarms gold, mining exhibitors Bring out the gold crowd, more than 2,000 of them, and you'll get more mining and gold-share metrics than you bargained for. The Vancouver Gold and Investment Show this past weekend hearkened back to the days, less than 10 years ago, when gold was a $500-an-ounce-plus commodity with cachet. "Three months ago, we never would have expected this kind of crowd," said Joe Martin of Cambridge House, the gold show's organizer. "I think we're seeing the light at the end of the tunnel." Fiat -- Sharefin, 20:39:39 01/28/03 Tue Cycle of Deflation We continue to believe our graph "Cycle of Deflation" (see attachment below) is as pertinent today as it was 3 years ago. In the most recent of our many references to it we have expressed our belief that we were entering the stage of competitive devaluations after going through the stages of excess capacity and pricing power weakness.   Gold -- Sharefin, 20:30:25 01/28/03 Tue Gold -- Sharefin, 20:30:25 01/28/03 Tue Sharefin's Post Has Points to be Heeded I'm staring at three commercial neural net subsystems all of which have independent recent buy signals on gold (and other things), all of which are run by 3 independent groups with no direct connection to gold sellers, gold traders, gold mining companies, etc. These systems are un-emotional, non-human, automated systems. I don't see how they can be greed-motivated. Fundamentally, when there is minimal resistance overhead and valid supporting reasons, as with gold, that fuels rallies. A non-linear system can predict and can be effective.  Gold -- Sharefin, 20:03:28 01/28/03 Tue Gold -- Sharefin, 20:03:28 01/28/03 Tue Nachbar Rare Coin Index  Gold -- Sharefin, 18:10:34 01/28/03 Tue THE CASE FOR GOLD THE CASE FOR GOLD By William Rees-Mogg In 1974, I wrote a short book, "The Reigning Error", in defense of gold as a monetary instrument. The argument was that all paper currencies are abused by the governments or banks which issue them. Gold cannot be created or replicated by a printing press; it is therefore protected from the human abuse of over-issuance. Many people do not realize that a strong historic argument for gold even exists. Put at its simplest, one can say that gold has the same exchange value as it did in 1900. That is approximately true in high inflation countries, like Germany, which had two wipe-out inflations in the 20th century; in medium inflation countries like Britain, which lost 98% of the purchasing power of the pound; and in low inflation countries, like the United States, which lost about 95% of the purchasing power of the dollar. In Britain, the gold price has moved with the cost of living index, at least over long periods. An ounce of gold will now buy about the same area of farmland as it did in 1660. After my first book, gold responded to the global inflation of the 1970s. At one point, it rose from the official price of $35 an ounce to a peak of around $850, or by about 23 times. Provided one sold out near the top, gold was the star performer of a very difficult decade. Since then, gold has been a poor performer, particularly when compared to the Wall Street boom of the late 1990s. ~~~~ I have repeatedly written that gold has become a better investment than the Dow, and it has been. In 1980, at $800 an ounce, gold was a bubble. At $260, it was dirt cheap, and the dot-com shares were a bubble. Is gold still cheap? The gold market is certainly performing very well, up 30% in the last two years and outperforming most other investments. For several months, the gold price hovered around $320 an ounce and seemed to have difficulty breaking out above that level. What are the factors now? The expectation of war in Iraq is probably the most important one. Gold certainly benefits from inflation, but it also benefits, more generally, from uncertainty. I think it is probable that the United States will go to war to overthrow the Saddam Hussein regime, and that the war will be short and successful. At least temporarily, that would be unfavorable for the gold price, because it would remove uncertainty. However, there is no certainty about any war. Gold remains a good protection against a spread of war, such as is widely predicted by Arab commentators. So long as the uncertainty exists, oil prices are likely to remain high, and Middle Eastern investors are likely to be putting some money into gold. The second influence to consider is interest rates. They are abnormally low at present, not only in the United States, but also in Europe and Asia. That means that the cost of holding gold, which is always a first-class security, is very low. Governments remain afraid of another recession, so there seems to be little risk of a higher trend in interest rates for the time being. That is favorable to a higher gold price. So is the general anxiety about the major world currencies. The dollar has been weak, because the United States has a high and rising external deficit to finance. It now amounts to nearly 5% of the gross domestic product. Because the dollar has been weak, the euro has been comparatively strong. But the European Union has agreed to accept 10 new members, with 20% of the existing E.U. population. These are poor countries and will be a burden on the currency. The Japanese banking system is in serious trouble, which affects the yen. It is not hard to see that gold is more attractive than any of these currencies. Every other currency relates to debt; gold has no debt, though individual gold holders, of course, may. Central banks have been selling gold, but that has largely stopped. The main creditor countries, including China, Taiwan, and Japan, are in Asia. They have a gold tradition. I expect their central banks to prefer gold to dollars in 2003. This seems to be the view of the market. A year ago there were large bear positions, but now the speculative positions are bullish. My own view is that the latest rise is only the start of a long-term bull market in gold. From the late 1960s, the last bull market in gold lasted for over 10 years. It is quite possible that what looks like a new bull market will run for some years, and go well above the present price. But, inevitably, there will be market reactions along the way. Fiat vs Gold -- Sharefin, 18:00:09 01/28/03 Tue Dow Turns Down - Gold Bull Market Is Based On More Than Iraq GOLD BREAKS 15-YEAR RESISTANCE LINE... Back on December 20, we showed gold bullion testing a 15-year down trendline extending back to 1987. That line sat near $350. Gold has now exceeded that long term bear line by about $20 (closing near $370 today). That puts gold prices almost 6% above that major resistance line. Normally, we require a 3% penetration to convince us the upside breakout is for real. We certainly think this one is. Our next upside target in gold is $400 -- the peak reached at the start of 1996. We believe that the bull market in gold represents a generational shift out of stocks and is far from over. GOLD VERSUS STOCKS... We believe there's a lot more behind this gold bull move than war jitters. The charts below show why. Historically, gold moves in the opposite direction of the stock market. That's because gold is a hedge against bad times. It doesn't matter if the threat is from inflation (like during the 1970s) or deflation (like now). The fact is gold is tied to the stock market -- but as an alternative investment. Gold prices peaked in 1980 and were in a bear market for approximately twenty years. Stocks bottomed during 1982 and were in a bull market for most of those twenty years. The charts show those two major trends turning at the same time from 1999-2001 (see green and red circles to the right). It seems pretty clear that the big bull market in stocks ended right around the time the new bull market in gold started. The moral of the two charts is that each asset class has its own time to shine. From 1982 to 2000, stocks were the place to be. Since 2000, gold has been the preferred asset. Since these are twenty year trends we're talking about, we don't expect them to end anytime soon. That's why we believe this bull market in gold is still in its early stages. The media is attributing stock market weakness and gold strength almost exclusively to the Iraq situation. These charts suggest, however, that there are much larger forces at work here than Iraq.  War -- Sharefin, 08:55:23 01/28/03 Tue The Real but Unspoken Reasons for the Upcoming Iraq War Although completely suppressed in the U.S. media, the answer to the Iraq enigma is simple yet shocking - it an an oil CURRENCY war. The Real Reason for this upcoming war is this administrationâ??s goal of preventing further OPEC momentum towards the euro as an oil transaction currency standard. However, in order to pre-empt OPEC, they need to gain geo-strategic control of Iraq along with its 2nd largest proven oil reserves. This lengthy essay will discuss the macroeconomics of the "petro-dollar" and the unpublicized but real threat to U.S. economic hegemony from the euro as an alternative oil transaction currency. Gold -- Sharefin, 08:40:29 01/28/03 Tue The decline in production is inevitable I leave you with a quote from the president of Homestake Mining, in 1974: "With higher gold prices, it's become profitable for us to mine lower grade ore. So while the amount of ore we process remains about the same, actual gold output is lower. For instance, during 1972 our gold output declined 20% from 1971, yet our income and profits are considerably greater than a few years ago. The situation is similar for gold mines in South Africa. Over the years, I expect gold production will continue to drop--the faster the price of gold rises, the faster the drop. If gold were at $300 per ounce (it was $100 at the time), I think gold production would be something like a half or third of what it is now." ~~~~ "The higher (gold) price enabled profitable mining of a lower grade ore and substantially lengthens the life of the operation. Although total gold production was lower in 1973 than in 1972 as a consequence of the lower grade of the ore milled, Carlin's net income was sharply higher." -- 1973 Newmont Annual Report Gold -- Sharefin, 21:10:51 01/27/03 Mon Finally, A Star For A Journalist! - pdf file Warning - this file is big at 2.5mb in size It contains many charts & comments.  Fiat -- Sharefin, 20:32:38 01/27/03 Mon Fiat -- Sharefin, 20:32:38 01/27/03 Mon The "Go it Alone" Iraq War! Hedge Fund Operations in Gold & Gold Shares. The Final Answer to the Million-Dollar Question: Why Are Gold Shares Doing What they Are Doing? As the short interest in gold shares started to increase, it was easy to excuse the phenomenon as a product of what occurs in markets when active listed options exist. However, that excuse for the short position now defies logic because the short side of the gold shares exceeds the open interest for the appropriate options that would apply. Are you totally perplexed by the action of gold, which is robust, and the action of the shares which is debilitated? Have you noticed that when gold strengthens, the shares hit a brick wall? Yes, I know you have but have you seen the timing of that strange and contradictory occurrence? The answer to what is going on is shouting at you if you have the ability to see the charts in real time on a one-minute bar overlaid as shares over gold. You will see that as gold is being purchased, the shares are being shorted. What has occurred is that major ratio traders (those who develop mathematical relationships determined by back testing to balance potential loss and gain on either leg which is subsequently adjusted to their bullish or bearish desires) and hedge funds are the source of the gold share short, being long gold and short the shares. In truth, I cannot blame them where the gold producer hedgers are concerned but it seems they may have gone bonkers with this spread and simply shorted all listed gold producing companies from 100,000 ounces per annum and up. It also looks to me as if there might be a little hanky-panky going on since the short of certain shares seems to exceed that which is reasonably available to borrow. A requirement of a short sale is delivery of shares. These shares are obtained by borrowing. Every major brokerage concern has a loan clerk for this purpose. Only shares on margin are automatically available for lending. Fully paid shares require permission of the lender to qualify them as available to the short seller. I have given you one lesson on felony 101: explaining how probabilities support Enron as being the yet to be discovered largest money laundry to have ever existed. I will also give you a felony lesson on how to short sell a listed stock without an up tick: back the sale through Canada or elsewhere over the counter where delivery laws are different. This is a key reason why some stocks face inexplicable bear raids on NASDAQ. Now please do not be tempted to employ these illicit strategies. They are only explained so you will understand market phenomena. So, in my opinion, the short of gold stocks culprit now is identified as Hedge Funds and Hedge Operators long gold and short the shares. The interesting point is that these funds plan to sell gold between $372 and $386 into the Iraq invasion with a plan to cover the short gold stock on a gold bullion price pull back after the invasion. What have the Hedge Funds gotten wrong? Why are these hedge operators going to be hurt financially on this play? First and foremost, they have the wrong price at which gold will potential top in the short-term top as we begin the transition between Wave#1 and Wave # 2 of this long term gold bull market. I believe I know the right gold price number but am not eager to put it in print so the hedge funds can hurt the community gold stock traders that they are already taking advantage of. For those that wish to know the gold price that maximizes this leg, please, if you are not already on my email list, go to www.tanrange.com and register on this site. That way you will go on my private list automatically and save my staff a great deal of work and potential error in your email address. I will have the list carefully reviewed. I will soon email you an attempt to do the impossible. That is outlining the future of gold in terms of time and price. You will have to bear with me knowing, as I do, the impossibility of such a task. I will present it twice under two different conditions. However, we will constantly monitor progress as the ability to predict from point to point, the gold price is doable, or at least it has been so far in my career. The Hedge Fund Errors 1/ The Hedgers & Hedge funds are going to exit the futures on gold at the wrong price thereby leaving themselves increasingly exposed to the debits developing on their gold shares position. 2/ The Hedgers & Hedge funds have shorted the gold shares too hard in light of the relatively small floating share supply. In some cases, as I see it, the entire float on certain issues may well be shorted. 3/ The Hedgers & Hedge funds are not familiar with the tenacious nature of the gold share investor vs. the gold share trader and therefore will not get the volume of selling they are hoping for. Conclusion: As gold approaches the $381 to $386 price level, shares will start to firm and gold's momentum will slow slightly. This will be due to the operations of the Hedgers and Hedge funds getting ready to rake in their expected profits. However, as gold trades into the middle $390s you will see the gold shares start to move ahead of gold momentum-wise as some of the faster and smarter hedgers will see an abyss of losses opening in front of them. As gold passes $400, which will be to almost everyone's surprise, the Hedgers will panic and gold shares will go ballistic. These gold share shorts, in certain instances, are simply too large and therefore cannot be covered under any circumstance that I can envision. Like the mountain of derivatives, the hedgers have gone wild in this shorting of the smallest capitalization that can be found in any publicly traded industry, the gold mining industry. What "fundamental factor" have the Hedgers and Hedge funds forgotten that will totally bury them in their gold share shorts well after the Iraq invasion is history? The mistake made by these greedy hedgers and hedge funds is the definition of the USA going it alone. What that means is that no one will share the cost of the operation with the US but, more importantly, share the cost of reconstruction of Iraq and its modernization. I gave you a must read in the current issue of "Foreign Affairs." Basically a mouthpiece of the sitting administration, this journal tends to reflect foreign policy trends relatively well. Reading it that way, and not critically, it can be a useful tool in understanding the impact of international politics on markets. I have already told you that since Lawrence of Arabia, the mistake made by the West concerning Middle-East matters have been the same. We fight battles and then, as recently as the Iraq invasion, leave the results in the hands of anything from despots, international criminals to our sworn enemies. As a result, the Mid-East situation for their citizens never changes, but in our terms simply gets worse. This invasion will be followed by a rebuilding of Iraq as Bush will not stop the fight unless Hussein and bin Laden are history, or more likely, occupying the same hut somewhere in Upper Mongolia. The cost of this invasion, assuming a short war and the rebuild, is well over one trillion dollars. That will be paid for by expansion of the monetary aggregates. As a result of "going it alone," the USA, who will bear at least 90% of this cost, will gain from the business demand but lose on the impact of all this on the US Dollar. The US Dollar is building multiple head and shoulders, as did Enron and General Electric, with a dollar downside maximum potential well under the low I have suggested to you at 72 on the USDX. This insures that gold will find its way back into the system to prevent the multiple head and shoulder potential for the US dollar from becoming real market prices. In the final analysis, the War against Iraq will help business activity and hurt the dollar. Gold will rise to a level not expected by the Hedgers and Hedge funds will react and return to the second leg of the long-term bull market from a reaction low so high as to nail the Hedger and Hedge Funds. That low in the reaction to come could even be higher than gold is today. Fiat -- Sharefin, 20:24:55 01/27/03 Mon We Ain't Seen Nothin' Yet! Ominous storm clouds have been gathering for some time. There have been a few gusts of wind and a few drops of rain have fallen. An enormous storm is about to strike an unsuspecting world. Only a tiny fraction of people in this nation and the rest of the developed world are prepared physically and financially for what is about to strike their lives. Our great nation, along with others, have warning systems in place to provide the populace with early warnings for many natural disasters such as hurricanes, earthquakes and tornados. A very great tragedy, a true disaster, is about to hit the entire globe, but there were no warnings to prepare for it in advance. And, even more tragic, a widespread general alarm has not yet happened a full 3 years after the first signs of grave trouble appeared. The true understanding of what is now happening and what is to come is held by a tiny fraction of our population. From the top down, neither President Bush, his advisors nor members of our Congress, with the possible exception of Representative Ron Paul of Texas, have a correct and full knowledge of the economic devastation about to strike. There are no signs of recognition of our "once in a century" storm by our corporate leaders in Wall Street or around the nation. The ivory towers of academia have not recognized the scope and magnitude of what they now perceive as a "modest recession." Prof. Jeremy Siegel of the Wharton School of Finance, a renowned author and student of the stock market, has recently declared on CNBC that the bear market is over - a brilliant case of the blind leading the blind! The highly paid executives and the thousands of employees of the large corporations that have declared bankruptcy recently must surely recognize that something quite unusual is occurring. The heads of other companies struggling to keep their business alive and the millions of investors who have lost trillions of dollars from their retirement plans know that there are serious problems with our economy. But no one, from the President and Alan Greenspan on down to our nation's daily newspapers, are telling the scary truth about the crisis situation threatening America and the rest of the world.  Gold -- Sharefin, 18:40:50 01/27/03 Mon Gold -- Sharefin, 18:40:50 01/27/03 Mon The Second Leg Of The Uptrend In The Gold Price has really begun Generally speaking, the gold price has moved in two very distinct, broad phases since the mid-to-late 1970's, and the second leg of a third phase is now still in the fairly early stages of forming. It is that third phase we will concentrate on, but the background is important. Phase 1 (mid 1970's to 1980) In the mid 1970's there occurred what was in fact the second Arab oil price shock. This drove the western world from a period of low, single digit inflation to a rate of 13 per cent or so by the late 1970's and triggered what became known as the “hard asset” or “inflation” boom. The gold price rose rapidly from a low of US$127 in 1977 to US$524/oz in 1979 before surging to spike at US$850/oz in January 1980 . Christmas Eve share trading in London in 1979 was the busiest since the Australian nickel boom exactly a decade earlier. But this was not to last for several reasons. Phase 2 (1980 to 1999) Firstly, Paul Volcker, then chairman of the US Federal Reserve, took swift action to kill such high inflation by raising interest rates sharply into double digits-a process which the world found painful and which had, by 1982, precipitated the worst US recession since World War 11, a collapse on Wall Street to around 620 points on the Dow Jones Industrial Average and a sharp decline in business and investment confidence everywhere. Gold , very sensitive to high interest rates, bottomed in 1982 at US$297/oz. There were other factors at work. Individuals, overjoyed by the near seven-fold rise in gold between 1977 and early 1980, took gold artefacts for sale at jewellers and goldsmiths, irrespective of the fact that that the antique value of the gold pieces was often very considerably greater than the intrinsic value of the gold content. Another key, fundamental factor behind gold's demise in phase 2 was sporadic official gold sales by Central banks and the IMF. These sales, and the increasingly obvious fact that gold was in a definite downtrend punctuated only by various international political skirmishes, prompted bullion houses and some investment banks to sell gold short, often rolling over their positions and taking advantage of gold producers, worried by gold's sharp fall, themselves selling gold forward (hedging) in order to lock in at a fixed price. Under this onslaught gold finally bottomed at US$253/oz in 1999, shortly after UK Chancellor Gordon Brown announced the sale of over 400 tonnes of the UK's gold reserves-a process which was completed at a weighted average price of US$275/oz. Phase 3 Since 1999 several things have changed or become obvious. Officially there is a moratorium on further central bank sales until at least 2004. Secondly, since at least 1990, there has been a shortfall in the supply of new gold production. Demand has only been met by official sales, short selling by bullion houses and investment banks and forward selling (hedging) by the mines. Occasionally there has been minor disinvestment by horders of gold or owners of jewellery pieces. The issue of how much gold has been sold short by investment banks and bullion houses is arguable and estimates range between 5,000 tonnes (almost two years new gold production) and 15,000 tonnes. Whatever the case it is a large amount and it cannot sensibly continue in a rising gold price climate. On the contrary, the question arises as to what price gold would have to reach in order for these “paper sales” of gold (ie non physical) to be covered. In the middle of all this Blanchard & Co, the largest retailer of gold bars and coins in the US, filed a lawsuit against JP Morgan (investment bankers) and Barrick Gold (a major Canadian based gold producer) alleging illegal price fixing of gold and collusion between the two. If Blanchard & Co wins when the case gets to court it is almost inevitable that the US Justice Department would have to follow up with a criminal investigation as price fixing in the US is a criminal, jailable offence (as the billionaire chairman of Sotheby's in the US has discovered). Many mining groups have been persuaded by investors not to hedge their positions forward. Firstly, the exercise was self-defeating in that they only drove the gold price down against themselves. Secondly, investors in gold shares rightly pointed out that they invested because they believed in a rising gold price and they did not want mine managements to deprive them of that possibility by locking in at fixed prices. At this point we come to a seminal speech by the current chairman of the US Federal Reserve, Alan Greenspan, on 19 December 2002 delivered to the Economic Club of New York. What was perhaps most surprising was not what he actually said about gold (fascinating though it was) but that he featured gold at all-and in the prime slot, right at the beginning of his speech. Here are some prime quotes. ~~~~ Doing some theoreticals, if full gold convertibility were to be re-introduced in the US alone, it would require a gold price of over US$2,000/oz. And the US has the highest proportion of gold in its total reserves ( over 57 per cent). On a world-wide basis it would need a gold price of over US$4,000 /oz to match gold reserves with total fiat money (paper currency). The UK's gold reserves are a miserable 7 per cent or so of total reserves after Chancellor Gordon Brown's efforts initiated in 1999. It is highly unlikely that Alan Greenspan has those sort of gold price numbers in mind, but they do highlight just how much the world has relied on the printing press over the last fifty years. Conclusion The two decade bear market in gold is over. The prime reason for saying this is the generational change in official US attitudes towards the metal's role. Furthermore, many mines have ceased selling forward and thus shooting themselves in the foot, while investment banks and bullion houses will, once they have sorted out their paper short positions in gold, likely cease the game they have been playing for the last decade and more - ie. selling gold short in which they were assisted by the then unwitting mines and people like Gordon Brown. This may all take a while to manifest itself in a quantum move in gold to, say, over US$450/oz as: (a) Greenspan's remarks were, surprisingly, not at all widely reported in the financial media, either in the US or UK, (b) some mines will still be tempted to hedge at the higher prices now prevailing and (c) investment banks and bullion houses who are short of gold will desperately try to cover their positions without moving the price. On the point of lack of coverage of Greenspan's 19 December speech highlighting gold, the Economist has always treated it as something of a joke, while the Financial Times also failed to grasp the nettle-as did CNBC and plenty of others. One wonders why their financial reporters are employed at all. This incompetence has cost their readers money. Nevertheless, it seems that gold is now in a firm and well based uptrend for the first time since Paul Volcker killed the price back in the early 1980's. International political issues such as Iraq and terrorist threats can only add to that. Gold is once again taking its place as a serious asset class. As Greenspan hinted, more fiat money can only be issued with a checking mechanism in place-and that mechanism is gold. Predicting an eventual new price level is hazardous, but US$450 or more by the end of 2003 looks quite possible. Remember, it is the groundswell of economic change that moves the gold price on a major and lasting basis, while unsettling political events just add to that. One must know “what game is being played in town”- and Alan Greenspan has changed the game. Gold -- Sharefin, 18:34:34 01/27/03 Mon Desjardins raises gold forecast to $360 an ounce Desjardins Securities was the latest brokerage to raise its gold price forecast as bullion hit a six-year high on Monday, saying it expects gold to average $360 an ounce in 2003 and 2004. The forecast is up from a previous estimate of $335 an ounce. ----- Nice to see them raise their targets more than three times a year.(:-))) Gold -- Sharefin, 18:31:18 01/27/03 Mon Short sellers switch attention to Durban Deep Short sellers - investors who borrow stock and sell it immediately with the aim of buying it back at a lower price - have maintained a remarkably consistent overall position against gold stocks irrespective of movements in the gold price. However, they have shuffled their individual interests switching primarily from Placer Dome as it closed its acquisition of AurionGold, to Durban Deep. Another apparent target was Ashanti, which saw a doubling in the bet against it in November. The overall short interest in the senior gold producers, representing five-eighths of the value of global gold equities, has been nearly constant at around 70 million shares. Having averaged less than a million shares short for most of the year, Durban Deep suddenly found the position increased to nearly 9 million shares, or one-fifth of the float, in November. That fell to a sixth of the float in December. The primary beneficiaries are Placer and Harmony, the former breaking out of its flat performance as the “swap” took effect. Kinross and Newmont have the biggest short positions against them in absolute terms, although Newmont's is a whopping 42% of its float. That float is the second smallest in relative terms in the peer group after Ashanti. ----- Can't wait till they cover...... Gold -- Sharefin, 18:28:02 01/27/03 Mon Golden Interest Gains! When even Louis Rukeyser has a guy on his show explaining the value of gold, I am circumspect at best. This guy has been preaching the same drivel for years. The article that came out against Silverado was a hatchet job pure and simple, CNBC allows persons to talk of gold, it just all smells as we are in the very beginnings of this bull. Seems to me, the ultimate contrarian that I am, that things are getting a little dicey in here. Too many touting the value of gold that have made it clear in the past as to how they abhor the golden one. The charts are showing possible breakouts coming soon above the established bull channel as things appear to be heating up in the gold markets. We all knew that day would eventually arrive, it just seems awful sudden to me. Maybe it is just the speed at which things move now and I am behind the times. If there is a near term downward reaction in prices, it will only represent a correction in an ongoing bull market. This will not detract from the long term trend in gold that has now established itself. Any shakeouts that occur are typical of bull markets. On the following weekly chart of Comex Gold, you can see the breakout above the bull channel. If this breakout holds, we are then entering a new acceleration phase of this Golden Bull and the long awaited 400 level will soon be achieved. Amazingly, I still hear people talking of how this is a correction in a Bear Market. This Bull was established long ago, and in early winter when it broke above the 330 area the long term trend was confirmed.  Fiat -- Sharefin, 18:23:59 01/27/03 Mon China Bank Bailout Could Need $290 Bln China must bail out its ailing state banks soon and may need a staggering $290 billion or more to do the job properly, a Goldman Sachs economist said in a report on Monday. That dwarfs figures floated in Chinese media in recent days, such as a $40 billion injection of funds said by the Business Post to be under discussion. Goldman economist Jonathan Anderson said China's banks needed one last huge bailout to pretty themselves up for foreign investors by cleaning up their balance sheets. Gold -- Sharefin, 18:21:00 01/27/03 Mon Searching for Bulls in the Gold Complex Judging by my daily email and phone encounters, there are very few investors enamored with Newmont, the gold-stock complex or the physical metal. There's no affinity for anything to do with gold. It's been a long time since anyone has made any money with the sector. It's considered a relic, nobody understands it, and most people, even if they are considering it, only view it as a corollary to the geopolitical instabilities. When it comes right down to it, people only want to own "sexy" stuff. That makes gold the Phyllis Diller of investments. Investors' inability to embrace Newmont et al. is especially interesting because virtually no other sector in the entire market displays the same technical characteristics: bullish absolute and relative strength, group strength, underlying commodity/monetary asset strength and generally uninterested investors. Maybe this is a stretch, but the lack of interest in Newmont and related stocks is the reverse image of technology in the spring of 2000. I'm sure you remember -- back then, tech had broken charts with ebullient sentiment. Now, gold and gold charts have bullish charts, and most people don't care or don't like them. So how did I use perspective and look-through methods to read these charts and come to these conclusions? I coupled anecdotal sentiment evidence with technical analysis, and then I used longer-term charts (monthly to smooth the data and weekly to show some volatility) to get perspective on where we've come from and where we can go. Daily charts don't provide that sort of perspective. Perspective and the look-through theme combine to produce a powerful vision for Newmont, the gold stock complex and the physical metal. And not in a Jim Jones Kool-Aid kind of way. Here's the takeaway: *The gold complex is bullish. **Gold stocks should be bought on pullbacks. ***We're in a secular bull market for the gold complex. ****As long as sentiment remains unconvinced, these stocks will likely be insulated from speculative forces.    Gold -- Sharefin, 18:14:45 01/27/03 Mon Gold -- Sharefin, 18:14:45 01/27/03 Mon What's Making Gold Glitter? The London p.m. gold fix on Friday, January 24, was $366.00 an ounce - the highest price since January 2, 1997. Compared with a year ago, the dollar price of gold is up $86.80, or almost 31%. Why is gold starting to glitter? The most common answer is the answer for just about everything that might be rattling markets of all sorts these days - concern about an armed conflict in Iraq. Although Iraq may be playing a role in gold's recent price rise, I believe there is something more fundamental at work here - investors' fear of not getting an "honest return" on their funds. By "honest return," I am referring to a positive inflation-adjusted return on money market instruments such as 3-month bank paper. When investors cannot get an honest return on their short-term funds, they turn to other liquid assets that will, at least, preserve their purchasing power. Historically, gold has been one of these liquid assets. ~~~ In recent weeks, the dollar has tumbled in value in relation to the euro and the pound sterling (see Chart 2). If the dollar is depreciating against another currency and the dollar price of gold remains unchanged, then there are arbitrage opportunities to buy gold in dollars and sell it in the currency that is appreciating relative to the dollar, say euros. This will tend to drive up the dollar price of gold relative to the euro price of gold. We cannot say for sure whether the dollar price of gold will rise absolutely or the euro price of gold will fall absolutely. All we can say for sure is that their relative prices will change. But what if, with the dollar depreciating against the pound and the euro, the price of gold is rising absolutely in terms of dollars, pounds sterling, and euros? That would be consistent with the notion that investors are becoming fearful of not being able to get an honest return on their money. And Chart 3 shows that the price of gold is rising not only in terms of dollar, but pounds and euros, too.  An acquaintance of mine, Clyde Harrison, a managing member of the Rogers Raw Materials Fund, says that fiat currencies do not float, they just sink at different rates. That gold is starting to glitter in terms of dollars, pounds, and euros seems to bear out what Clyde has said. Lenny's Corner -- Sharefin, 18:09:40 01/27/03 Mon GENERAL COMMENTS: In the past week, the precious metals accelerated their upward moves, soaring in price as the drums of war beat louder and louder. There is ONLY one theme to the recent markets, and that is the imminence of war between the USA (and its decidedly shrinking coalition) and Iraq. As the rhetoric becomes more inflammatory, as the USA now proclaims that it will go it alone in Iraq if it has to do so, and as fear and uncertainty grow in regards to both the inspectors report to the United Nations today and tomorrow's speech by George Bush, the precious metals have simply rocketed as investors and speculators grow more assured of war. Fundamentals and supply/demand characteristics no longer have any relevance in the gold market AT ALL. Physical demand is virtually non-existent and imports into India, the largest demand for gold in the world, have virtually halted. But, it makes little difference to the gold price, as investors and speculators continue to add to their positions. It is a one-way street now, in almost all the financial markets, whether it be the Euro (rising almost 2 cents last week), gold (up $15.50 just last week), oil, the equity markets (down over 70 points last week!!, basis the S&P) or the Bond Market. Investors are seeking safe-havens and are seemingly willing to pay any price to achieve their goals. And, all depends on the geopolitical situation, all depends on the news. There is absolutely no doubt that gold is carrying a rather large "war premium" at present, perhaps as much as $30-$50 per ounce. But, the markets are screaming that such pricing is still cheap, and gold prices rise day after day after day. Most analysts in the gold market see $400,and perhaps higher, as a ready target. Yes, perhaps one can conjecture that such volatile price movements are irrational, but irrationality has very few upside limits given the fact that the world may indeed see a significant war, with some fearful consequences scaring even the most hardened dove. These are most fearful times for the world, and most dangerous times to trade aggressively. Again, all depends on the news. Although a completely peaceful end to the Iraqi situation seems only remotely possible at present, IF it does come, these markets will reverse with a vengeance to seek their fair value. ~~~~ While investors/speculators have rocketed gold of late, the "real" driver behind the gold market rally originated in the least likely quarter, by the very gold producers that should have been selling their production but reversed their tack and bought back previously sold forward contracts. Last year, the top 98 gold producers bought back 15 million ounces of gold, maybe 4 times ALL other investment demand sources in 2002. Please note that it is estimated that there is still another 2500 tons of gold on global producer hedge books, but it is highly unlikely that the pace of these buy-backs will continue with gold at current price levels. I expect de-hedging to fall very rapidly in 2003 in comparison with previous years. With USD interest rates still at 40 year lows, with forward contangos almost non-existent, and with stockholders in mining companies now considering filing their tongues with a metal rasp more desirable than forward selling, it is highly unlikely that we will see an increase in producer forward selling.  ChartsRus -- Sharefin, 09:22:36 01/27/03 Mon ChartsRus -- Sharefin, 09:22:36 01/27/03 Mon Here's some currency charts to show the values of the DJIA - SP500 & NDX when held by people living outside the US. They clearly show the loss of capital caused by the markets fall plus the currency changes. DJI In Global Currencies SPX In Global Currencies NDX In Global Currencies  Gold -- Sharefin, 09:21:04 01/27/03 Mon Gold -- Sharefin, 09:21:04 01/27/03 Mon Also here's a series showing the values of gold & silver in 76 countries across the globe. It's quite an eye-opener to see the values & the growth rates in the 2nd & 3rd world countries. Global Gold & Silver Currencies Goldbugs across the globe have been enjoying stellar profits for some years now - & now it's the Western world's turn. Gold -- Sharefin, 06:23:45 01/27/03 Mon Goldbugs are back in force 'It's not a boom yet': Iraq crisis, plunging U.S. dollar driving interest What's driving the interest is the biggest surge in gold prices in years. Triggered by the crisis in Iraq and a plunging U.S. dollar, gold is back in fashion, climbing above US$350 an ounce last week for the first time since the beginning of 1998. The sector, which was virtually abandoned by investors during the technology boom, is coming back to life. Junior minors that were trading at less than 10¢ five years ago are watching their shares trade hands at 10 times that. "It's not a boom yet. It's more of a cult thing ," says John Kaiser, editor of the Bottom Fishing Report, an investment newsletter. According to Mr. Kaiser, much of the interest is coming from a small coterie of goldbugs, grey-haired retail investors whose memories often stretch back as far as the Depression. "A lot of goldbugs believe that paper money is useless and the apocalypse is coming," he says. "That crowd has been very much into this thing. Most of the gold guys sat out the dot.com boom and just grumbled on the sidelines when everyone was making money. Now these guys are in a frenzy buying [gold shares]." Not far away from Mr. Kaiser's booth, Don Balser is warily checking out a mining firm booth. At 80, Mr. Balser is a retired biologist, who takes care of his orchard in Seattle and plays the market. "I'm interested in gold because it's real money. Paper currency isn't," he says. Ron Little, CEO of Orezone Resources Inc., believes bullion will go to US$400 an ounce this year. "A lot of people got burned by the dot.coms and they're looking to get back to basic investments like gold." Industry executives such as Mr. Little are watching closely to see if the fad turns into a boom. "Once the psychology of the market says, 'I gotta get some,' that's when it really happens." Gold -- Sharefin, 06:20:14 01/27/03 Mon Gold may struggle with higher price levels Gold is at its highest prices in more than six years but the metal may run into trouble in coming months once its war premium fades, Barclays Capital said on Monday. The rise in gold has been spurred by geopolitical tension, notably a potential war involving Iraq, and it has gleaned support from a sharp drop in the dollar and stock markets. ~~~~ "So is the bull market still in its early phases? Is the gold price set to double from current levels... We think not," Barclays Capital said in a monthly report. The bank forecast that gold would average $315 an ounce in 2003 and $275 an ounce in 2004 against an average for 2002 of $310. Spot gold (XAU=) hit a six-year peak at $372.55 on Monday. "Once the uncertainty associated with Iraq fades, we expect stronger U.S. fundamentals relative to the eurozone, notably higher productivity and higher growth prospects, to become evident in a dollar recovery," the report said.  Gold -- Sharefin, 06:05:51 01/27/03 Mon Gold -- Sharefin, 06:05:51 01/27/03 Mon Gold shorts sweating bullets Gold market action in Asia this morning will have short speculators sweating, as a floundering dollar and a growing expectation of war in the Middle East sent investors into a renewed bullion frenzy. By mid morning in Johannesburg, gold was up to six year highs of $372.25/oz as good early morning appetite for the metal in Japan was continued by European and local institutions. “The market opened very strongly this morning. Everyone is expecting the worst and all the interest is one the buy side,” said one South African bullion trader. He said a “sick dollar” - which at $1.08 to the Euro was at a three year low - was also giving bullion increasing upward momentum. The fortunes of the dollar are unlikely to improve significantly soon, given the prospect of an expensive Iraqi war and a record current account deficit which needs inflows of $1.4 billion a day merely to reach equilibrium. According to a Bloomberg News report last week, however, foreigners continued to be net sellers of US assets. The bullion trader said resistance for the metal's price was between $375/oz and $377/oz, while immediate support was between $358/oz and $360/oz. Technical charts suggested, he said, that the metal had “run too hard too soon” “But this a market driven purely by sentiment and they're buying on rumour and selling on fact. Anything can happen,” he said. A run at $420/oz According to yet another bullion dealer, if the reigning sentiment continued in its current vein, gold could easily burst through resistance and make a concerted run at $420/oz. ~~~ ‘Could get ugly for shorts' “Although a lot of the bad news is already in the price, we have to look at the how the US reacts to the weapons report to get some direction. If we go through $377, then shorts are going to start sweating and it could get ugly,” said the trader. On Comex, the speculative long position continued to grow, indicating a consensus bet on a rising price; as of Friday the longs had racked up a position of 9.81 million ounces, while the shorts - who are backing a fall in the price - were at 2.89 million ounces.  From the Far Side -- Sharefin, 05:59:49 01/27/03 Mon From the Far Side -- Sharefin, 05:59:49 01/27/03 Mon Farfel (1/27/03; 01:54:26MT - usagold.com msg#: 95784) *********************** 413.50************** ( A Corollary) The gold market can best be compared to a private club in which a relatively small number of players determine the course of events. The hallmark of this private club has been conspiracy -- and no better conspiracy deprived small gold investors during the late Nineties than the gold carry trade, a gold shorter's dream, aided and abetted by Western central banks' relentless public announcements of large gold sales PLUS the very public declarations by major gold miners (like Barrick and Anglogold) of superhedging aka massive gold shorting. Was it it mere coincidence that Barrick gold chose to short 75% of its future production immediately following the Bank of Belgium gold sale (1996) or did the well-connected company have forewarning with respect to the litany of central bank gold sales to follow over the next several years? If it smells like a skunk, it must be a skunk. Although there is every indication that many Western central bank gold sales were no more than intra-bank exchanges (at lower prices), the strategy achieved its intended purpose and caused the gold price to crater in the prevous decade. The gold carry trade appeared to be nothing less than an Establishment-endorsed license to print free money for the major bullion banks on Wall Street and the senior superhedged gold producers. Utilizing the proceeds of the gold carry trade (plus various other commodity and currency carry trades), the bullion banks poured "free money" into the bond and stock markets, utilizing the carry trades as a primary propellant to create verticality in the those respective markets. Simultaneously, Wall Street hedge fund raids upon various Second and Third World countries' currencies would provoke a mass flight to safety of foreign funds into US stocks and bonds. Several years later, the downturn in US stock and bonds would prompt the Fed to increase money supply at a double digit, super-stimulative pace in order to protect those respective financial instruments....although the ironic consequence would be the fomentation of a superbubble in US real estate instead. As the derivatives books of the bullion banks and the gold books of the superhedged miners turn negative (see JP Morgan's recently announced large loss as a harbinger of worse things to come), then one can be fairly sure that heads will roll, specifically the heads of those originators of the gold carry trade strategy that at one time seemed so immune from failure. In my opinion, we are nearing a point where a "Gold-Throat" -- possibly the embittered former employee of a bullion bank -- will step forward and reveal the inner machinations of the gold carry trade...every single dirty detail and secret of what is an incontrovertible conspiracy designed to suppress and ultimately destroy gold as a viable investment alternative in the world of finance. When such a revelation is made, then I believe that will serve as a propellant for a record, single day price increase in the spot gold market, one that simply will take the breath away of every gold investor on the planet. As an infamous rock group once said: "It's just a shot away, it's just a shot away....." |