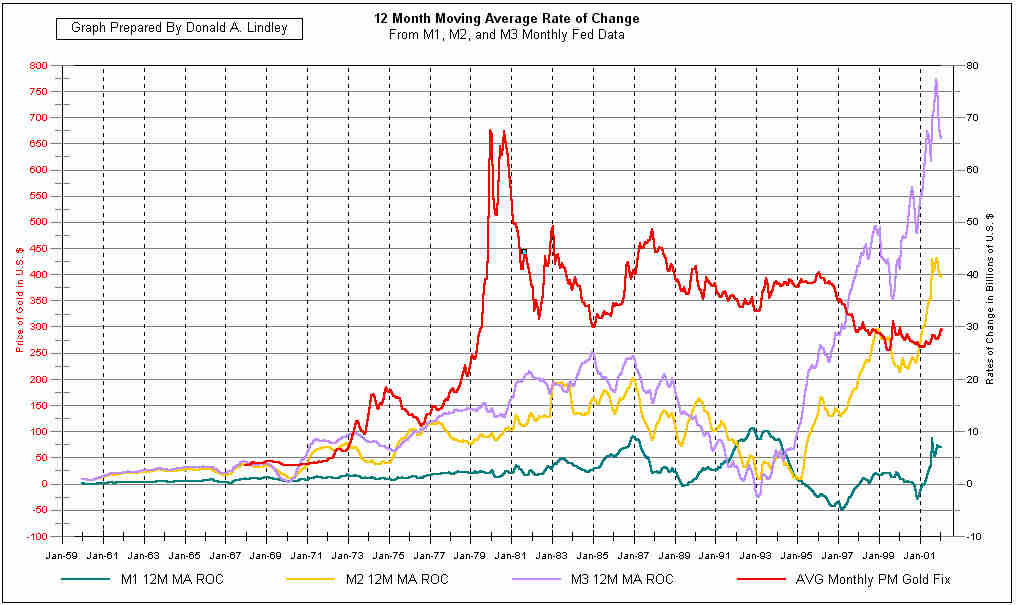

Gold -- Sharefin, 20:24:29 04/16/02 Tue Emetra decides to stop trading Emetra, the metals trading site that has been one of the dwindling band of survivors of the metals dotcom boom, is shutting down at the end of the month, reports Reuters from London. "Due to the continued lack of activity on the trading platform, Emetra has decided to cease trading with effect from April 30," the company said. Emetra was once touted as a possible threat to the London Metal Exchange (LME), the world's largest base metals exchange. It was formed in 2000, with the backing of MG, then a leading trading company. "While we enjoyed a great deal of interest from the industry, this failed to produce sufficient trading activity on the site," said the company. -- eMetra gone, Quadrem says safe eMetra is another big failure for Internet Capital Group which was an original investor along with British trading firm MG, Safeguard International Fund and subsequently Deutsche Boerse. The involvement of the German exchange was a bid to create a rival to the London Metal Exchange which did not have its own electronic system at the time. The June 2001 liquidation of MetalSpectrum is perhaps the biggest failure to date, but is far from an isolated incident. Metique, MetalSite, Aluminium.com, Coppernet, Ferrousexchange, BaseMetalsExchange.com and MetalSmart are the other big names that crashed and burned after riding high on Internet hype. TheBullionDesk.com shelved plans to become a fully-fledged online precious metals trader and is now a news and data dissemination service. GlobalCoal.com, MetalMerge.com, SteelScreen.com, Hong Kong listed WorldMetal.com and e-MetalMarket.com are survivor exceptions although they are hardly setting the world alight. Quadrem is drawing attention now, especially since its primary competitor, Mining and Metals Procurement, collapsed before it even got off the ground. --- Online metals trading platform EMETRA to close EMETRA was formed in February 2000, with a heavyweight backer in then-leading trading company MG plc. It caused a real stir in the market with an announcement in June 2000 of a deal with Germany's Deutsche Boerse to set up a metals derivatives trading platform. Gold -- Sharefin, 20:19:02 04/16/02 Tue Japan may drive gold price to $330 Gold prices might rise to $330 an ounce this year, the highest since 1999, as demand gained in Japan and violence in the Middle East would lead investors to buy the metal as a safe haven, analysts said yesterday. Gold prices have gained by as much as one-tenth this year as Japanese government limits on bank deposit insurance spurred a tripling of demand for gold from Japanese investors. Speculation that prices will rise further encouraged companies such as Newmont Mining, the world's biggest gold producer, to spend $8.5 billion in the past six months buying new mines. "What you're getting in Japan is a real crisis of confidence in their banking system," said Brian Bath, the managing director of Australian Gold Refineries, which is half-owned by Newmont and refines two-thirds of Australia's gold production. "People are going into gold coins or any other gold as a defence against any concerns that they have." Japanese investors bought about 45 tons of gold (1.45 million ounces) in the first quarter, up from 12.6 tons a year earlier, the World Gold Council said. "The Japanese have lost confidence in political leaders to right their economic woes and are buying gold by the bucketload," said Tamara Stevens, the Australian Gold Council's chief executive. Japanese demand might rise again in early 2003 if banking rules were changed again, analysts said. The nation's investors were concerned about the weakness among Japan's banks, which hold about '151 trillion in problem loans. "The gold boom may emerge again before next April, when the government will expand its limit to other deposits," said Nobuyuki Kudo, a gold researcher at Ace Koeki, a Tokyo-based commodity futures brokerage. "The rising trend in gold demand from Japanese investors will continue." Gold -- Sharefin, 20:12:17 04/16/02 Tue Sultan & Shaitan As a matter of fact, the US dollar has no cover. It is a cheque written by a bankrupt wastrel, good to be framed and put on the wall. Provided they issue as many dollars as they need, it is not amazing there is one superpower and all the rest are in debt. It is not a secret: brave Fidel Castro tells it at every conference, thus assuring endless hostility of the US. The US financial wizards, Greenspan et al, play with us an old trick of confidence, called a ‘pyramid'. Such games were played in many countries, notably in Albania and Russia, by local tricksters. Usually they end with a catastrophic crash. The Judeo-American con-game differs by its size. It is global. Otherwise, it the same pyramid. 90 per cent of all financial transactions are speculative transactions, writes Noam Chomsky. The pyramid is supported by a massive propaganda brainwash to encourage consumption and expansion. Ordinary people of the US and its allies get no fun out of it: in England, child poverty grew threefold since Margaret Thatcher came to power. In the US, there are millions of homeless children. Americans, Brits, Germans are deeply indebted, as the countries of the Third World. The US dollar succeeded to replace gold, because it offered an attractive fixed interest rate. The interest rate has become a honey trap for the mankind; it has caused the burden of debt, impoverished states and persons, created the ugly aberration of globalization. Not in vain, Sam Bronfman the Bootlegger, the founder of the powerful Bronfman dynasty and father of the World Jewish Congress chairman, when asked what the most important human invention is, replied without hesitation: ‘interest rate'. The US dollar is not ‘money' anymore; it is a license, like a Microsoft license, or a patent by a pharmaceutical company. Whenever the US rulers decide, they can freeze the assets of a rebel country. Iran had its assets frozen, Libya, Iraq; surely Saudis will suffer the same fate the moment they will object to American policies. Here is a good riddle for Bilbo Baggins: what is overpriced, unsafe, green and greatly desired by fools? In the last days of the war in South East Asia, I travelled by a slow junk boat down Mekong River, in the company of fellow-journalists, adventurers, local peasants, pigs and chickens. The boat was frequently stopped, searched and taxed by warring parties, but it made an unhurried progress from the old royal capital of Luang Prabang towards Vientiane. In a sleepy village of twenty huts and three elephants, where we stayed overnight, I wandered into a Chinese shop. In front of me, a dark and dour Pathet Lao guerrilla in rubber tyre Ho Chi Minh sandals and AK assault rifle on his back completed his modest shopping and paid for it with some funny money. I recognized its colourful pattern: it was Pathet Lao currency. As the soldier went away, I took out a few Pathet Lao bills I got as a change on the boat and asked the shopkeeper for a pack of cigarettes. The Chinese did not move. “But I have seen you accept this money”, I protested. He replied with wise words worthy of Lao-Tzu, “Only from people with gun”. The US dollar is still accepted by the world community out of fear, and that is why the US military budget grows every year. That is why the hermit kingdom of North Korea, Iran and Iraq became The Axis of Evil: they do not accept dollar. But fear is a bad adviser. The collapse of the pyramid is imminent. The meltdown began in August 2001, as the Economist advised its readers on 25.08.01, and, unless the timely intervention of persons unknown on 11.09.01, the US dollar would be now of value to numismatists only. But the World War III can only delay the completion of the process. Sheer prudence and enlightened self-interest have caused the wise rulers to move out of the dollar sphere. European countries launched Euro, the Japanese Yen rose sharply. But their attempt to substitute paper by paper while keeping interest rate is necessarily flawed. In a revolutionary proposal, Dr Mahathir, the Prime Minister of prosperous Malaysia, proposes to return to gold and silver, more specifically to the idea of golden ‘Islamic' Dinar as a zero-interest rate reserve currency for the world. His great idea to undo the dollar and loans' double hold deserves to be compared with the reform of Solon, the legendary Sage of Athens, who cancelled debts, defeated Oligarchy, returned land and freedom to people. If implemented, it would put an end to the suffering of Palestinians and to suffering of the Third World in general. The US dollar would fall as fast as in 1929, and with it, the US support for Israel and your debts. It should not be seen as an attack on America. The ordinary Americans would regain their homes from the banks' clutches, as mortgages would disappear. The burden of debt would fall off the back of people. True, George Soros and Mark Rich would have to apply to welfare office, together with many ardent supporters of Israel. But it is hardly a misfortune: they would be too busy to make mischief as they would have to earn their living. Gold -- Sharefin, 20:04:23 04/16/02 Tue Gold Fields: Gold prices too low "At US$300 (an ounce), the gold price is not yet high enough to either justify massive increases in expenditure and/or development of any resulting discoveries," Gold Fields chief executive Chris Thompson said. "Most of what is available out there can't really be profitably developed at $300," Thompson told the Australian Gold Conference. Gold -- Sharefin, 19:59:39 04/16/02 Tue More ride left in gold merger wave Gold -- Sharefin, 19:56:00 04/16/02 Tue Move out of golden hedges continues Gold mining companies have reduced their hedge books and were willing to sell more of their commodity at market prices as bullion prices creep higher, industry executives said. In Australia, hedging continues to fall out of favour, dropping nearly eight percent in the December quarter as mining houses speculated on an upturn in world prices. The reduction to 34,2-million ounces from 36,5-million took in a wide swathe of the industry and was led by three of Australia's biggest mining houses - Aurion Gold, Newcrest Mining and WMC- and the former Normandy Mining. Hedging has been criticised by industry behemoths such as Newmont Mining and South Africa's Harmony Gold, avowed non-hedgers, for long restricting bullion's upside by effectively erecting a price ceiling. Gold -- Sharefin, 19:41:13 04/16/02 Tue HK's jewellery retail sales down despite a rise in tourist arrivals The year 2001 didn't ring in very well for jewellery, watches, clocks and valuable gifts retailers in Hong Kong. The retail sales of the above items fell by a staggering 5 % by volume to US$2,721 million as compared with 2000. Gold -- Sharefin, 19:36:37 04/16/02 Tue Early NY gold drops below $300/oz, silver on ropes Gold -- Sharefin, 19:31:50 04/16/02 Tue Goldman's McConvey Comments on the Outlook for Gold Prices Daniel McConvey, New York- based vice president of global investment research at Goldman, Sachs & Co., comments on the outlook for gold. He was speaking with reporters at the Australian Gold Conference. McConvey raised his forecast for the long-term gold price to $325 an ounce because of an anticipated decline in output. Spot gold recently traded at $299.45. Annual U.S. production may fall to about 300 metric tons during the next five years, from 350 tons, he said. On the outlook for gold prices, and his stock pick: ``We've had quite a run from $275 to $300. A lot of the jewelry markets, the markets in India etc. have to adjust to that new price. Without another event, we're going to settle here for a little bit. ``If you want to be in a company that's leveraged to the gold price, in my universe it's Newmont Mining Corp. Relative to the other North American production only about one year of its production is hedged. ``It's got great leverage and it's the favored stock for those people that believe the gold price is going up. ``The smart investor has been in the hedged stocks for the last number of years. Going forward it's a tougher call.'' On a central bank agreement to limit gold sales: ``The chances are high that it will be renewed but I don't think it's going to be renewed early. The problem is you've got 15 central banks that are involved in this -- try to get them all to agree. Until they have to it's going to be very difficult. ``It's not a sure thing -- if the gold price went really high they might think `there's no real need for this'.'' Gold -- Sharefin, 19:29:40 04/16/02 Tue Gold Fields' Chris Thompson Discusses Industry Consolidation On consolidation: ``Consolidation is going to slow down. The opportunities left here in Australia are getting few. ``The thing that disturbs me in the outlook for the gold business is the hiatus that has taken place in exploration in the last five or ten years that almost guarantees a decline in production. ``That decline in of itself has implications for the price. It used to be an issue that was on the edges of the radar screen - - it's now advancing to a point where most of us can see it. ``Simply by buying assets we're camouflaging the real issue and the real issue is a shortage of reserves. The old clich‚ of shuffling the deckchairs on the Titanic is starting to apply. ``At $300 the gold price is not yet high enough to either justify massive increases in exploration expenditure and/or development of any resulting discoveries. What is out there can't really be developed profitably at $300. ``The debate perhaps needs to shift from the issue of who's going to win the consolidation race. So far it hasn't necessarily been a value-adding proposition from some of the deals I've seen.'' On the effect of AIDS on Gold Fields' business: ``AIDS is not as big an issue as you would ordinarily think. While it will have an impact, even without interventions we calculate it will cost probably about $10 an ounce. With interventions, and we have a number of very good interventions under way, we can probably get it down to about $4.'' Ross -- Suresh Garg, 13:16:40 04/16/02 Tue Marvellous chart. Thanks. postage vs gold -- Ross, 11:48:20 04/16/02 Tue After reading beesting's link to the Armstrong letter on Miningweb, the following statement struck a chord: "Gold is no longer a barometer of inflation, we all know that a postage stamp is... and maybe a loaf of bread..." I thought it would be nice to whip up a little chart with the $POG overlaid on the price of first class postage. here we go:  Silver's 2-pronged attack - @auspec -- Giovanni Dioro, 09:10:34 04/16/02 Tue Auspec, I think you're right about this perpetual runaway bull market aspect being a bit of wishful thinking. Of course things come and go like the tide and then come back again - peaks and troughs, so to speak. Well, silver has been in a trough for awhile, and many of us think its tide is about to turn significantly for the better. However to say that silver is going to become more or less extinct or can be mined and consumed out of existence goes against the principle of "conservation of matter". Nonetheless, I do believe the fundamentals for silver look very promising on two fronts. Firstly, US money supply been expanding very rapidly over the past years. This bastardisation of the money supply should be inflationary, and it is in many respects. When you think about how much things cost years ago and what they cost today it's ridiculous. Case in point, a couple of weeks ago I spoke to an elderly man in a betting shop. We talked about how prices have gone up a lot with the introduction of the Euro. He said he remembered paying 7 pence for a pint of Guinness in his youth ($3.00 today), although that was the old money he said. "How much was that", I asked him. He said, "7 pence was in old money was......." I said, "7 coppers anyway" (7 copper pennies) to which he nodded his head. I would think that the amount of copper in 7 old pence might be worth today around 15-20 cents. So today it takes roughly 20 times the equivalent value of copper to buy a pint today than it did 75 years ago. Many comparisons with silver and gold could be made as well. My point is that most commodities (e.g. silver) have not kept pace with inflation in other items, and are thus undervalued. Secondly, we must look at the cyclical nature of commodities in general and how it relates to silver. Usually there is a cycle in which a shortage of a given commodity brings forth higher prices. These higher prices spur increased production which in turn leads to a glut and then lower prices. The lower prices lead to lower production and an eventual shortage again, and thus the cycle repeats. Malthus observed this cycle with pigs which was a 3 year cycle, influenced by the time it took to raise a pig to sell to market. In regards to silver, we are seeing that stage where today's relatively low prices are leading many mines to be shut down. Coeur d'Alene announced just yesterday that it was facing a cash crisis, and many other mines are under pressure. Exploration has also suffered, as you mentioned. This should therefore lead to a cyclical shortage, and much higher prices in the years to come. The only thing holding it back in my opinion are the stockpiles of above ground supplies, and it is hard to say how much exists, and how much is for sale or lease. One of these days, much of the above-ground sources are either going to be exhausted or they are going to be "not for sale". Then we will see the feeding frenzy. So when the day comes when silver shines again, we will likely see it rise in price due to 2 factors - one being due to inflationary pressures, the other being due to a cyclical nature. The cyclical nature could lead to a 5-15 year boom, based on your estimates on how long it takes to get a mine into production. I think we both agree that this wouldn't last forever. It would just be part of a multi-year cycle. However prices could still stay at relatively high levels due to built up inflationary pressures caused by the constant printing of money by the central banks. Sharp pullback -- Cyclist, 08:32:17 04/16/02 Tue in gold and expect hui to check out 93 and 88 within previous given parameters. Oil cycles looking to top in second week of July. More thoughts on where we are -- Mike Stewart, 08:14:03 04/16/02 Tue Shell, another consideration. The Dynamic Canadain Precious Metals fund is a Canadian fund that has a high percentage of juniors in it. I use it to cover this area with some pension plan money. In a bull market, it tends to lag a bit in the early years and outperform in the later years. I assume that this is a result of "public" money coming in at the end of a bull market move. In the last bull, 93-96, the fund rose by 377%, close, but stronger than the big cap Toronto gold index (up 310%). Since the Oct 2000 low, this fund is up 123%, on track with this timeframe from 1993-96 (17 months into it), and slightly underperforming the 1993-1996 price pattern at this time. It is not overheated, nor overpriced at this time from a long term view. FWIW, the big South Africans were very strong early in the 93-96 bull and then slowed down in the last half. They were spent. Gold Specimen -- Sharefin, 07:39:48 04/16/02 Tue  Shell -- Mike Stewart, 04:31:09 04/16/02 Tue Shell, I have noticed that there are three worlds out there right now. Unhedged majors, juniors and the hedged majors. As you know, the XAU has a good blend of these as hedgers like Anglogold, Barrick and Placer Dome are offset somewhat by Newmont, Harmony and Meridian. The Unhedged South Aficans have been boosted by the weak rand. That is hard to factor in. The hedged majors are weaker because investors are looking for pure upside at this point. This leads me to wonder, like you,whether the XAU will perform normally. Newmont is about the only pure benchmark around now. Unhedged, North American and big. The Toronto Gold Index has the same problem, so it doesn't help to look there. Too much ABX/PDG. My opinion is that outside of the rand benefit, South African unhedged mines will always vastly outperform the XAU in any bull market. USERX reflects this. The rand is a bonus. This is why I bought them and ignored North America. Bull markets last around three years in gold itself. The stocks lead by six months to a year at the start. Some gold bulls start strong and finish weaker (93-96), other are the opposite. Along the way, we can expect three or four sharp corrections of 25 - 33% in the XAU. (A stock like Drooy may be cut in half). We had one already late last year, assuming that the bull in gold stocks started in Oct 00. It is usually very difficult to buy and hold in a gold bull with such large swings. I am still waiting for the XAU to rise to .32 of the gold price, but realize that it ABX/PDG/AU begin to suffer seriously from hedge postions, rather that just lagging the market, we can't expect the gold indices to work. For the record, I reduced my holding recently as sentiment is too bullish for me, I was way up on Drooy/Hgmcy/Hcmcw/Gold. I kept the Gold Fields and some juniors(total 13% of my partnership) and will return on a correction. If I am wrong, I can live with it as I have hit my targets on these shares anyway. I try to avoid "greed vs fear" extremes. mike stewart-if the xau [full of hedged mines] had risen as much as userx for instance, the ratio -- shell, 22:20:17 04/15/02 Mon to gold now would be .31----many other gold funds are up more than userx, ie 80 to 110%--would appreciate commment Gold & Hedges -- Sharefin, 09:51:19 04/15/02 Mon I'm not sure on this and just taking a stab in that dark so correct me if wrong. I presume that most all of these gold hedges that are being wound down (Harmony 2.7 million ounces - Anglogold 1.7 million ounces - Goldfields 230,000 ounces - Australian producers reduced hedges by 7% etc etc) are being transferred out to a counter party through paper contracts of gold rather than by closing out the actual position with physical bullion. This means that the counter party is left still hold a major position and carrying all the risk. This would remove the risk from the gold producer and transfer it across to the new holder - the bullion banker who crossed out the position. So some major paper gold holder is increasing their exposure immensely. Perhaps they consider themselves to big to fail. I don't know but I doubt the original hedges are being closed out with physical. From Midas -- Sharefin, 09:16:13 04/15/02 Mon The US system is now creaking with debt. The deflationary forces of debt are so strong that it is taking more and more phony legal tender to offset the forces of deflation. Meanwhile, it's taking an increasing amount of so-called dollars to buy an ounce of true money -- gold. This is a clear and present danger to the central banks. For should gold start surging -- say 400, 500, 700, a thousand, it could blow the system apart. It could do that because the population would start asking questions, they would start asking why the value of these so-called dollars were sinking so rapidly in terms of real money. Gold is your and my way of getting out of (defending ourselves against) the Federal Reserve system. But the Fed does not want you and me out of the system. The Fed wants us to live within the system, because they have the power; they run the system. OK, enough background. The trend of almost everything but housing appears to be declining against real money, gold. How long will this last? I don't know -- I only know the trend. I think this trend may be the beginning of something BIG, but I obviously don't know for sure. However, I'm not taking any chances. I want my foot in the water, and I think your foot should also be in the water. The best way to do that is to buy gold stocks or even to buy some gold coins -- or preferably both. If you only buy one gold stock I'd say buy Newmont, but it's generally better to buy a few stocks in a group -- say NEM, AEM and GG. My good friends and gold experts for decades, the Aden Sisters, are quoted in Barron's today on page MW19. The Adens' advice is that 40% of your "investing portfolio" now be in gold items. The Adens note that gold is stronger than stock, bonds and currencies -- and that's a clear fact. How much of your portfolio you want in gold is a personal choice, but I would at least get your foot in the gold pool now. Alan Greenspan won't like it, the Fed governors won't like it. But you may like it. You may like it a lot before the next few years have passed. _____________ Also: The Gold Story Several people have inquired about my gold stocks and whether or not I would attempt to sell these near the highs and buy them back on a retracement. That strategy sounds tempting, but its too risky to let go of these positions. Something could happen overnight to cause an explosion in gold prices, and we do not want to be left behind. An interesting story popped up today. We were approached a couple of years ago by a group who wanted us to finance their business. They were involved in brokering and investing in gold, mainly on the short side. There are many quick buck artists here in Los Angeles with all kinds of schemes to speculate on gold. And given the miserable performance of the metal the last 20 years, most of these guys are speculating on the short side. Today, I found out where these guys went. They got their deal financed over at General Bank, a local bank owned by Chinese Americans. General Bank is known as a sweat shop, with intense pressure on the lending officers to drum up lots of commercial loan business. Well, today, GBC Bancorp (General Bank's holding company), was smoked for a huge loss today after it was revealed that large loan losses were going to have to be taken as a result of bad loans made to “metals dealers” encountering “severe liquidity problems”. Sounds like those guys betting on the short side are getting squeezed. “GBC Bancorp GCBC is off $4.20, or 13.1 percent, to $27.82, in afternoon trades. After Thursday's closing bell, the Los Angeles bank holding company disclosed two potential problem loans totaling $27 million. The company said that the loans are to companies in the metal importing and trading business that are having liquidity problems. "We cannot estimate at this time the extent to which the collateral plus insurance coverage will repay the loans," said the company in a press release. In light of this situation, GBC is recording an additional $5.4 million charge-off associated with the loan, reducing its book value to zero. For the first quarter, the company expects to record a provision for credit losses of $18.5 million. Including its share of an impairment loss related to its investment in an aircraft finance trust, the company expects to report a loss of about $3 million in the first quarter.” I suspect that there are going to be a lot of squeezes out there if we have another breakout on gold. So it is simply too risky to let go of positions on the gold mining stocks. Leonard Kaplan -- Sharefin, 09:03:32 04/15/02 Mon GENERAL COMMENTS: Gold -- Sharefin, 09:02:13 04/15/02 Mon Platinum versus Gold / Considerable Slack Gold -- Sharefin, 08:53:58 04/15/02 Mon Gold sets standard in Japan "It is certainly possible that a rise in demand for gold bars in Japan raised the international price of gold in February," said Masaaki Kanno, economist At JP Morgan. "The estimated purchase of gold in January and February is only 0.2 per cent of annual savings by the household sector. This implies that the impact of a change in Japanese householders' investment can be so big that it could affect the global market prices of financial assets." A broker at one of Japan's leading general trading companies said she expected gold retail sales to increase if the price fell even slightly. "The public are holding long positions in gold and enjoying the surge in prices. "If prices fall, brokers and short-term traders will sell but the public will buy." "It's calmed down since February's peak, when we had crazy sales. But even now people come in with tens of millions of yen and take several kilos of gold bars home with them," said Mr Matsumoto. Gold -- Sharefin, 08:46:38 04/15/02 Mon Canada's TSE 300 Poised to Rise, Led by Gold and Oil Producers Gold shares may rise as analysts forecasted bullion may climb to $330 an ounce this year. Japanese worries about that country's banking system and concern about Middle Eastern violence may lead investors to buy the metal as a safe haven, analysts told Bloomberg News. Gold -- Sharefin, 08:44:55 04/15/02 Mon Barrick Gold focuses on organic growth Canada-based Barrick Gold, the world's largest gold miner by market capitalisation, expects its future growth to be primarily driven by new projects and expansions, though acquisitions still remain on the agenda. But at the Super Pit mine in Western Australia, the country's largest single gold mine, Oliphant is confident Barrick can work well with new equal partner Newmont of the U.S. Barrick acquired its stake in the Super Pit through its merger with Homestake, while Newmont acquired its stake earlier in the year through its takeover of Australia's Normandy Mining. Noting that the mine has underperformed in the past, Oliphant said "we want to ensure that the Super Pit, which was a key part of both of acquisitions, performs as well as possible." "We want to do it better than how it has operated in the past and I'm positive our companies can do that," he said. "I think before there are any moves made, both companies need to understand better what the challenges and opportunities are," Oliphant said. ---- The Super Pit - Kaloorlie Monster dump trucks  Gold -- Sharefin, 08:20:36 04/15/02 Mon Gold Higher But Seen Holding In Range "Nobody wants to sell short because there is no guarantee that the situation in the Middle East won't get worse," said one. "People are happy to hold onto their longs for now and just see what happens." This reticence to sell gold should help keep prices above $300/oz and the longer the market can remain strong, the more physical buying should emerge as end users become accustomed to higher values. Other sources have noted that fresh investment interest for gold has been a feature of recent trade and could help bolster any gains. Gold -- Sharefin, 08:17:50 04/15/02 Mon International gold producers go all out to shine Rationalisation among gold companies is expected to continue, the head of one of the world's biggest gold companies said yesterday. Randall Oliphant, president and chief executive of Canadian-based Barrick Gold Corp, said on the opening day of the Australian Gold Conference in Melbourne, that rationalisation was leading to a healthier, more efficient industry. "All of the companies in this industry are talking to each other, trying to work out if something can make sense, and I think the trend that started will continue," he said. "As an industry, we will undergo more consolidation, further rationalisation, a simplification of ownership structures, and a greater focus on achieving competitive returns." But he noted that market capitalisation of the industry, at less than $US50 billion ($A93.7 billion), still struggled to register on international investment radar. He said the number of players operating in the global industry had shrunk dramatically: between 1997 and 2001, the number of mines in Australia had fallen to 62 from 137, and the number of companies to 35 from 86. But the average size of the remaining producers had increased to 258,000 ounces a year from 117,000 ounces. Gold -- Sharefin, 08:15:45 04/15/02 Mon GOLD - South China Morning Post "It seems like we do have a lot of new money coming into the business nowadays. There's very good interest in buying this market on dips," an analyst said. Gold -- Sharefin, 08:13:59 04/15/02 Mon Russia's gold, forex reserves up 1.84 pct 1Q to 37.295 bln dlr Gold -- Sharefin, 08:12:38 04/15/02 Mon Gold price rise buoys prospects of miners An expected surge in the gold price has painted a rosy picture for the mining sector, according to Australian-listed miner Oxiana Resources. Gold was expected to surge to US$350 an ounce in the next five years due to a supply shortage, chief financial officer Steven Armitage said. Auspec - silver stocks -- Sharefin, 08:03:19 04/15/02 Mon Silver Bonanza is as good today as when it was written - an excellent book. I've emailed Franklin & suggested he do a rerun for this coming bull market. As to the contents - There is basically no content on the manipulation except for recognition that major players move markets - just like today (:-))) Also little content on in-ground stocks. In a bull run lasting a year or two I don't think in-ground stocks will be a worry. The price will be forced high long before the product comes to the markets. Be it that we get a major market tank (the main reason why the metals will fly) then I would guess most base metals producers will slow up which will further aggravate the supply/demand scenario. Maybe they open up a new mine or two - I doubt that there will be great impact on the supply. There's probably five years plus into it before the miners have reacted to the price rise and hiked production higher. I presume that the silver rally (and gold) will be long over before they get production running. Giovanni Dioro...Silver -- Cobra, 06:23:50 04/15/02 Mon I've been told by miners in Virginia City Nevada that there is still enough silver beneath Virginia City, the value of which, " Would pay off the National Debt " The EZ silver has been taken. One said a sustained price North of $20 oz would be needed to justify the expence to dig it. I've looked at several mines there, they are old and unstable and Deep. Many are flooded. Silver can be had but at a Hell of a price from Virginia City. It is almost a Ghost Town now. Virginia City and surounding area is the Largest known concentration of AG on the planet earth. Shell - Faber Article -- Mike Stewart, 00:17:10 04/15/02 Mon Use Donald's link, then click "Market Commentary" Periodic Ponzi Update PPU -- $hifty, 22:49:26 04/14/02 Sun http://home.columbus.rr.com/rossl/gold.htm Periodic Ponzi Update PPU Nasdaq 1,756.19 + Dow 10,190.82 = 11,947.01 divide by 2 = 5,973.5 Ponzi Down 47.33 from last week Thanks for the link RossL Go GATA Go Gold $hifty donald--your link to faber just leads to his title page -- shell, 20:29:08 04/14/02 Sun . A Golden Opportunity (by Marc Faber) -- Donald, 15:10:25 04/14/02 Sun click here Sharefin -- auspec, 14:16:13 04/14/02 Sun Oops, it's auspec here. Sharefin/Silver -- AuAg, 14:15:09 04/14/02 Sun Silver Bonanza was a huge winner then in spite of their predictions yet to come to pass, and it certainly has been a long time since written. That should just make us all that much more bullish. The one variable that I do not recall being discussed in the Silver Bonanza is the current paper/physical silver manipulation theme that is now so apparent. They had no idea at that time that CBs and Govts would go to the extremes they since have to suppress silver and gold. If I had known what the feds were up to in these metals I would have avoided them like the plague. Same with the stock market and the 90's bubble, who knew what they were up to? Who'da thunk it? Now we know. Now, they give us the opportunity of a lifetime as they have hit the extremes. As far as $50 POS. Mining will increase as fast as it can until it overproduces and kills the market. This is true IF there is sufficient silver to find and produce, and I'm told and believe there is. The variable is how many years it will take them. I have somehow lost my copy of Silver Bonanza, do they get into remaining underground supply, known and or projected at various POS levels? Figures at $5 or $20 are fine, but if one is projecting $50 Ag we must look there as well, no? At $50 POS recycling will reach a whole new strata, any newly mined silver will be more likely to be re-cycled as well. Lots of investment silver remains, that's what we're doing isn't it? Some will sell at $15 and some at $50, and some will hold out for $200 or $500. All will make nice profits ONLY if they cash out somewhere above their buying levels. Some will sell early and some will fail to sell altogether, simple human nature. You can be sure of this: at $50 silver will be flying out of the woodworks as well as the groundworks. I'm going to keep my ear to the ground. Glad you're back! giovanni dioro -- auspec, 13:45:16 04/14/02 Sun Hello g. v., I must say I totally agree with everything you say in this recent post. How's that for getting along {smile}? Am personally a mega silver bull, but just cannot accept a 'perpetual' silver bull, which has been described as 50 years or more. I haven't seen the facts to sustain it and simply have too much faith in the natural commodity cycle. There is only one variable that will stop the commodity cycle from taking place along somewhat 'normal' lines. Will get to that very shortly. A normal commodity cycle is drastically less than the 5 to 15 years that it ordinarily takes to bring a silver mine into production, depending upon the size of the mine. So my projection of a runaway silver bull for 10 to 15 years ONLY is still anything but normal! These are extraordinary times in silver, for sure. Now, what is the unknown variable that will {likely imho} or will not allow a run away silver bull for 50 years or a 'lifetime' as we all have heard. It's the amount of remaining underground silver supply as probably the hugest variable. The folks that are making the longest term predictions do not know what the quantification of this variable is, and we've pretty much come to the conclusion that it is simply UNKNOWN at this time. You can't make such predictions w/o all the facts, it simply becomes emotionalism, no? My resource sources have led me to believe there is PLENTY of remaining underground silver. Give the miners, who happen to be extremely efficient {especially the explorers}, the time, money and incentive and they WILL bring forth the goods. Mining is slow, but it's simoly not 50 years slow! Is the silver there? That's the Q! Discoursing along these lines has led me to exactly what I was beginning to suspect: NOBODY KNOWS HOW MUCH UNDERGROUND SILVER REMAINS! At lest nobody yet that we have been able to querie, Ted Butler doesn't know, Charles Savoie doesn't know, the US Geological Survey doesn't show. How much is in China for sure? Other 3rd world countries or unsurveyed countries? There is a common misconception that the world has been fully 'explored'. Silver hasn't come close to being fully explored at $5 POS, much less a $50 POS!! All the variables have to be recalculated at $50 POS, the threshhold for a mine becomes much smaller, no? You cannot project perpetually high silver prices w/o gathering all these unknowns into some form of concensus. I will be thrilled with whatever POS the coming silver bull brings, if it lasts 10 to 15 years, WOW. Will also keep a very close eye on silver exploration and mining while it all unfolds. Now that some of these mining questions are coming to the surface the answers may soon be forthcoming. Regards Charts Online -- Sharefin, 11:24:32 04/14/02 Sun Sharefin's Charts It looks like someone's trying to do a hatchet job on the CRB through attacking various components.!!! The PM's should move up solidly when this resistance line just above us is broken. AU-AG-PL Sentiment Index The support-line was very strong and I believe triggered this PM rally. And I expect breeching this resistance line will lead to a major rally in the prices of the metals. Auspec - silver stocks -- Sharefin, 11:13:39 04/14/02 Sun I just spent a couple of weeks away on holiday and took with me a book titled "Silver Bonanza" by James Blanchard & Franklin Sanders and thoroughly enjoyed walking back through history with silver. It was an excellent read & very informing and reminded me strongly of Peter Bernstein's book "The Power Of Gold". Anyone who is interested in silver should read this book. Here's some text that's quoted from the book: --------------------------------------------- Just how much silver is there in the world? In 1992, the Silver Institute commissioned Charles River Associates, INC (CRA) of Boston to answer that question. CRA found that from 4000 B.C. through to 1991, 37.5 billion troy ounces (1,165,132 metric tons) of silver has been produced. Only about 25 percent of total world silver was produced before the American Revolution. The discovery and exploitation of the huge American deposits after 1492 flooded Europe with silver. Later, technical advances in silver extraction (including production as a byproduct of base metal mining) led to even greater silver production. CRA estimated that of the 37.5 billion ounces of silver ever mined , only 19.1 billion ounces still exists in the form of bullion, coins and medallions, and silverware and other artforms. Bullion and coins plus medallions are conventionally defined as "total stocks," that is, stocks readily available to the market. However, the important question is not how much silver exists above ground. Rather, how much of this silver is available for sale, and at what price? The CRA study says, "The common perception in the market that silver stocks are very large and thus readily available is wrong. The stocks are large, but not all readily available." If large stocks are available, even at bear market bottoms, they aren't just floating up in the air. Somebody owns them. The presence of large stocks doesn't necessarily mean that nobody wants silver. Large stocks can mean that sophisticated investors are accumulating silver for the long term, Including bullion, coins and medallions, and silverware and art forms, CRA places worldwide stocks of silver available to the market at prices of $10 or less at 541 million troy ounces. Some of this silver includes business stocks required for production. It might come onto the market at very high silver prices, but only temporarily. Silver will have to be re-bought to carry on business. Most coins and medallions are held by families in small amounts, for sentimental or other reasons. This silver is not terribly responsive to small changes in price. Finally, under normal market conditions, very little silverware or silver artforms will hit the market. Either they are spread out among small holders who have an emotional attachment to them, or they are held for their high value as art. No one is going to sell a Bernini salt cellar because the price of silver jumps from $5 an ounce to $20 an ounce. Likewise, churches around the world won't line up to hock off their chalices, crucifixes and decorations just because silver's price breaks through $30. At prices of $20 an ounce or less, CRA estimates that 16.85 billion ounces of silver are simply unavailable to the market, except in small increments over many years if high silver prices persisted. One anecdote will serve to illustrate how much of this silver supply available at $20 an ounce or less has been exhausted. Anyone who participated in the Mad Silver Melt of 1979/80 can relate similar tales of priceless heirlooms sold for scrap. We remember particularly one visit to the scrap dealer about 1983 when we saw on the shelf some pieces which he had pulled out of the melt pile. It was a silver tea service, engraved as a gift to the Mayor of Augusta, Georgia in 1854! If family heirlooms such as this are lured into the melting pot by high silver prices, we can speculate that not much heirloom silver is left to melt for market at prices under $30 an ounce, much less $20. ----- Ten years has passed since this was written and I'm sure much of the stockpile since then has been used up. Attitudes towards the PM's have soured over this last decade and what heirloom silver that was left should be in strong hands now so to speak. Though the total amount of silver on this earth surprised me to the upside. The total supply available to the markets way back in 1992 surprised me to the downside. There are some important tenements to the above passage that bear thinking about. Giovanni - I'll go for the feeding frenzy......  What if a Serious Shortage Happened overnight? - @auspec -- giovanni dioro, 07:55:40 04/14/02 Sun What if a Serious Shortage Happened overnight? - @auspec -- giovanni dioro, 07:55:40 04/14/02 Sun Auspec, you bring up some good points in your rebuttal to that silver article, and you surely know more about the finer points of silver than me. However let me suggest a scenario that could fuel much higher silver prices You said that if silver reached $30-50 per ounce, then mines that had been closed down would re-open and other new silver deposits would be exploited that would have otherwise been left idle, all of which would bring vastly much more silver onto the market. While that is true, there is an important aspect that we must consider, which is What happens if a chronic shortage of silver appears more or less overnight? In such a case, there would be a considerate lag time before any additional silver from new production could reach the market. The logistics involved in raising capital, hiring workers, getting machinery, mining it, refining it, shipping it, plus the administrative red tape ensure that it would take many months, if not years, before this new silver would reach the market. In the meanwhile manufacturers would have to outbid each other to get the silver they need for production. If the shortage is serious enough, Govts may step in and requisition a significant portion of silver production and earmark it for certain uses, leaving other silver consumers scrapping it out for whatever silver remains. With a feeding frenzy like that, we might see silver rise dramatically to $50 an ounce. And this won't happen without the investing public taking notice. Many will see silver as hot investment and will jump in. There will be stories in the paper about how many billions of dollars Warren Buffett's Berkshire Hathaway has made on its silver horde, and fund managers will also jump in. My opinion is that a rising silver price will attract many speculative investors who will want to buy silver for the simple fact that it's going up. These investors who never would have looked at silver before will buy so much silver that any new production will have no effect in lowering the price. In other words, even at higher prices, increased supply could very well be more than offset by increasing demand. Response to "Perpetually Escalating Silver Prices" -- auspec, 17:38:38 04/12/02 Fri It wasn't too long ago that an article came out written by Charles Savoie entitled "Perpetually Escalating Silver Prices" link at http://www.silver-investor.com/prsp.htm In this article the following statement was made: "United States Geological Survey figures show, as of 2002, about 270,000 metric tons of recoverable silver reserves. This is roughly ten years worth of supply at current rares......" Why is this line of thought important? Mostly because it is only a small part of the overall picture and it is most misleading if not properly labeled! Lets' look to his source at: http://www.nma.org/commodity%20stats%20.html This shows a category of "Recoverable Reserves" in the order of 280,000 tons, just what Mr. Savoie is pointing to. He has also made reference elsewhere to the category called "Reserve Base" which shows the other figure recently tossed around of 420,000 tons of silver. These figures are accurate indeed, but some gentle parsing will show the incompleteness of the figures. 1st Category....... "Recoverable Reserves", 280,000 tons, this is simply what is KNOWN by drill proving methods as well as being currently economic to be mined. Pretty simple, BUT, if one projects this as the total remaining silver supply, and at the same time projects dramatically higher POS, this can be most misleading. Category 2 then comes into play.... 2nd Category...... ""Reserve Base, 420,000 tons. This category includes category one. Some might call this category a 'geological reserve', but it includes all KNOWN silver deposits that have had a minimum standard of proving up via drills. Mining companies are always working to get sufficient drill holes to upgrade a 'resource' to a 'reserve'. It could mean silver deposits that have drill spacings of 25 meters or less, but it will mostly include silver that is known but not currently mineable, as well as category 1 silver which IS economic. It might be a good idea to delve into the methods of the U.S. Geological Survey as listed in this article. I have yet to do that. OK, we have two categories that are commonly being used to project future supply/demand fundamentals and time periods for market rationing. Is this the entire picture?????? NO, emphatically, NO! Let's project forward to what these numbers and this survey does NOT tell us, a category 3 if you will. That gives a much more accurate picture of what will happen with $30, $50, etc. POS. 3rd Category...... this one includes a lot of UNKNOWNS and that is exactly why it is NOT listed by the U.S. Geological Survey, they can only list what they know, right? But we must analyze what they do know and extrapolate from there. Let's start with resources of silver that have yet to receive sufficient drill testing to be put into either previous category. Large systems, yet no capital for initial or expanded drilling. Does anyone seriously think all worldwide silver is a known entity?? Does anyone think that a higher POS might get a few trenches dug and drills turned. What will happen with $50 POS? Primary deposits will be explored for and discovered, as will secondary silver producing deposits. Existing deposits will be expanded, and previous, high grade narrow veins will find the marketplace. All the way down to the literal pick and shovel, possible donkey. See what I mean, the danger in not defining terms? This is not just semantics, but goes to the core {sorry} of future silver fundamentals. You cannot attempt to predict the future based on incomplete data. Let's proceed with category 3 and all the countries listed in this survey, would have to go to their references. Is this an all inclusive list with accurate projections for China? How many producing countries provided no information? Oops, looks like some more silver should be in category 3. We recently had an extensive 'Black Gold/Silver' discussion and one of the main 'tenets' to come forth was that: "Nobody knows the exact amount of above ground silver supplies"! That's a fact. We don't know what's there and we don't know what's not there. In all fairness, this 'unknown' should also be taken into consideration, no, even though it can't be quantified. We also can't make silver projections w/o taking silver scrap/recycling into the picture. Silver recycling is currently a cottage industry, it will be a growth industry at $30 POS. Silver recycling is a larger market than primary silver mining if what I have been told is correct. This is a huge potential supply source. So category 3 has an unknown silver supply/resource both above-ground as well as below-ground. Ignore it at your own peril. Don't make investment decisions based on incomplete pictures. Does this make me any less of a silver bull than before. Nope. Does this make me pause when considering essays that talk of perpetual silver shortages? Yep. Silver WILL blow-up on the manipulators, sooner or later, likely sooner. How long will it take mining and recycling sources to catch up with worldwide silver demand at that point? The typical time to bring a mine on line is between 5 and 15 years depending on their size. Is there PLENTY of remaining below-ground silver which will become future silver economic reserves. Absolutely. Will capital and mining expertise be efficiently allocated? No doubt. I'll stick with my 10 to 15 years estimate of a runnaway silver bull, that'll do the trick nicely. Thanks for parsing along with me. a Gold -- Sharefin, 17:08:53 04/12/02 Fri Harmony, Gold Fields close hedges Harmony Gold [HGMCY] has closed the hedge book inherited from its acquisition of Randfontein Estates from JCI Gold in 2000 at a net cost of $11 million. "The closure of the Randfontein hedge book is a continuation of Harmony's strategy of being unhedged. We believe our shareholders want the exposure of a potential increase in the gold price," financial director, Frank Abbott, said today (12 April). Harmony said that the remaining forward sales contracts and call options totalling about 490 000 ounces have been closed. Owing to the higher gold price, Harmony also closed a further 220 000 ounces of forward purchases. In total, about 2.7 million ounces were closed out in the Randfontein hedge book, but a further 120 000 ounces of forward calls (longs) still remained which Abbott said would be closed out opportunistically as the gold price trends upwards. In total, there were about 430 000 ounces of calls inherited in the Randfontein hedge book. The closure of the hedge book resulted in a net cost after tax of $11 million (R125 million) which was financed from existing cash resources. "The closure cost of the hedge book will, however, not have an impact on the company's financial results, as these had been accounted for previously," the company said. Abbott said the company had been highly cash generative in the March quarter but he could not disclose details ahead of Harmony's March quarter results scheduled for April 29. Harmony closed the December quarter with net cash of R1.2 billion. Harmony is not yet entirely hedge-free, however, owing to hedge books it owns from its recent acqusitions of New Hampton and Hill 50, two Australian gold producers. Abbott said there was about 1 million ounces of forwards and calls in the Hill 50 hedge book, and a further 500 000 ounces, again of forwards and calls, in the New Hampton hedge book. "The company will continue restructuring the hedge books of our Australian acquisitions, New Hampton and Hill 50, as and when market conditions allow," Abbott said. This follows a spate of hedge closures by South African producers. AngloGold said in a Bloomberg report recently that it was continuing shutting down parts of its hedge book. Gold Fields told Miningweb in March that it had only half its book to close after closing out 230 000 ounces of forward contracts from Obosso, the company that owns Damang, a Ghanaian gold mine. At the time, financial director, Nick Holland, said about half of the hedge book remained in the form of put options. Gold Fields chairman, Chris Thompson, confirmed the company now had no hedge component at all and that it was the only gold producer truly fully exposed to the gold price: "We are completely unhedged, completely pure and loveable," he said. Gold -- Sharefin, 17:05:33 04/12/02 Fri Gold Trends 2 Gold -- Sharefin, 16:45:46 04/12/02 Fri Gold above key level in Europe on Mideast bomber Speculation over a possible U.S. military strike against Iraq and ongoing military operations in Afghanistan have also made traders reluctant to go short on gold. Gold's gains this year has been led by an inflow of funds out of equities markets rattled by the Enron scandal and concerns by Japanese consumers over the health of that country's banking system. A decision by leading gold miners to heavily cut back the amount of unmined bullion they sell into so-called forward markets so that they can instead capitalise on rising gold prices has also fired prices higher. An annoucement by world number three gold producer AngloGold (ANGJ) this week that it was "aggressively" running down its hedge book which guaranteed them lower prices that current levels led gold back over the important $300/oz level. Disciplined selling by European central banks and expectations that mine supplies which start to contract this year have also bolstered gold prices. Gold -- Sharefin, 16:43:55 04/12/02 Fri M-East attack supports gold Further violence in the Middle East kept gold above the key US$300 an ounce mark in European trade on Friday and analysts saw scope for more gains by the metal, which has already risen 10% this year. Analysts said gold could climb further. "After some consolidation in the next few days down to $299, further gains should be seen towards the previous highs around $308," JP Morgan Chase Bank said in a briefing note. "Once attained, we expect a move towards the $315/320 area before stalling," the bank said. That would be the highest level for gold since October 1999, when a decision by some European central banks to limit spot sales until 2004 sent prices soaring. Gold -- Sharefin, 16:42:10 04/12/02 Fri LBMA: Gold Clearing Stats Dn 13% In Mar Gold and silver clearing statistics fell in March, the London Bullion Market Association said Friday, with silver dropping more sharply than gold as prices for both metals were confined to tight ranges. --------------- Study Forecasts 30% Gold Output Drop, But Others Disagree New York, April 11 (OsterDowJones) - A new study by a Canadian mining investment research firm predicts a 30% drop in gold mining production over the next 10 years but may have failed to consider how higher gold prices will fuel interest in exploration for new deposits, some market watchers are saying. Gold -- Sharefin, 16:30:09 04/12/02 Fri Will Gold Ever Rally Silver -- Sharefin, 07:34:31 04/11/02 Thu Perpetually Escalating Silver Prices! Gold -- Sharefin, 05:22:28 04/11/02 Thu US dollar hegemony has got to go Gold -- Sharefin, 04:51:42 04/11/02 Thu South Africa Benchmark Index Rises to Record Led by Gold Miners South Africa's benchmark index climbed to a record, led by gold companies after bullion prices gained on AngloGold Ltd.'s announcement that it reduced the amount of gold it sells at fixed prices. The benchmark Johannesburg All-Share Index rose as many as 115.64 points, or 1 percent, to 11,356.20, as 68 stocks gained, 10 fell and 374 were unchanged. The following shares are making substantial gains or losses today in South Africa. Ticker symbols are in parentheses. Gold miners rose after the metal's price gained 0.8 percent yesterday. It rose as much as 0.2 percent in early European trading today to $302.05 per ounce. Anglo Gold Ltd the second-biggest gold producer, advanced as much as 21.20 rand, or 4.1 percent, to 535 rand. Gold Fields Ltd the No. 4 producer, surged as much as 9.60 rand, or 8.7 percent, to 120 rand. No. 6 producer Harmony Gold Mining Co. Ltd. (HAR SJ) rose as much as 9.80 rand, or 7.8 percent, to 135 rand. Durban Roodepoort Deep Ltd. (DUR SJ), climbed as much as 3.60 rand, or 9.4 percent, to 42 rand. Anglo American Plc (AGL SJ), the second-biggest mining company, advanced as much as 2.40 rand, or 1.3 percent, to 188 rand. Anglo may buy M.I.M. Holdings Ltd. using money raised from a $1.1 billion bond sale, the Australian Financial Review reported in its Street Talk column. This would help satisfy Anglo American's desire to boost its exposure to base metals and coal in Australia, the paper said. BHP Billiton Ltd fell as much as 40 cents, or 0.6 percent, to 65.80 rand after ABN Amro Holding NV downgraded the world's biggest miner because demand for metals in the second half of the year will suffer from ``little follow through from either consumer spending or private investment.'' Gold -- Sharefin, 04:48:43 04/11/02 Thu Gold rallies on Middle East, miner view on prices Gold -- Sharefin, 04:40:40 04/11/02 Thu Gold Stocks vs. Dow Declines In last week's issue, we showed you what happens when the Dow declines 10% or more compared to the XAU. Our conclusion was that each time the Dow declined 10% or more, the XAU, and therefore the gold stocks, went down a greater percent and for a longer time period. "Yes, but, but …this time, it will be like it was before 1980 … like the last bull market in Gold. In those days, when the market went down, Gold went up." And so the numerous challenges went this past week. We knew it was only a matter of time before someone pushed us to take a look back before 1987, and so this week, we made the trip - all the way back to 1975.  Gold -- Sharefin, 23:06:01 04/10/02 Wed Gold -- Sharefin, 23:06:01 04/10/02 Wed Gold Prices Continue to Outshine Other Investments Slowly and with little fanfare, gold prices have been inching higher for more than a year now. Typically when an asset class or segment of the stock market begins to thaw as gold has, the sector will be prominently featured in investing magazines and highlighted on the financial programs on television. But managers of gold-oriented mutual funds and other industry experts say they are disappointed by the lack of attention being given to the yellow metal. Gold -- Sharefin, 22:47:38 04/10/02 Wed Punters Lift Gold Price, Not Japanese Investors -- Futures Demand, Not Japanese Physical Buying, Lifts Gold Price -- Japanese Physical Gold Buying Frenzy Cools -- Gold Market Correcting Lower, But Trades A Higher Range By Wong Chia Peck SYDNEY, April 11 (Dow Jones) - Recent press coverage on Japanese buying of physical gold having pushed spot prices is exxagerated, as physical demand from Japan is but a small factor in determining gold prices, one of the country's largest gold traders said. Instead, heavy buying of gold futures by speculators pushed gold prices to its two year high, Bob Takai, the deputy general manager of Sumitomo Corp.'s (J.SUT) commodity business department, told Dow Jones Newswires late Wednesday in an interview. Gold futures on the Comex division of the New York Mercantile Exchange were bought heavily by U.S. fund managers, while the Japanese general public bought gold futures on the Tokyo Commodity Exchange, Takai said. "There has been a lot of publicity in the foreign press about Japanese gold buying. It seems to me that the publicity is a bit overdone," Takai said. Japanese investors' buying of gold bars and coins is but a trickle in the volume of gold futures traded in the world, the key determinant in gold prices, he said. "What drives the gold market the most, is the activity in the futures market...and the physical market is a very small percentage of the entire (global) bullion trade," he said. Sumitomo Corp. is one of the largest gold traders in Japan. It's involved in the wholesale business of selling gold bars to industrial and jewelry makers and runs two retail shops. It also trades Tocom's gold futures. Takai estimated Sumitomo trades around 50-60 metric tons of gold on the domestic physical market, roughly 20% share of the market. Since January, press coverage has made much of a "gold rush" or "gold boom" in Japan, where official figures showed surging gold imports in January and February. In February, Japan's Ministry of Finance showed the country's gold imports skyrocketed almost seven times to around 19.8 metric tons from a year ago. The figures for March aren't available yet. Japanese Physical Gold Buying Frenzy Cools While acknowledging that Japanese investors indeed went into a gold buying frenzy in February, Takai said the fever has definitely cooled down since. "There's definitely a cooling down in physical buying. In February, I saw people queuing up at gold retail shops but this month, I see people selling back their gold holdings," he said. The easier demand is reflected in the lower premium for gold bars over the spot price, which has fallen to around 40-50 U.S. cents a troy ounce, compared to the peak of slightly over US$1/oz in January and February, he said. Gold rose to a two-year high of US$307.80/oz on Feb. 8 as a result of the U.S. fund buying on Comex and the Japanese general public's buying of Tocom's gold futures, he said. "Those two are the biggest buyers of gold in the past three months," he noted. With most of the Japanese investors' interest tied up in Tocom's gold futures, the gold price is vulnerable to dips as and when these investors sell, Takai suggested. "They are buying on the futures exchange(s) because they don't intend to take physical delivery....their motivation is to make money, not to hold gold, they're punters," he said. He also said that some Australian gold producers unwound their hedge positions over the past few months, typically in the over-the-counter, or OTC, trade which is less transparent. That boosted the gold price in recent months too, he said. Gold producers in Australia, the world's third-largest gold-producing country after South Africa and the U.S., tend to hedge more than their foreign counterparts by selling in the far forward markets. A quarterly review by J.P. Morgan Securities Australia Ltd. reported that Australian producers' hedging fell by 7.7% at the end of the fourth quarter in 2001 from the third quarter. Gold Market Correcting Lower, But Trades A Higher Range Takai's gut feeling of Japanese investment demand in gold for the first quarter is 30 metric tons, a much less optimistic one than the World Gold Council's projection of 45-50 tons. He explained that it was difficult to know the exact figures as the Japanese government doesn't issue any such data. Japan's Ministry of Finance gold import figures aren't the complete figures, partly because the country also produces gold bars. For instance, in 2001, Japan imported a total of 43.22 tons of gold, but it consumed 109.3 tons, according to the World Gold Council. Turning to his outlook for gold prices, Takai said it is bearish in the short term, as the bullion enters a correction phase from an overbought situation. "In the very short term, I am bearish on gold, but at the same time, the trading range has definitely been lifted by US$20 a troy ounce," he said. Gold is now trading in a US$280-US$310/oz range, compared with US$260-US$290/oz two years ago, Takai said. He cautioned that price-sensitive buyers, such as the Indians and Chinese, might buy less gold as prices rise, and any cutback in buying from them wouldn't be compensated by an increase in buying from the Japanese. India, the world's largest gold-consuming country, accounted for over 26%, or 855 tons, of the world's total consumption in 2001 of 3,235.1 tons, according to the World Gold Council. China was the world's fourth-largest gold-consuming country in 2001, accounting for 213.2 tons or about 6.6% of the total consumption. "So if the gold price goes up, there's always a countervailing effect," Takai said. "The Japanese people are the only people buying gold when the price is going up," he added. Gold -- Sharefin, 22:40:57 04/10/02 Wed AngloGold cuts hedge in gold price rise wager "They are positioning themselves for an up cycle" in the gold price, said David Hall, an analyst at Merrill Lynch. "They are probably getting rid of every weak hedge they dare." "People are naive to think that in a rising price scenario we are not managing our hedge book," Best said. "You will see a substantial reduction." Gold -- Sharefin, 22:38:47 04/10/02 Wed Gold price revives as AngloGold reduces hedging Financial director Jonathan Best told journalists in South Africa that while the company has not changed its hedging policy per se, it had cut back its hedge position substantially during the March quarter. He said AngloGold is taking out weaker positions in its hedge book so that going forward it does not have a period where it is receiving lower prices or incurring an opportunity loss. "We are aggressively running down our hedge book and the reason for that is that we are more bullish on the gold price and because US interest rates are low," Mr Best told Reuters. gloGold is due to release details of its hedging position in the March quarter at the end of April. Analysts in South Africa have commented that the March quarter may be the first in nine years that the average price received by AngloGold has not beaten the average spot price, which was $US290 an ounce. AngloGold already closed out 1.7 million ounces in its hedge book over the December quarter of 2001, leaving it with a book of 14.6 million ounces, and executive director Kelvin Williams flagged in February a likely further reduction in the gold hedge book to about 10 million ounces over this year. Gold -- Sharefin, 22:35:50 04/10/02 Wed NY gold resuscitated by AngloGold hedge reductions COMEX gold jumped on Wednesday, recovering from early profit taking after top-tier South African producer AngloGold Ltd said it was "aggressively" running down its hedge book. AngloGold closed 1.7 million ounces in its hedge book in the last quarter of 2001, leaving it with a hedge book of 14.6 million ounces. Best said the company was reducing its book because it was more bullish on the gold price and because U.S. interest rates are low, raising the cost of carrying short gold positions. Other dealers saw stop-loss buying all the way up. Gold was also supported by firming oil prices and underlying interest in the precious metals as portfolio protection in case a broader war breaks out in the Middle East. --- They're getting nervous for the coming rise.... Covering here is essentually the same as loading up. It's not because of today's price but rather the price that is coming. $300 means squat to these guys but exposure to their positions at higher prices is what worries them. And also that the prices that are coming will not be a spike where the price afterwards eases so they can ride it out but rather a shift in the POG to new levels with little retracement. Let the producers cover but if they're covering with paper & not physical being delivered then who's taking on the counterparty risk? When the CB's start to cover then that's when the prices will be surging. And how will they cover...^o-o^... Bonds & inflation -- Sharefin, 22:25:33 04/10/02 Wed Brandies It means that short-term rates are even more critical to the profitability of Corporate America - to the level of the stock market - to the growth rate of the American economy than ever before. It means that Alan Greenspan dare not raise interest rates too much or risk sinking the stock market and the economy once again; it means that because his ability to raise short rates is limited, that ultimately inflation may be higher than it otherwise would be in a still near deflationary world; it means that bond investors should do certain things and not do others. And that, dear readers, is a bagful of brandies - not in the creek, but lying half-hidden in the tall grass. Explain please. Well, explanations should include proof but when it comes to the interest rate swap/derivatives market, the evidence is nearly impossible to come by. According to recent data by the Bank for International Settlements (BIS), worldwide swaps outstanding (mainly U.S.) total over $43 trillion. That's a hunk-a-hunk of love folks: love for derivatives that in the corporations' case may serve to reduce interest rate costs in the short run, but increase exposure/risk in the long run. Try finding these swaps detailed by amount and purpose in a 10K or annual report though. Even Sherlock Holmes couldn't find something that wasn't there. So I sleuthed in a different way. The following two charts show nonfinancial corporate debt and nonfinancial corporate interest expense - both as a function of annual corporate cash flow. And because Greenspan must keep short rates relatively low, the risk of inflation in future years will be greater than otherwise, the yield curve will remain more positively sloped than otherwise, and the dollar will ultimately be weaker than otherwise. ---- Go Gold - inflation incoming.......... Alan -- Sharefin, 22:21:49 04/10/02 Wed I've posted it into the historical charts page in the silver section under the label 1970-1980. hyperbole & BS.... -- Dave, 15:39:33 04/10/02 Wed Berlin - Germany, the biggest economy in the 12-country euro zone, is facing a wave of corporate failures this year, with up to 40,000 companies expected to file for insolvency, the association of German people's and agricultural co-operative banks BVR predicted on Wednesday. http://www.busrep.co.za/html/busrep/br_frame_decider.php? click_id=345&art_id=ct20020408192447483N243753&set_id=60 Nicely Done! -- Alan, 12:20:42 04/10/02 Wed Nick wrote: >Here's the chart for silver between 1967 & 1980. >I've cut the price off just as it's about to leap as that >throws the scale out of whack. .......... Yo! Nicely done. Are you going to post it somewhere? I would like the URL, if you could (or else I will save to disk). I note that as late as end 72 it was still possible to get in at $2, and as late as 76-77 at $4.50. Other than the early '74 spikes, a nearly smooth progression up to the mania/singularity of late '79. Hmmmm. Can anyone imagine an orderly progression, now, through $6, $8, $12, and so forth? Or will the singularity be triggered before then? Cyclist -- Suresh Garg, 11:13:39 04/10/02 Wed Thanks for today's post. Very useful for a somewhat longer term perspective (as compared to a few days to 2 weeks). Look forward to your posts, as always. Gold & pollution -- Sharefin, 10:40:37 04/10/02 Wed As an aside to the prior article, I personally know from experience the pollution that stems from mines adjacent to the sea. For many years, I fished in the Gulf Of Carpentaria Australia, which has currently 5 mines near it's shores. Many years back on fishing near Weipa there were occurrences of mutated sharks & dolphins. When questioning CSIRO staff upon this I was told that this was only half of the story as fish, turtles & crabs were also showing mutations. Tests for chemicals had shown high concentrations yet because so many prawns were caught in the area & so much mining was done nearby it was considered economical. As a captain involved in the fishery CSIRO told me to shut up about such things as the bad press would effect the industry as well as my livelihood. Across the other side of the Gulf was Gove where if you anchored the boat in the effluent outlet that dumps the mines toxic waste offshore, all barnacles & seagrowth would be burned off the hull in a matter of hours. Gove which once was a popular fishing ground is now basically dead water with little left alive close to the harbour. There was a new mine (back then) started up off Borooloola (sp) where the ore was loaded onto barges and then sent out to sea where about 10-15 miles offshore it was then load onto ships bound for overseas. Although the project was certified safe and environmentally sound, after a year the neighbouring seafloor was buried under many inches of heavy metals. The process of transferring the metals from barge to ship wasn't perfect and once again the sea life suffered. The latest project built by Pasminco - the Century Zinc mine - which pumps it's slurry across to Karumba where it is dried and then transferred to a barge to take offshore once again to transfer to ships offshore will be suffering the same fate. As a fisherman who fished for many years upon these waters it always saddened me to see the degradation of the environment for the sake of a profit for some multi-national corporation. When I read articles such as the prior one and think about the integrity of those testing and the monies paid for such services and the profits flowing to the corporations, I sincerely doubt their ability to tell the truth. Alas the simple views of the islanders add up to little in front of the smarmy opinions of the media experts & the corporations lawyers & their public relations officers. Alas, today we live in a world where ethics & integrity are shoved aside for the sake of faceless corporation profits. Investors care more for their personal gains rather than for the degradation of lands sourced for their wealth. So beware of where you invest your monies & the pollution that stems there from. Today what is accepted as passable may tomorrow be considered improper. And as such not before time. Amen Gold -- Sharefin, 10:12:25 04/10/02 Wed $1.3bn mine sinks islanders' golden days of fish in a cyanide sea April 9 2002 Sydney Morning Herald, Australia The plume is caused by the mine tailings and rock waste dumped in the sea. The locals are reaping a bitter harvest from a Rio Tinto venture, writes Greg Roberts on Lihir Island. In the main restaurant on Papua New Guinea's Lihir island, surrounded by one of the world's richest marine environments, the mussels on the menu are from Thailand and the fish is from the relatively distant PNG port of Rabaul. Regina Asiad, the women's representative on Lihir's village planning committee, says that a few years ago dugout canoes "overflowing" with fish arrived daily at Lihir's wharf. "Now you might get five or six fish in a boat or nothing. Strange things happen that we never encountered before. We find dead fish, and sometimes fish we catch tastes strange, so people won't eat it. A lot of pigs died after eating stuff on the beach. We wonder about that mine." The lucrative Rio Tinto-managed Lihir Gold mine, with a market capitalisation of $A1.3 billion and extensive Australian involvement, began production in 1997. It posted a $80 million profit last year and plans to produce 22 million ounces of gold in 37 years of operation. The mine is pumping 110 million cubic metres of waste, contaminated with cyanide and other chemicals, into the sea each year through a pipeline 125 metres beneath the surface. Another 20 million tonnes of rock waste are dumped each year into Luise Harbour. Australia's Mineral Policy Institute says that the discharge of wastes into the harbour breaches the spirit of conventions that ban the disposal of similar wastes from ships in international waters. But Lihir Gold says the mine is environmentally sound and provides 800 jobs for locals, as well as much-needed improvements in islanders' living standards. A plume of sediment from the seaside mine extends two kilometres into the Pacific Ocean. Huge piles of rock waste sit on reclaimed harbour that locals say was a breeding site for endangered leatherback turtles. A moonscape of orange and grey meets lush, tropical rainforest above the mine on the steep slope of an extinct volcano. Clement Nah is one of 300 people who were moved out of the beachside Putput village to make way for the mine. The company gave his family a home in the hills nearby. Mr Nah says he puts up with noise from a generator running 24 hours a day, dust falling over his home and the stench of chemicals. "We did not know any of this was going to happen. I get chest infections and things I never had before." He complains that the company does not maintain the home. "It's falling to pieces; we don't have money to fix it up. It was so much better in our houses by the sea; that was our life. I wish I never came here." Another resident who was forced out, Leonie Kelele, agrees. "Sometimes the smell makes you feel like vomiting. It makes you feel really sick." Gabriel Kondiak heads a committee of islanders that has been negotiating issues of dispute with Lihir Gold. "The mine workers get a small proportion of the wages they would get in Australia and they don't have many of the conditions they should have," Mr Kondiak says. "The mine has failed to provide the promised business spin-offs. Its benefits go offshore. Most people on Lihir now oppose it. We think it is the next Bougainville." (Bougainville's Panguna mine was forced to close in 1989 by violent protests.) The Australian Government's Export Finance and Insurance Corporation provided the mine with political risk insurance in 1996 after its United States Government equivalent, the Overseas Private Investment Corporation, refused on environmental grounds. Lihir Gold insists that allegations against the mine are baseless, exaggerated or ill-conceived. According to the company's chief executive, Alan Roberts, daily sampling in the sea near the mine has failed to reveal any potentially harmful chemical concentrations, while tests on the dead pigs referred to by Regina Asiad suggest the animals had been chewing acid batteries. "The mine has had a negligible effect on fish populations," Mr Roberts says. A recent report to examine impacts on fish, commissioned by the company from the CSIRO, is more qualified. It says there is no change in the probability of catching fish at depths greater than 30 metres in different parts of the island, but of the 10 most abundant species caught, four were more numerous away from the mine and one was more common close to it. The reports says the impact on the abundance of fish in shallower water had been low, although this varied for individual species, and some fish showed an increase in recent years in concentrations of aluminium, a possible contaminant. Mr Roberts says that while leatherback turtles may have nested at the mine site in the past, the company is now protecting turtles nesting nearby from islanders who take their eggs. He says there had been maintenance problems with homes provided to displaced villagers because untreated timber was used in their construction, but extra funds were provided to deal with the problem. The company believes some complaints may be motivated by a desire for monetary compensation. "Our experience has been that most people are happy with their lot. There can be unpleasant surprises for some when industrialisation arrives on their doorstep, but there are other very pleasant things happening." An international school has been established, and the infant mortality rate is now half the PNG average. Two-thirds of the local population suffered from malaria before the mine opened; the proportion is now 10 per cent. Mr Roberts says the wages and conditions of mine workers are among the best in PNG, and the proportion of locals in the workforce - 37 per cent - is exceptionally high. Alan -- Sharefin, 10:11:02 04/10/02 Wed Here's the chart for silver between 1967 & 1980. I've cut the price off just as it's about to leap as that throws the scale out of whack.  I also tweaked the others to fill in the gap from '75 to '78 Thanks for pointing it out. Gold -- Sharefin, 09:38:33 04/10/02 Wed Japanese '02 Gold Demand Stays Strong, But May Not Boost Price Ikeda said it isn't the company's practice to disclose actual figures. But, while declining to provide a forecast of Japan's demand for the year, Ikeda suggested that Japanese players will continue to seek refuge in gold as long as the economy stutters and doubts linger on the banking system's health. A representative at the World Gold Council's office in Tokyo said Japanese investment demand for gold in the first quarter of the year is close to the 45-to 50-metric-ton ballpark as earlier forecast. Koichiro Kamei, a former research director with the WGC in Tokyo, who now runs his gold investment consultancy firm, also argued that the Japanese investors' love affair with gold is less fleeting than most would suggest. Unlike the "Japanese general public," whose interest in gold is apparently more speculative and concentrated on the Tokyo Commodity Exchange's gold futures, Kamei said most Japanese investors are into gold for the long term. Thanks, Nick -- Alan, 09:33:49 04/10/02 Wed you wrote: Alan -- Sharefin, 20:48:34 04/09/02 Tue If you're looking for historical charts then have a browse here; Historical Charts Also there's many more charts linked in here. I do approx 300 charts on a weekly basis - most on the PMs. More Charts Point & Figure charts If what you're looking for is not present then I can readily create the charts for you. Just supply the specifics ie dates & formats etc ........... Thanks! I DID find one chart that was useful: Silver 1978-1982 It was embedded in THIS series: Silver 1965-1969 Silver 1978-1982 Silver 1991-1995 Now, not to be picky, but why not include the 1970-1977 period, as well? That certainly was an interesting period, second in interest only to the 1979-80 explosion. Your charts pages also have this series: Silver 1965-2001 [ a bit too "macro", but appreciated ] Silver 1971-1975 Silver 1985-1989 Silver 1996-2001 ....... providing a glimpse of that 71-75 period, but again there is a gap; no data for 75-78 (actually the 71-75 chart only goes thru 1/2 of 1975). Again, it just seems odd to me that the most boring periods would be represented, without more careful coverage of the explosive periods! ($1 to $50 in 10 years!) Thanks again. Alan Gold -- Sharefin, 09:30:53 04/10/02 Wed Gold retraces in line with oil, but trend remains positive  Gold -- Sharefin, 09:28:36 04/10/02 Wed Gold -- Sharefin, 09:28:36 04/10/02 Wed Gold Eases As Middle East Tensions Rise Gold off lows as Israel says offensive to carry on Gold -- Sharefin, 09:24:09 04/10/02 Wed Japanese gold demand no flash in the pan Imagine the weight of 15 Asian elephants stacked on top of each other. That's a rough approximation of the amount of gold Japanese investors bought in the first quarter of calendar 2002, when fears of a looming financial crisis sent people scurrying for safe-haven assets. It's also 11 elephants more than they bought in the same period a year earlier, assuming each beast weighs in at three tonnes. "We've named this phenomenon not a gold boom but a money shift", said Hitoshi Kosai, general manager of the precious metals division at Tanaka Kikinzoku Kogyo K.K., Japan's largest bullion retailer. Gold -- Sharefin, 08:45:18 04/10/02 Wed Investing pendulum swinging back to gold stocks Martin Murenbeeld, a Vancouver-based gold and currency analyst, is betting on 2004 as the turning point for the gold price, when pressure piles up on central banks to extend an agreement that limits their gold sales. TRENDING HIGHER He said containment of central bank gold sales, the potential for the U.S. dollar to decline, and low inflation have already caused gold producers to cut forward sales to increase their exposure to higher gold prices. "We are in a nice phase trending higher," said Murenbeeld, who believes the current gold rally has staying power. "I don't see the factors that could drive gold lower as being a high probability and that goes into the stocks." Gold -- Sharefin, 08:42:11 04/10/02 Wed Anglo hedge set to falter The March quarter could be the end of a nine-year run for AngloGold, which has used its hedge book to consistently beat the spot gold price. The last time the group's hedge book failed to trump the spot price was back in 1993. Analysts estimate that in the intervening nine years, AngloGold's hedge book has netted about $1.2 billion in profit. But times have changed and the view of senior industry pundits is that the days of hedged gold companies realising gold prices considerably above spot were over; for at least as long as current gold price strength persists. Jonathan Best, AngloGold's financial director, would not comment on how its realised price would perform relative to the spot price ahead of the publication of the group's results. "We would move quickly - within two or three quarters - to correct our postion," said Best. "People are naïve to think we are not managing our hedge position in a rising old price environment," said Best. He said the group had cut back its hedge "substantially" over the March quarter. AngloGold has, however, singled out the rand-denominated portion of its hedge book as a problem it is keen to resolve. According to AngloGold's 2001 annual report, it has 22,920 kg of gold - 13 percent of this year's forecast production of 179,000 kg - sold forward in South African rands this year at an average cost of R60,322/kg. While the sale price covers the group's projected cash costs of about R54,000/kg, the position makes for a staggering opportunity loss of R47,127/kg. Hedge haunts Newcrest Gold -- Sharefin, 08:35:20 04/10/02 Wed Heavyweights upgrade gold; more to follow US investment bank Goldman Sachs is the first in what is likely to become a stream of institutions taking a more bullish stance on gold. "Japanese investment in gold could still be huge if there is systemic risk in Japan, but we'll first have to see how the government deals with that," said Leslie. "There are real reasons why people are bullish on gold…they need to go back to basics and that means going back to gold." "The technical picture for gold looks like it is turning, but that is going to be a long process. There are huge vested interests in keeping the gold price lower; a lot of producers can't afford for the price to rise too much," says Viljoen. Viljoen has a novel way of rating the gold price relative to equity markets; simply by dividing the Dow Jones Industrial Average by the gold price. "The gold price relative to other financial instruments is pretty cheap at current levels, the Dow can buy you 34 ounces of gold," said Viljoen. Viljoen says in gold's heyday, in the 1970s, the Dow would buy close to a single ounce of gold, while at its worst level in 1999, the index would fetch around 50 ounces. He believes the trend will head back toward a long term average through a combination of a weaker Dow and a firmer gold price. Dow/Gold Ratio Chart Flierdude -- Sharefin, 08:20:19 04/10/02 Wed Ain't it good to be able to pick up a bargain.(:-))) Gold -- Sharefin, 07:36:51 04/10/02 Wed Cycles long term consolidation -- Cyclist, 06:06:14 04/10/02 Wed is at hand,where June gold might make it to 312 tops. HUI is due for a decline ,starting in earnest between end of June and second week of July.The low will be reached in December in the upper 60's. The place to be would be shorting the SPY for the duration. Aside of holding physical,goldstocks are not the place to be when the general market will commence its slide in May. re gold yesterday, today"... -- shell, 04:36:00 04/10/02 Wed ..i came to same conclusion as to who could order CB's to sell the public's gold to them at low prices  Gold yesterday, today and tomorrow -- flierdude, 20:53:00 04/09/02 Tue Gold yesterday, today and tomorrow -- flierdude, 20:53:00 04/09/02 Tue .............It is my conviction that the shady characters who are behind the scenes in this world, and who really run things, a la Disraeli's “Coningsby”, have a plan which they have been carrying out over the past decades. These are the individuals who give orders to Central Banks, of their own, and of other nations. They have the power to do so. We have been witnessing a new way of accumulating gold, never before seen in the world: accumulation through mass-deception, through manipulation of the mass-mind, which was never before possible............. .............These 'identifiable' characters have used the dollar to accumulate wealth, and they have been going after the gold............. .............The propaganda regarding the “death of gold” has been effective. It has allowed the Central Banks to sell off their stocks, painfully acquired through centuries, at cheap, very cheap prices, to the characters operating in the shadows.............In a sense these past decades have been one long bankruptcy sale on the part of the world's Central Banks, where the banks have been selling off their best assets - to their owners! - at rock bottom prices. Of course, at fire-sale prices, otherwise, it would be next to impossible to accumulate it in any quantity............. Gold yesterday, today and tomorrow Alan -- Sharefin, 20:48:34 04/09/02 Tue If you're looking for historical charts then have a browse here; Historical Charts Also there's many more charts linked in here. I do approx 300 charts on a weekly basis - most on the PMs. More Charts Point & Figure charts If what you're looking for is not present then I can readily create the charts for you. Just supply the specifics ie dates & formats etc Observation re PM Charts -- Alan, 19:48:33 04/09/02 Tue An example of what I am talking about: Below: "since 1988" "since 1983" ......... hell, studying PM charts since those dates is like studying daily charts of oak tree growth! (well, not quite, but you get my meaning) --------------- http://www.the-privateer.com/g-charts.html#precious $US Gold Charts $US Gold 1 x 3 Point and Figure chart - below $US 300 (* > 800x600) $US Gold semi-log Bar chart - weekly - since 1998 $US Gold 2 x 3 Point and Figure chart - since 1993 $US Gold 5 x 3 Point and Figure chart - since 1981 $US Gold semi-log bar chart - monthly - since 1974. Precious Metals Charts Gold, Silver, and Platinum bar chart - daily Gold in Euros, $US, $A and Yen bar chart - weekly $US Gold/Silver comparison bar chart - monthly - since 1988 $A/$US comparison - 5 x 3 Point and Figure charts - since 1983 $A semi-log bar chart - monthly - since 1983  Silver Historicals -- Alan, 19:46:24 04/09/02 Tue Silver Historicals -- Alan, 19:46:24 04/09/02 Tue After some bit of poking around (most of the logical places, plus a few googles) I've not been able to find good historical charts of silver spot prices during the big run-up period of circa 1975-1981. That is, DETAILED charts -- daily and weekly closes, and even intraday detail -- for the whole period. Even kitco cuts off (weirdly) *after* all the excitement (as though anyone cares about studying a chart from, say, 1986, but not 1980!). This may be a no-brainer and something that everyone has known about for 5 years. Please advise. Alan  Gold -- Sharefin, 19:43:35 04/09/02 Tue Gold -- Sharefin, 19:43:35 04/09/02 Tue A Golden Opportunity - Marc Faber In late 1999, in the midst of the gigantic NASDAQ bubble, I recommended in a column for a magazine that Bill Gates ought to switch out of his holding in Microsoft shares into gold. Since then the stock of Microsoft is down by about 40%, whereas gold has rallied by more than 10%. Moreover, gold shares, which had performed miserably for the last 20 years, began to outperform both the S&P 500, as well as bond returns. In last month's column, I wrote about "secular changes in leadership" and made the case that the bull market for US financial assets, including equities and bonds, which had started in 1982, had come to an end in year 2000, and that from here on a new leadership would emerge in an asset class other than US stocks. I argued that investors ought to switch out of US equities into the emerging stock markets of Asia and also into gold and gold mining stocks. I have several reasons for my positive stance toward precious metals. Broadly speaking, we had since 1980, a bull market in U.S. stocks and bonds, and a bear market in commodities. Thus, whereas in 1980, one ounce of gold, which was then selling for more than US$ 800, could buy one Dow Jones Industrial Average which was then hovering around 800, today, it would require almost 35 ounces of gold to buy one Dow Jones. In other words, in the early 1980s, the Dow was "cheap" and gold as well as other commodities were expensive, whereas now, the Dow and the S&P 500 are high while gold and all other commodities are extremely depressed. In fact, in the history of our capitalistic age, the gold price has never ever been so low and depressed when compared to financial assets. Don't forget that at the peak of the US stock market in 1929, when stocks were relatively high, it took 18 ounces of gold to buy one Dow Jones Industrial Average, whereas after stocks had collapsed in the 1929 to 1932 bear market one required just 2 ounces of gold to buy one Dow Jones average. Thus, it is clear that at present the Dow is very expensive compared to gold since it takes 35 gold ounces to purchase one unit of the Dow Jones Average. Also, being a firm believer that secular or long-term trends are from time to time reversed and that contrarian investors can greatly profit from such reversals, I am intrigued by the recent out-performance of gold versus equities. Maybe gold is rising now because investors are beginning to appreciate the fact that the annual physical demand exceeds the yearly supply. The annual supply from mines amounts to around 2,500 tons with a value of about $ 25 billion, but the physical demand is 300 or 400 tons higher. Thus, if central bankers would not sell gold from their reserves the price would undoubtedly rise. Now, it is conceivable that because the gold price has recently strengthened central banks will increase their sales and, therefore, depress the price once again. But, also consider the following. In Britain, several newspaper articles have already appeared, which accused the Bank of England of wasting the county's wealth. These articles argued that the Bank of England has already lost several hundred million of Pound Sterling by selling gold last year at a price, which was far lower than it is now. In other words, if central bankers around the world wake up to the fact that a new bull market in gold is underway, they may no longer sell their gold reserves because they will be afraid to look even more stupid, than they are, for having sold their gold right at the gold market's lowest point in the last 20 years! In this respect it is interesting to note that central bankers did not sell any gold in the late 1970s and early 1980s, when gold was above $ 600 and when they could have invested the proceeds from their gold sales in US long-term government bonds at over 13% interest per annum or in short term deposits yielding more than 15%. But now, with gold prices a tad above $ 300, and long-term bond yields at 5.75% and short-term rates below 3%, they consider it to be wise to make this switch. Talking about poor market timing and you do not have to look any further than to our central bankers, whose investment acumen is about as good as the one of the unfortunate investors who bought Internet stocks in March 2000, when the NASDAQ exceeded 5000! Supply demand imbalances aside, it is also possible that the gold market is rallying because market participants are gradually growing more suspicious about Alan Greenspan's monetary policies. After all, it is remarkable that, while the Fed Fund rate has been cut since January 3rd 2001 from 6.5% to 1.75%, long-term bonds have failed to rally and are in fact, today, lower than they were January 2001, when the rate cuts began. Thus, the bond buyers seem to believe, as I do, that present easy monetary policies will lead down the road to more inflation. Consider the following. Since the beginning of 2002, the Goldman Sachs Commodity Index is up by 14% whereas the US stock market is basically flat. Service inflation is already running at more than 5% per annum. True, import prices are still deflating, but if sometime in the future the dollar were to weaken, goods inflation could pick up almost instantly. Moreover, if for the one or the other reason the economy was to slip back into a double or multiple dip recession, I have no doubt that the FED, which through its irresponsible monetary policies created history's biggest financial bubble, will once more do everything it takes to stimulate the economy with monetary means in order to avoid another economic dip. This particularly since the FED will regard the interest rate cuts of 2001 has having been successful at stimulating the housing market and consumption, which kept the economy afloat. Thus, with monetary measures a deeper economic slump was avoided than if the system had not been flooded with liquidity and credit. These recent monetary interventions could, however, have some unpleasant and unintended consequences, the way all interventions into a free market do. Last year's interest rate cuts did, namely, neither help the still overvalued NASDAQ very much nor lead to a lasting improvement in consumption. What the interest cuts did was to bring about a temporary housing and mortgage refinancing boom, which allowed consumers to reduce their equity in their homes to a record low and continue to spend on consumer goods. However, with interest rates now rising, it is increasingly likely that the housing boom will hit a roadblock and that consumption will at some point stagnate or decline. Thus, the FED will sooner or later have to administer to the credit addicted sick US economic patient an even larger and more potent dose of monetary stimulus, which will, in my opinion, lead to a pick up in the price of commodities, a rise in the rate of inflation and a massive fall in the value of the US dollar, whose strength looks increasingly suspect given America's growing external imbalances and its dependence on foreign capital flows. But, could the U.S. dollar really decline meaningfully against other currencies? In my opinion, it is not very likely that the U.S. dollar will fall against the Japanese Yen and along with it against other Asian currencies, since most emerging economies around the world have embarked on competitive devaluations in order to boost their exports. Moreover, if the Asian currencies do not strengthen and actually continue to weaken against the U.S. dollar, how could the Euro move up much against the dollar? No, I do not necessarily believe that the U.S. dollar will decline much against other currencies, the way it did in the 1970s, when it lost close to 70% of its value against European hard currencies. But, the U.S. dollar could depreciate in value against a basket of commodities. In other words, inflation would over time gradually migrate from financial asset such as the still expensive US stock market and the dollar to commodities such as oil, food and precious metals. The skeptics will of course argue that I am inconsistent by simultaneously forecasting another dip into recession and a rise in the price of commodities. Correct! Under normal conditions, commodity prices would decline in a recession because of the lack of demand, but when monetary policies are designed to avoid a recession at any cost, recession can unfold while commodity prices soar, as was the case in Latin America in the 1980s and in Asia following the Asian crisis. Don't forget that in Indonesian Rupiah terms the price of gold and other commodities have trebled since 1997, although the economy went into recession. Moreover, one of the reasons I am not very optimistic about the U.S. economy is precisely the expected acceleration in the rate of consumer price inflation, which will bring about higher interest rates and cut into real income growth at a time when the consumer is already suffering from the NASDAQ asset deflation and a record indebtedness. Thus, I would argue that in view of the FED's believe that all economic evils can be solved by monetary means, an additional round of economic weakness would be even more bullish for commodities including gold than an immediate economic recovery, which would boost commodity prices right away. There is another observation I wish to make about gold. The value of the annual supply amounts to around $ 25 billion and the entire market capitalization of all gold mining stocks around the world is about $ 50 billion. Compare this to the entire stock market capitalization of the world, which is around $ 25,000 billion and the annual supply of bonds around the world, which exceeds currently $ 3,000 billion and it becomes evident how even a very small shift of money could boost gold and gold mining shares. If US financial institutions alone decided some time in future to allocate just 1% of their assets in gold, more than $ 250 billion would flow into bullion and gold shares and send its price to the moon! This, especially, since as mentioned above, the annual supply from mines is valued at only $ 25 billion and also because of the large gold short position, which is estimated at between 4 and 8 years of mining supplies! There are several ways to play rising gold and commodity prices. For now, I recommend the purchase of gold mining companies such as Newmont Mining (NM), AngloGold (AU), ASA (ASA), Harmony (HGMCY), Agnico Eagle (AEM), Placer Dome (PDG), Freeport McMoran (FCX) and Glamis (GLG). However, should the price of gold rise in the next few years by as much as I believe it will then I am concerned that central bankers, who sold their gold near the bottom, will scramble to buy it back at higher and higher prices in order to carry on with their investment policy of selling low and buying high! Worse, the world's central banks, which by then will have lost most of their credibility will persuade governments to nationalize gold mines, and to declare the ownership of gold by individuals as illegal, the same way the US government did in the depression year 1933. So, at some point in future investors will have to own physical gold well hidden in some safe place! Cyclist -- Suresh Garg, 12:52:48 04/09/02 Tue Thanks. Looks like the HUI decided not to start rallying yesterday afterall! Darn. Suresh Garg -- Cyclist, 12:49:40 04/09/02 Tue SWC on the weekly chart Cyclist -- Suresh Garg, 12:45:21 04/09/02 Tue Would you please tell me "triple bottom" in what? Gold or something else? And that triple bottom -- Cyclist, 10:39:58 04/09/02 Tue sure looking formative on Sweetwater mine. Rangy -- Cyclist, 10:34:28 04/09/02 Tue is on sale.Driving down that P/E multiple..:) Gold -- Sharefin, 09:03:33 04/09/02 Tue Contrarian's Contrarian You report that gold funds are showing gains just over 20%. Are people hedging or is gold finally seeing a meaningful resurgence? We did well with gold last year. A few weeks ago, a lot of gold stocks had buying climaxes. As a sector, it's making a new 12-month high but closing down for the week, which makes us a bit nervous. So we cut gold buying down from 75% of what we would normally invest in this area to 50%, because we're looking for a little more correction. We're looking to raise our allocation later this year, because we think we're going to see gold doing better but not going through the roof. We currently have Fidelity Select Gold Fund, Newmont Convertible Preferred, Coeur d'Alene Convertibles, Barrick Gold and Placer Dome. If prices dip a bit, we'd add one or two more gold stocks.  Gold -- Sharefin, 22:03:01 04/08/02 Mon Gold -- Sharefin, 22:03:01 04/08/02 Mon The Battle Ahead: Truth and Justice in the Gold Market Whatever else he may have done, Judge Lindsay did not minimize the factual allegations of the complaint. He did not say that if proven, they were insufficient to establish price fixing. Instead, he republished them in considerable detail, including: Alan Greenspan's statement on gold lending by central banks to control the price; Eddie George's admission of cooperating with the Fed and other central banks to suppress gold prices in the wake of the Washington Agreement; Mike Bolser's statistics on preemptive selling of gold on the COMEX as well as other evidence of manipulative practices on that exchange by the defendant bullion banks; and evidence of gold price fixing contained in various government reports, both those relating to official activities and to the changes in the gold derivatives of the bullion banks. The larger message contained in these allegations is that American officials have preached free market principles to the world while subverting them at home, that they have condemned crony capitalism abroad while practicing it here. Judge Lindsay's decision of March 26 may have given the gold cabal temporary shelter from the law, but it was at best a pyrrhic victory for the Department of Justice. Its job is to defend the Constitution and laws of the United States, not errant officials trying to get around them. A few more such victories and the Department of Justice will have evolved into the Department of Selective Justice, and in the process reestablished the need for a new Special Prosecutor law. The gold cabal may escape legal justice. But these perverters of law cannot forever escape the justice of the market place. In the fifteen months since the complaint was filed, aided by additional evidence uncovered by GATA, most acute observers of the gold market have come to accept that the price fixing allegations are true. Richard Russell has been watching markets and writing about them almost since the day he returned from World War II service in bombers over Europe. His Dow Theory Letters is among the oldest and most successful investment letters. Last Friday, he reviewed the bullish factors affecting gold, concluding: Against all the above, of course, is the position of the central banks. Precious metals, real intrinsic money, is outside the system -- and the central banks want to control the system and they want to own the system. Therefore, the central banks will do everything in their power to protect their monopoly over the world's money, and in my opinion that includes manipulation of the precious metals market, particularly the gold market. As gold approaches the 300 dollar level, I believe the battle is on. The central banks (who have been selling gold) do not want gold above 300 dollars an ounce. And they will do everything in their power to keep gold below 300 dollars an ounce. As I said, the battle is on ... . The central banks will lose this battle. Exactly when, none can say. Don Lindley's updated graphs of money supply growth, reproduced at the end of this commentary, suggest that judgment day for Alan Greenspan and his Federal Reserve is not far away. (For earlier versions of these graphs, see U.S. Money Growth: Words Unnecessary.) With the dirty secret of their manipulative activities exposed, the central banks are no longer an unseen enemy and their manipulations will be correspondingly less effective. Thus recent statements from the Bundesbank that it may sell gold to buy equities, and endorsement of this nutty idea by the European Central Bank, were quickly seen for what they were: transparent attempts to keep gold prices under $300/oz.  Gold -- Sharefin, 21:24:10 04/08/02 Mon Weak Stocks Help Gold Hold Over $301 Precious metals prices settled mixed Monday, gaining support across the board from the U.S. stock market being shaken by a negative pre-earnings announcement by IBM and by Iraq's suspension of oil exports for 30 days. "The market was looking for something to move it. Interestingly, generally sentiment had been negative prior to this. Most people thought gold would probably drift off and test support," said precious metals strategist Kevin Crisp at Dresdner Kleinwort Wasserstein in London. "The Iraqi statement has turned that a little bit on its head." Gold & the Longwave -- Sharefin, 20:30:08 04/08/02 Mon The Kondratiev cycle revisited: Implications for gold Gold -- Sharefin, 20:00:26 04/08/02 Mon Central banks aim to extend gold sale deal "Central banks have E signalled they expect the agreement to be extended," said Benedikt Koehler, the council's spokesperson for Europe. "There would be great uncertainty if it were not, because markets would think central banks planned to massively reduce their gold reserves." Shifty -- Sharefin, 19:58:56 04/08/02 Mon Thanks - it's good to be back in the chair.  Gold -- Sharefin, 00:11:56 04/08/02 Mon Gold -- Sharefin, 00:11:56 04/08/02 Mon Important Information Regarding Updates To Indices Several months ago, the ASX announced it was changing the classification of all equities in line with the Global Industry Classification System (GICS). This change is scheduled to come into effect in June 2002. One of the results of this reclassification is the number of indices being published - the previous 60 indices have now been reclassified into 20 indices. Find out more here -------------------- Due to the above changes the 'XGO' - Australia's Gold Index will be scrapped & forgotten. It matters not that Australia is the 3rd largest producer in this modern fiat world. Australia having sold off most of it's gold production to overseas company's, is now throwing away the recognition that such an industry even existed. Fools, follies & fiat...... Periodic Ponzi Update PPU -- $hifty, 00:09:14 04/08/02 Mon http://home.columbus.rr.com/rossl/gold.htm Periodic Ponzi Update PPU Nasdaq 1,770.03 + Dow 10,271.64 = 12,041.67 divide by 2 = 6,020.83 Ponzi Down 103.81 from last week. The trend is your friend! Thanks RossL for the link! Go GATA Go Gold $hifty  Welcome Back Sharefin! -- $hifty, 00:06:44 04/08/02 Mon Welcome Back Sharefin! -- $hifty, 00:06:44 04/08/02 Mon Good to see you back ! $hifty Gold -- Sharefin, 23:12:09 04/07/02 Sun PLAINTIFF'S MOTION TO AMEND JUDGMENT  Gold -- Sharefin, 23:08:00 04/07/02 Sun Gold -- Sharefin, 23:08:00 04/07/02 Sun Gold Aims to Recapture Its Lustre as a Safe Hedge in Troubled Times After years of playing the part of Cinderella to other more-favoured financial assets, gold is finally shaking off its dowdy image and taking a shot at gaining the prize for best-performing asset market of 2002. Since 1997, $300 (UKpound 208) an ounce has been a ceiling for gold as a combination of central bank auctions and lending to hedge funds, forward sales by gold producers and the much-touted death of inflation conspired to keep the price well below its historic high of $870 hit in 1980. To those gold bugs who have never given up hope that this once lauded store of value would again take its rightful place in the pantheon of credible financial instruments, the poor performance of the commodity has been nothing short of a conspiracy. Indeed, according to many gold aficionados, particularly those at the Gold Anti-Trust Action Committee, the US Federal Reserve, the US Treasury and European central banks, in league with major US investment banks, have conspired to keep the price of gold low. Gold broke through the $300 level to reach a two-year high of $307.80 on 8 February. But the move did not last long, and as the price drifted off German Bundesbank President Ernst Welteke conveniently speculated that Germany might at some stage start selling gold. The timing of his statement was seen by many as an attempt by the central banks to ensure the price of the commodity remained capped below $300. However, the price has since rebounded, trading back above the key $300 level last week. The latest rebound has been driven by new-found interest from the hedge funds, many of whom are betting that persistent selling by large investment banks to keep the price down, and central bank comments to achieve the same end, will ultimately fail to cap the upward trend. Indeed, the talk now is that this so-called cartel is about to get its come-uppance, with some gold optimists suggesting gold may hit $600 or even $1000 an ounce. The Enron scandal has brought to the fore the issue of cartels and especially the role of so-called bullion banks that reportedly have very large short positions in gold via the derivatives market. These are now being squeezed as the price of the commodity rises. Indeed, there is wildfire speculation among some US gold watchers that if the price of gold moves even $20-$30 higher we are going to see these shorts getting hammered. There are plenty of other reasons why gold and gold-related stocks are worth serious consideration. As well as Enron, the markets also have to contend with Argentina's debt default and the huge bankruptcy cases of US companies. Another factor favouring gold is the quadrupling of purchases of bullion by Japanese consumers worried about the safety of their bank deposits. Also, investors in the Middle East have started to actively purchase the metal as tensions over Iraq, Israel and Palestine mount. Finally the all-powerful US dollar, which has held up remarkably well in the face of a weaker US economy, evaporating corporate profits and heightened worries over the threat from terrorism, may be set for a downturn, which usually means higher gold prices. Against this backdrop there is a genuine case for thinking that gold provides an attractive hedge against financial and political stress. However, gold has to become more than just an icon of gold bugs, conspiracy theorists and short-term speculators. Instead it needs to broaden its appeal as an asset among mainstream investors anxious to protect themselves in an increasingly uncertain financial and political environment. Gold -- Sharefin, 22:03:21 04/07/02 Sun CFTC Commitments: Silver Bearish, Gold Facing Risks Gold COTs Silver COTs Gold -- Sharefin, 22:01:35 04/07/02 Sun China 2002 gold output seen down despite plans China aims to produce 180 tonnes of gold this year That would represent a one percent cutback in output from last year, despite official plans announced in January to steadily raise output for the next five years. China had gold reserves of 500 tonnes at the end of 2001, the central People's Bank of China has said. Gold -- Sharefin, 21:53:13 04/07/02 Sun Australia's Newcrest/3Q -2: Gold Output Dn 15% Yr-On-Yr Some A$13 million was lost on the delivery of US$22.4 million of foreign exchange contracts that matured during the quarter at an average rate of 73 U.S. cents to each Australian dollar. A further A$4.7 million was lost with the repayment of 59,390 ounces against a gold loan at a historical rate of A$488 an ounce and below spot prices. The company's revenue also was impaired by delivery into 144,700 ounces of exercised granted call options at an average price of A$507 an ounce. Newcrest also said A$4.4 million of an A$8.9 million unrealized gain from valuing surplus gold contracts at Dec. 31, 2001, has been reversed. Gold production in the quarter was 149,865 ounces, down from 163,984 ounces in the December quarter and 175,254 ounces in the March quarter of 2001. Hedging covers 21% of the company's inventory, compared with about 60% at the end of December. Gold -- Sharefin, 21:43:59 04/07/02 Sun PM Gold Funds Gold -- Sharefin, 21:40:41 04/07/02 Sun Gold conspiracy case dismissed  Gold -- Sharefin, 21:39:26 04/07/02 Sun Gold -- Sharefin, 21:39:26 04/07/02 Sun Gold's fight against activism: a rebuttal to Oxfam America In October 2001 Oxfam America published "Extractive Sectors and the Poor"1, written by Michael Ross, a member of the Department of Political Science at the University of California2. This report is couched in terms of being an objective academic analysis, but its sub-text is a determination to add intellectual weight to the anti-corporate global lobbyist movement. This Oxfam report is the latest in a series of attacks on mining and mineral exploitation by non-governmental organisations (NGOs). Another example appeared in July 2001, when Friends of the Earth published a position paper called Phasing Out Public Financing For Fossil Fuel and Mining Projects (downloadable from the website www.foe.org/international). In part, this growing wave of anti-mining (specifically, anti-gold mining) research and analysis stems from a paper published by the University of Michigan in December 1997, and co-authored by a Federal Reserve employee (in a private capacity). This paper (updated in 2000) - "Can government gold be put to better use? Qualitative and Quantitative Effects of Alternative Policies"3 has passed into folklore as the strongest-yet attack on the holding of gold reserves by central banks. The abstract of this paper states: "making all government gold available for private uses immediately through some combination of sales and loans maximizes total welfare…" There is no need to adduce any conspiratorial collusion when what is much more likely is a simple confluence of opinion, coming together in a disparate and uncoordinated fashion. But it is certainly true that those who are opposed to mineral extraction generally (and gold mining in particular) are developing a broader range of subtle and sophisticated arguments, attached to respected NGOs. The case against gold and gold mining is being steadily and consistently promoted through a conjunction of pressures deriving from various like-minded entities, many of which share an ideological opposition to globalisation, the development of free-market capitalism and the spread of economic liberalism. In the face of these and other critical attacks the gold mining industry has two choices: it can either ignore them and hope they will go away, or it can study them and make counter-arguments based upon reason, evidence and objectivity. We believe the first option is running on empty. Large-scale, heavily capitalised industries such as mining are easily pinpointed examples of global corporatism. A gold mine situated in an environmentally sensitive or economically backward region presents an apparently easy target for any anti-global activist who wants to make a statement of opposition. Those who, like FoE, Oxfam, and other NGOs appear to claim to occupy the moral high ground and to be working on behalf of a better planet, are currently mobilising all the arguments. Where they lead, others may follow. They require challenging. To some extent they are being challenged through entities such as the Global Mining Initiative (www.globalmining.com). But much more groundwork needs to be done to establish a convincing and cogent set of arguments against the allegations that gold mining (and mining generally) is destructive and damaging to the environment and people.  Gold -- Sharefin, 21:35:08 04/07/02 Sun Gold -- Sharefin, 21:35:08 04/07/02 Sun Hedging hurts in quarterly performances There was little to choose between hedged and unhedged stocks for much of last year, but a gap worth nearly 30 points separates the two categories at the end of the first quarter. That will hardly be a surprise to many, but it is still remarkable that the most pronounced hedgers are trailing the pack even after blowing ballast on their hedge books. It has made little difference for the group and that can partly be explained by the success of anti-hedging proponents in scaring new investors into lightly hedged counters. The rise in the gold price has attracted new interest in the sector with money flowing into mutual funds at a rate thought unlikely just two years ago. With investors rusty on what counts in the sector after years of miserable returns, the anti-hedging message is a huge propaganda victory that should not be treated lightly. Activists have used the Internet to great effect to spread and entrench the doctrine - would that they were as effective in stimulating physical purchases. Obviously, the hedged stocks would be expected to under perform in a rising price environment, but with gold up a mere 9 per cent, it is not a sufficient explanation for the gap which would be more consistent with a one-fifth increase in the metal price. Gold -- Sharefin, 21:33:58 04/07/02 Sun Gold chips away at resistance Gold -- Sharefin, 21:32:09 04/07/02 Sun Newmont exits Lihir The trans-Pacific rumour mill has gone into overdrive about Newmont possibly closing out a portion of Normandy's extensive hedge book. At the time of the merger, Newmont said it would deliver into the hedge book rather than close it out as many had expected. There has been every incentive to close out early as the gold price has retained its strength and looks poised to hold in its current range for at least this year and perhaps most of 2003. Also, the Australian dollar has continued to strengthen suggesting that the Normandy hedge book is being battered on both the commodity and currency legs. Newmont is expected not to talk about the Normandy hedge book until it releases mark-to-market data in conjunction with operating and financial results for the first quarter. Any substantial announcement will add further short-term impetus to the upward trend in the gold price. Gold -- Sharefin, 21:29:46 04/07/02 Sun South Africans' R80 million bet on gold Gold -- Sharefin, 21:28:29 04/07/02 Sun DRD to take loan for hedge Durban Roodepoort Deep [NASDAQ:DROOY], the South African gold producer, is expected to unveil terms of a loan aimed at closing out the remainder of its hedge book, currently estimated at just under 400 000 ounces. This is in terms of a promise to shareholders last year that the company would be completely unhedged by 30 June, Durban Roodepoort Deep's (DRD's) financial year-end. Gold -- Sharefin, 21:26:50 04/07/02 Sun Gold's Challenge We're looking for a three to five year bull market in gold that should begin sometime this year, if it hasn't already. This bull market in gold, we contend, will be all about overcoming the State's global monopoly on money. For gold to win, in the end, will require the utmost moral conviction on the part of every single individual who holds the power to vote for the system of private property… to veto the government, if you will. Long-term global prosperity depends on it. Gold -- Sharefin, 21:15:32 04/07/02 Sun Proof of Manipulation Gold -- Sharefin, 21:13:01 04/07/02 Sun Exposing a gold myth Ten years of steadily falling gold prices and severely reduced exploration budgets were widely expected to result in a big drop in production of the precious metal. But so far this has not happened. So when will global gold output start to fall? And by how much? A bunch of gold groups - including AngloGold, Barrick, Gold Fields, Newmont, Placer Dome and Randgold Resources - have sponsored some in-depth research to see if these questions could be properly answered. 123@321 -- Sharefin, 21:04:06 04/07/02 Sun Must be a sign of the coming bull....... Robert Chapman - JP Morgan Chase -- Sharefin, 21:00:51 04/07/02 Sun JP Morgan Chase will pay Sumitomo Corp $125 million for having cheated them in a copper trading scandal in the mid 1990's. They assisted a rogue Sumitomo trader in rigging and controlling the copper market. Morgan engaged in fraud, racketeering, negligence, breach of duty and conspiracy, just as they are currently doing in the gold market. Robert Chapman - Gold Commentary -- Sharefin, 20:59:24 04/07/02 Sun The latest out of Asia is that the Chinese have bought $1 billion worth of gold. Gold shares were the shining light of the first quarter. The S&P gold index was up 24%, while the Philadelphia Exchange Gold and Silver Index was up 30% plus and the CBOE gold index's gain was 35%. Seymour Schulich and Pierre Lassende of Newmont told Forbes that the dollar will fall soon, given the high US current account deficit and that more than one-third of the new supply of gold, excluding central bank sales, will disappear due to shuttered mines. We see the gold market fundamentally, technically and emotionally a lock to the upside. Forward sales for the most part have ended and hedges are being covered. Ten and 30-year interest rates refuse to drop and that is not because the FED is going to raise rates because at least over the short time they will hold their rates where they are. Little money is flowing into gold mutual funds, which means we are still in a stealth move. The public and professionals either don't care or don't understand what's happening and that's okay. We'll need someone to sell too. On the Comex the commercials are sellers and the specs are buying. Open interest is small offering plenty of long-side opportunity. The 50-day moving average runs through $305.50 and moving upward thru that price should be a piece of cake. Silver prices are ready to crash through $4.75 an ounce. Japanese know the banking, economic and currency crisis' are not going to go away. They are shoveling sand against the tide. 119 million ounces of gold reserves are depleted each year and little new exploration is taking place. That means existing producers' shares should explode over the 3-5 years. Stillwater Mining will be asked by the SEC to revise its reserve estimates and 2001 earnings. The platinum and palladium producer could trigger default or violate Stillwater's credit agreements with banks. The company intends to vigorously defend its position or reserve methodology and will pursue all avenues of appeal. Behre Dolbear and Company, an outside mining consultant, who made the estimates, stand fully behind them. Behre is a first rate company. A reduction of the company's reserves would decrease the time span in which the reserves depreciate, increasing expenses, reducing earnings and paying more taxes faster. At issue are probable reserves. The SEC is trying to change the industry standard to get more taxes quicker. This is a witch-hunt. Gold cleared $305 an ounce again and we are sure the hedged producers are very concerned. A $330 gold price spells real rouble for Barrick and AngloGold. A move to that level could trigger defaults not only by producers but also option writers, which would spread through the industry. Considering all that is going on we wouldn't want to be on the sidelines. Concern about the economy, the state of the country's banks and now the unease and tensions in the Middle East are continuing to send the Japanese public to their nearest gold shop to stock up on ingots and coins. Households bought $180 million of gold in February and gold imports increased more than 7 times from February 2001 to 20,000 kg. The estimated purchase of gold in January and February is only 0.2% of annual savings by the household sector. This means the best is yet to come. The Japanese impact on gold markets could be colossal. Sales range by dealer just for January and February of increases of 9 to 13 times versus last year. Most Japanese banks are bankrupt, still with over $1 trillion in bad loans and the government limiting account insurance and rigging the stock market so the banks don't fail - an exercise in futility. Business is poor and unemployment grows as deflation holds the economy in its icy grip. Speculators will trade the gold market, but the public will increase buying on price weakness. There is evidence investors are buying platinum as prices have surged recently. This is only the beginning. The Japanese have $500-$700 billion of uninsured funds that is available to purchase gold and only a fraction of that will send gold prices soaring. Gold price ready to shine by Dan Atkinson, Mail on Sunday (London) GOLD prices are about to surge as the world's central bankers prepare to renew a 'ceasefire' on sales of their own bullion reserves. The present deal, agreed in Washington in September 1999, expires in 2004, but talks behind the scenes suggest it will be extended, or even made permanent. 'There is every indication of a renewal,' World Gold Council chief executive Haruko Fukuda said. 'The agreement is likely to be enhanced and to go forward for another five years - or for ever.' Already last week, bullion prices hit a two-year high. Gold closed at $303 a troy ounce in London, up from $301 midweek. The price has risen from just above $260 since 11September. In the Washington deal, 15 European central banks, including the Bank of England, agreed a five-year moratorium on gold sales. The US Federal Reserve, the Bank of Japan and the International Monetary Fund supported the deal. It came in response to the plunge in bullion prices after a number of high-profile sales of gold reserves, notably by Switzerland and Britain. With gold at its lowest in real terms since the early Seventies, producers such as South Africa, Zimbabwe, Russia, Indonesia and Brazil faced growing problems. SUBSCRIPTION INFORMATION email: bif4653@comcast.net Shell -- Sharefin, 20:57:04 04/07/02 Sun The OZ markets are open XGO - Australian Gold Index Click on the share codes for prices. http://www1.tradingroom.com.au/tpl/investments/tr_cur_ind_sub_grp_011.html">Australian Gold Stocks is aussie mkt. closed today, apr.8? -- shell, 17:20:20 04/07/02 Sun . Which Govt is Best -- Giovanni Dioro, 06:51:05 04/07/02 Sun Shell I prefer a Constitutional Govt based on religious principles, such as the one founded by the great men of 1776. Those men knew of the babylonian monetary system and therefore included in the Constitution a provision that only Gold or Silver could be used as money. What we have now in the western world are theocratic governments which espouse satanic anti-christian principles such as the condonement of such crimes as rape, murder, bestiality, and theft by monetary deceit. A sound govt is founded on sound money, that is why we must return to a gold (or silver) standard. Without that there is no morality. By the way I disagree with Harry Schultz about a skyrocketing Gold price making it impossible to return to a gold standard. Actually that is the only way it will be possible. There is not enough gold to fix it at these prices. Therefore gold would have to be fixed at something like $5,000 per ounce or we would have to go through such massive deflation that it wouldn't be funny. I'm talking deflation in houses selling for $2,000 or farmland at $5 an acre. We ain't gonna see that kind of deflation. And the only way we will ever see a gold standard again is after a given currency becomes worthless, i.e. it suffers from hyper-inflation and sky-rocketing prices. giovanni -- shell, 21:27:59 04/06/02 Sat many thanks for going to that kind of trouble, ie to type it i suggested hoskins isolate all the bible refernces into a single chapter would you want a theocracy running this country?-the horrors done by the church happened when it was a governing body if you trade gold shares i suggest you investigate the work of SKI--he posts at 321gold.com--his system has been off center recently, but i believe it to be exceptional work Cyclist -- Suresh Garg, 18:13:46 04/06/02 Sat By the way, I use only Fidelity Gold fund, that can be traded on a hourly basis. There is a stiff 0.75% exit fee if one does not stay in the fund for at least 30 days. So, I would prefer to minimize THAT fee, although I have not been successful so far. Trying to improve my methodology without losing my pants to save 0.75% fee, so to speak! Cyclist -- Suresh Garg, 18:09:50 04/06/02 Sat Thanks for your post. I am not a day trader, but trade only a gold fund. I just don't want to get caught in a down draft. I have no problem with 4-5% swings. Appreciate your posts very much. Positive Gold Article in Last Week's Sunday Times -- Giovanni Dioro, 12:23:38 04/06/02 Sat Gold glimmers as producers shore up price David Smith - London, March 31 WORLD gold producers, convinced that demand is on an upward trend, are launching an initiative to ensure that the price remains strong. The gold price has been hit in recent years by lack of investor interest, a perception that “yellow gold” jewellery is unfashionable compared with platinum and diamonds as well as sales of central-bank bullion reserves, including those ordered by Gordon Brown and carried out by the Bank of England. But gold closed above $300 an ounce last week and the World Gold Council (WGC) believes the tide is turning. “We're seeing a glimmer of light,” said Haruko Fukuda, chief executive of the council. “There have been a lot of inquiries from investors in recent months and yellow gold is starting to come back in the jewellery market.” The council will today launch a strategic review of the industry, the first for more than a decade, aimed at finding new markets for gold in the next three to five years. It will be carried out by Bain & Company, the consultancy. One aim will be to discover whether the increased investor interest, which has pushed the price higher, can be sustained. Japanese investors, beset with economic uncertainty, have been shifting funds into gold as a safe haven. There is also a belief among some investors that gold will do well if Middle East tension escalates. Its price rose to nearly $1,000 an ounce after the fall of the shah of Iran more than 20 years ago. The initiative will also examine new ways of marketing gold. A campaign last year to sell gold's appeal as a fashion item succeeded in clawing back market share. WGC members produce about 2,700 tonnes of gold a year, compared with a demand of 3,700 tonnes. Unlike the Organisation of Petroleum Exporting Countries (Opec), they cannot push through price rises by restraining production.Worldwide gold stocks of about 140,000 tonnes are neither owned nor controlled by the producers. The big quoted gold miners, such as AngloGold, have had strong gains in their share prices this year as investors have warmed to the sector. But gold still has a long way to go if it is to regain the $800 an ounce that it hit in the late 1980s. Analysts say that if gold is to have a future, there must be consolidation in the market among producers. This has already happened with platinum, where four producers now dominate 90% of the market. Man finds Valuable Gold Cup -- Giovanni Dioro, 02:36:42 04/06/02 Sat One of the earliest treasures ever discovered in England has been uncovered in a Kent field. The precious Bronze Age golden cup was discovered by a man using a metal detector at Woodnesborough, near Sandwich. click here  Harry Schultz open letter to Miners -- Giovanni Dioro, 02:15:38 04/06/02 Sat Harry Schultz open letter to Miners -- Giovanni Dioro, 02:15:38 04/06/02 Sat From the March 10, 2002 Harry Schultz Letter Gold shareholders: My motivation in pushing gold mine chairmen to close out their hedges quickly is to help them realize the danger, as follows: A gold bull mkt (which will ignite on a 2-day close over 305 (Ed. note: this may have changed to 2dc over 307 - see earlier post)) will later, freakishly & ironically, bust most investors holding shares in gold producers who have hedges of any kind. Gold will, in my opinion, streak first to $354 (that number produced via derivative extrapolation), where all hedged mines will bankrupt, & central banks will sell gold, sending it back to $270-$300(?) scaring out the bulls. But derivative damage will have been so great, & mine output slashed, the price will resume its rise (as it did after a 50% fall in 1974-76 from $200 to 100), til it reaches $1,450 or better, drawing in the bulk of the public at prices over $354, 529, & 800. Then when every short has covered, who will buy? Nobody, & the fall thereafter will be so violent as to disqualify gold as a reserve asset, for such volatility. There would go our hopes for areturn to the Gold Standard. The result could be gold back to $35 in our lifetime. We must prevent that. Read on. A mega-derivative squeeze is coming from Hung Fat & Dr. No (i.e. 1-2 trillionaire Chinese), which will shred the present day gold cartel into confetti. With them will go all the hedged mines! And their shareholders! Currently, you must note the concentrated gold buying on reactions, very different from the past 2 decades. Gold's bull move will only help Hung Fat & Dr. No & traders using our new gold chart service (& following it when the stakes are high & unrealized!). Before Central Banks fight the $305 & $354 levels, gold producers have the greatest (& last) opportunity in their corporate lifetimes to "get the hell out" of every hedge position. They risk class action sutis & worse if they don't. There is very little time left to do this. They'll say they can't get out due to bank contracts to hedge their new production during the lifetime of the loan. That's true. Solution: During rallies, pay off their development loans by issuing convertible bonds as Agnico Eagle just did, thus financing their development debt in this traditional way. As a bull market will cause a convertible bond to rise, they'll have the debt exhausted without ever having to pay it by the conversion of the bonds into common shares. As the bonds were issued to pay off thier development loans there'll be no dilution to present shareholders. It's a win/win & nobody goes broke. Gold producers are saved. Investors in gold producer shares are saved. Gold itself is saved. Even if mine hedge position is taken to a real hedge posture without possible gain or loss (balance) the contract can fail selectively (i.e. one leg at a time, among many legs), which would cause the position to become totally dangerolus. Gold producers umst expunge from their books every single gold hedge transaction & leased gold commitment before it is too late. Regarding gold hedges for the carry trade or for non-gold related financing, who cares? If producers need any help on how to convert production debt out of the need for a hedge position, & pay off non-recourse loans before the gold freight train hits, get in touch with HSL. I'm taking back the lead cape I took off in 1981. We have to save the producers from themselves (& the banks), save gold shareholders who will be tricked by wild whipsaws unseen to date, & save hope of a Gold Standard. It's time to stand up & be counted & get smart. Gold shareholders should send the letter below to the chairman of every mine that hedges its gold production forward, in which you own stock. A chairman is legally responsible to shareholders for managing his management. After receiving this letter the board chairman can never claim to not have known that derivatives carried extreme legal & structural risks This letter may end derivative hedge book trading in the manner used today. You can print this out from email or ask us to send you a fax copy or photocopy this letter & clip & recopy. Add your name. We seek to protect the hedging mines against themselves, thereby protecting their shareholders, which are our collective selves. We also recognize an obligation to certain develping nations, giving them the opportunity to mine gold, thus protecting them. The ultimate Murphy's Law is to have a gold bull market break the producers (via derivatives) & thereby break gold bulls. World monetary stability is also involved, about which more another day. Here's the letter: Dear Mr. Chairman: In light of the recent accounting & Enron scandals, I require answers to certain questions concerning the condition of your hedge book as a whole & the specifics of each individual hedge transaction. Your present reporting does not detail these key items that are critical to an investor's ability to calculate the risk factors of investments in your/our company. 1. What percentage of the funds that you have taken into earnings or deferred earnings originating from your hedge transactions in the past 5 years are free from the necessity of maintaining your present hedge contracts? 2. In derivative contracts with derivative dealers does the right of offset exist? That means should the dealer enter insolvency while owing money to us, can we charge that indebtedness against what we may owe the dealer? 3. Have we dealt with a well-known substantive investment or commercial bank, or with a subsidiary of that entity? If answer is a subsidiary of the investment or commercial banker, in what nation is subsidiary domiciled? What are legal/capital/bankruptcy laws of that domicile? This information is necessary to assess real credity risk. 4. Is the subsidiary of the investment or commercial bank entitled to an automatic fund forwarding from the parent to cover the "Trade Debt" of the subsidiary, if the subsidiary fails? If not, then we would have to cover the failed commitments, as margin calls do not wait for litigation outcome. 5. If we have dealt with a subsidiary of the investment or commercial bank, have you seen the balance sheet of that subsidiary & the audited amount of total nominal value of derivatives granted by that entity to others? Without this, no reasonable calculation can be made of our credit risk involved with this dealer. 6. If we have dealt with a substantive investment or commercial bank in hedge derivatives, has the board been apprised of the condition of an audited statement of the nominal value of all derivative granted by that institution to others? If we have not, then regardless of the hundreds of millions or billions in capital, no meaningful quantification of the risk factor has been made. 7. Can we trade entire option hedge book in totality with any dealer we wish or are we obligated to one granting dealer when changes or closure are required or desired? If we can't take our position in totality, or leg by leg, to any dealer we have severely restricted our liquidity & tied ourselves to the financial condition of our counterparty. 8. Qssuming we used a leased gold contract as part of the hedging program, do either ourselves or the dealer have the obligation of returning the gold, re-leasing the gold or replacing the gold at the end of the standard term of lease (which is 1-year) required by all central banks. Does the Board realize: no matter what our contract says with the gold bank, the leased gold needs to be re-leased, replaced or covered at the end of each year regardless of the fact that our hedge position goes out to 10 years forward? Is our dealer capitalized to guarantee this performance, not only to us, but also to every other producer they deal with? 9. Regarding the specific hedge instrument: a. Was the trade transacted over the counter or on a listed exchange? b. Is there any regulatory body presiding over the transaction? c. Are prices of these instruments in public record anywhere? d. Was price of the instrument determined by computer modeling? e. Is there any open market for each leg of the hedge transaction? 10. Regarding legal considerations: a. Are you familiar with legal precednt set in the early 1990's in Southern District of Manhattan Federal Court whereby validity of a transaction is determined by capitalization of a transaction versus nominal value of the transaction? b. Are you familiar with legal precedent concerning validity of a commodity transaction being determined by the timely & industry standard execution of a margin call? I require prompt answers to these questions, as without this knowledge no reasonable conclusions can be gained concerning the actual risk our company has, regardless of our company's position in the industry or the size of your treasury. If you have not reviewed all these criteria of the individual hedge contracts, dealer's stability by documentation, & freedom to deal for closure by individual leg or by total spread position with any dealer of your choice, I would feel you are not fulfilling your duty to us. Sincerely yours, Suresh Garg -- Cyclist, 16:24:05 04/05/02 Fri The highs are still in the cards for the 15/16th of April .If you are a day trader the HUI gave a sell signal on the hourly April 2nd at the close.For core holdings initiated November 26th last year,you should be still be long unless the HUI 88 level gets violated,93 is the first level of support. Again for a trader, you got to be in the most liquid stocks. Cycles are kind of back ground music,indicating mood swings, supported by other technicals. I gave you the dates in my previous post,you might want to read it again.Hourly cycles will give a turning point third hour Monday. Good luck.. Cyclist -- Suresh Garg, 11:52:01 04/05/02 Fri Something is not right with your projection of highs in gold and gold stocks through 15-16 April. Would you please comment today before the market close? Thanks. harry schultz letter form letter - @shell -- giovanni dioro, 11:05:16 04/05/02 Fri Shell, that letter was printed in the last harry schultz letter, march 10. I can type it up tonight and post it tomorrow. It seems like a letter that will scare the goldmines out of hedging. Re Hoskins, he has toned down a lot of the jewish bitterness in his work recently - ever since that nut shot up a JCC in LA a couple of years ago. While I agree with you that it is difficult to spread the Word when his work goes against the PC public norm, many of the biblical references he gives are extremely important in proclaiming the rights of Man which are derived from God. In an age of corrupt churches who lie, deceive, and practice satanism, many have turned away from the churches and God Himself. But those who renounce their religion and their belief in God are in turn renouncing their God-given rights. They are voluntarily selling themselves and their future generations into slavery. giovanni -- shell, 21:17:29 04/04/02 Thu a few days ago was posted h.scultz's scenario re dire possibilities from deriv's, plus a model letter for us to send to mining co.'s did you see it?-if so where was it ---do you have it?-if so can you paste it here? spoke to Hoskins today--told him his great work would be ignored and easily marginalized unless he cut the continous references to jews, to the bible, to the white race etc-if that is he wanted a broad audience Clarity on my Harry Schultz posts below -- Giovanni Dioro, 06:10:58 04/04/02 Thu Now I see why Harry picked 305 for a 2-day close above this level to buy aggressively. It is because although previously there were intraday highs above 305, the previous highest close on the June gold futures was 304.90. Since 2 days ago gold closed at 307, but yesterday failed to close above 305, Harry's buy advice was not confirmed. Moreover since now the previous high is 307, perhaps harry will be looking for a 2-day high over 307. I can't speak for Harry, but I would think he would be looking to re-enter at lower levels than where we are now. Some sign posts to play with -- Cyclist, 20:55:06 04/03/02 Wed Gold cycles looking for a high April 15/16 with a sharp pull back into April 26.May 2nd a recovery high with a May 17 low.An important week,second week of July ,will give a turning point for gold till the rest of the year. The currents at play will make gold quite volatile for the next three months.The stock market is toast after April and could influence liquidity for gold stocks.This is FWIW..:) Long Term View -- Mike Stewart, 15:17:07 04/03/02 Wed Since 1976, the gold price has moved in clearly defined cycles of 5 years up and 3 years down, Plus or minus a few months. The last top was Feb 1 96, projecting a low around Feb 01. We got it on Feb 20 01 with gold at 252.60 closing price. My point is that we are 13 months into a bull. The last three have lasted 35 months (Mar 93 - Feb 96), 34 months (Feb 85 - Dec 87) and 41 months (Aug 76 - Jan 80). The magnitude of the bull varies greatly from move to move. The 76-80 gave us 10 X moves in the larger South Africans. The Toronto Golds have usually quadrupled after declines of 66% or more. That means a move to 14000 plus from the last low of 3505.70. We are currently around 6100. I have no idea how we will get there, but it is still early in this game. june high -- giovanni dioro, 06:57:00 04/03/02 Wed just to say that the june high was higher than 305. I think the chart that harry has on his website was likely a rolling chart of current future prices. www.hsletter.com login: hslm pw: success go to subscribers click on "free market update"  Harry Schultz _ @ shell -- Giovanni Dioro, 06:47:38 04/03/02 Wed Harry Schultz _ @ shell -- Giovanni Dioro, 06:47:38 04/03/02 Wed shell, I looked again at the letter last night, which was written in mid march. I'm fairly certain he was referring to June futures, as it was in the "futures" section of the newsletter. Also, the chart he had on his website showed 305 as a previous high for the june futures. The chart linked below shows that yesterday the june contract closed at $307, a one-day close over $305. So Harry is looking for 2 consecutive days with a close over $305. It may do so today, but if it does it has a somewhat bearish aspect in that today june gold went higher than it did yesterday and that likely today we will get a lower close. Moreover we might not get that 2-day close over 305, and thus Harry's buy signal would not be confirmed. June Gold Futures giovanni re schultz -- shell, 19:51:28 04/02/02 Tue i didnt see letter itself but what i got was that the 2 closes...'COULD ignite a bull'---repeat 'could' not shold or 'will'-----so be careful i'd also like to know if he meant june gold or PM fix which was 304 today  Harry Schultz -- Giovanni Dioro, 10:33:47 04/02/02 Tue Harry Schultz -- Giovanni Dioro, 10:33:47 04/02/02 Tue If I recall correctly, Harry Schultz wrote in his latest newsletter a few weeks ago that if gold closes above $305, 2 days in a row (I think he means June Futures), then to buy agressively. Cyclist -- Suresh Garg, 08:29:03 04/02/02 Tue Thanks for today's posts. Appreciate them very much. Special SWC follow up -- Cyclist, 08:01:00 04/02/02 Tue SWC in the process of making a triple bottom in the next few weeks on the weeklies. June gold -- Cyclist, 06:23:15 04/02/02 Tue looking for 318 this week.Continued foreign policy weakness in the administration will cause the US dollar to weaken sharply in the coming month.Any planned adventurism in Iraq will weaken the US currency even more so and hence a flight to PM assets.April is a pivoyal month historically for gold and oil.NEM target sits at 34.00.Junior miners will make a sharp run in the next two month. Suresh Garg,no harm done. Cyclist -- Suresh Garg, 06:16:59 04/01/02 Mon In my previous post, I should have Please keep posting. I did not mean to appear rude. Sorry about that.  Periodic Ponzi Update PPU -- $hifty, 21:56:58 03/31/02 Sun Periodic Ponzi Update PPU -- $hifty, 21:56:58 03/31/02 Sun http://home.columbus.rr.com/rossl/gold.htm Periodic Ponzi Update PPU Nasdaq 1845.35 + Dow 10,403.94 = 12,249.29 divide by 2 = 6,124.645 Ponzi Down 14.885 from last week. Thanks RossL for the link! Go Gold Go GATA $hifty NG and CL -- kapex, 18:34:00 03/31/02 Sun NG Natural Gas CL Crude Oil ng and cl are what stocks in 'canadien's' post--also is oz closed tonite? -- shell, 18:03:08 03/31/02 Sun . Cyclist -- Suresh Garg, 18:25:08 03/30/02 Sat Thanks for your post. I follow your timing signals as well. Keep posting. A CANADIAN -- Cyclist, 14:00:39 03/29/02 Fri Thanx ....:) Stay long in goldstocks until end of May,NG and CL are eyeing 5.00 and 45.00.When the stampede starts in the above stocks it is time to bail out. Link to original post at kitco with links. -- kapex, 09:40:31 03/29/02 Fri http://www.kitcomm.com/comments/gold/2002q1/2002_03/1020329.110816.kapexeeee.htm Gold -- kapex, 09:32:36 03/29/02 Fri Real quick Elliott Wave count on Gold. ( My count ) 99 spike high went up in the prettiest 5 waves for a ( 1 ) . Everything to the Feb-Apr lows was a ( 2 ) . Since then the May straight up shot was a 1. It then had a large A-B-C for a 2 ending in early December. Since then we have a series of 1-2's. I don't think the proper count will be interprtable until more action, but this is how I have it. Because the price of Gold is Sooooooooo manipulated, a normal 5 wave advance continues to overlap the 4th wave over the 1st wave. Not allowed as an impulse wave due to this very reason and therefore HAS to be something else. Usually it turns out to be corrective. This time is different IMHO because of all the forces at work. Gold IS IN A BULL MARKET and has been for almost 3 years. It just hasn't felt like it because most play the stocks and they got hammered up until a year after the low in physical Gold. Silver made it's low a year after that! Because of these abnormal forces which I feel were due to the PTB wanting to accumulate as much as they could, rallies were stunted and stopped and Gold came back down. Only torise again after continually making higher lows. click here ...>click here ... Every single decline in Gold has seen it STOP above the previous low. It's coiling! Note the Feb 2002 contract and how Gold made a 5 wave advance from that low. Thats a 1 click here ... Everything gets muddy again and it's even the area that PD of Elliottwave called it a triangle B wave with the next move up a thrust up to a C. Although it did thrust up. It didn't resume any sort of decline. It pulled back and shot up into the Feb high. Another 1 So whether you can label a 1-2, -1- -2- or 1-2 -1- -2-, i-ii is not important because it seems to be clearly in a impulsive mode right now and trying to ( think ) you can actually understand Every wave is an exercise in futility. Heres a monkey wrench. You could even say the move up from the July low was a 1 too! So, while the count may or may not be perfectly clear, the technicals, fundamentals and Elliott Waves all point to Gold quickly going from bargin status to interest at much higher levels. Note here how April Gold Did make a higher high in Feb. 5 waves up click here ... Also note the MACD at the bottom of the chart being in the same condition as Gold weekly was in early December when I repeatedly said it looked Explosive! Here is that one again. http://www.Treasurestatefutures.com/chart/ts_cha72.gif To make a long story short, like I said Wednesday morning, Gold looks to be in a 3rd of a 3rd. Bill Murphy even said Goldman svcks was trying to get people to lease Gold for nothing. That says a couple things to me. 1 ) They are now on their own. 2 ) The reason why you can't depend on lease rates or COT's because they are controlled like most everything else by TPTB. 3 ) Gold is ready to go up like I said 6 - 9 months ago because they would wait until they needed it to go to help the economy and this could be the reason Gold has gone from total news blackout to in the limelight! 4 ) They are done with accumulation of miners and 5 ) Bill Murphy said that barrick's directors sold all their stock! What does that last one say to you? It tells me that Gold is going to go higher and barrick directors know that their stock WON'T participate like it should due to the amount of Gold they have sold forward. All these things combined with the technical picture say something. Sooooooo, expect them to go to monumental lengths to smack Gold back down and they may be able to do it! But for how much longer????????  Negative Interest Rates a Boon to Precious Metals -- Giovanni Dioro, 05:57:14 03/29/02 Fri Negative Interest Rates a Boon to Precious Metals -- Giovanni Dioro, 05:57:14 03/29/02 Fri Robert McTeer is a voting member on the FOMC that sets interest rates at the Federal Reserve Bank. He said recently that inflation is not a problem and that he is no hurry to see rates rise. While he feels that inflation isn't a problem state-side, in Europe inflation is starting to become a problem. With the euro-changeover many merchants have rounded up prices and/or tacked on another 5-10% while consumers haven't quite adjusted to the new price regime. In what is typical of this kind of pricing is that of Brennan's, the largest bread manufacturer in Ireland. It is raising prices 12% on a loaf of bread. CPI is higher than what is being reported, a friend says to me. He says he used to be broke 3 days before his 2-week payday. Now he says he broke a week before. Well, perhaps the European Central Bank thinks this price inflation just temporary and therefore it pretends not to see it. However if prices keep rising like this, European rates are going to have to rise, and if they rise US rates will be under pressure to rise too. One thing is certain - that is the rate of inflation in many countries is higher than interest rates set by their respective central banks. So while these Central Banks continue to price interest rates below that of inflation, there is little or no doubt in my mind that precious metals will continue to shine. Reg Howe's suit dismissed by Judge Lindsay -- Dave Brooks, 12:16:06 03/28/02 Thu From Chris Powell Dear Friend of GATA and Gold: Reg Howe's lawsuit against the Bank for International Settlements, the U.S. Treasury Department, the Federal Reserve, and the bullion banks was dismissed today by Judge Reginald Lindsay in U.S. District Court in Boston. We haven't analyzed the decision yet, but with Adobe Acrobat, you can read it on the Internet here: http://pacer.mad.uscourts.gov/recentopinions.html At this hour the decision is the fifth case from the top of the page, headlined, at the left, "Howe memorandum and order." GATA thanks and congratulates Reg for his heroic effort, and reminds its friends that we continue to press the cause on several fronts. It doesn't stop here. Far from it. CHRIS POWELL, Secretary/Treasurer Gold Anti-Trust Action Committee Inc. @ CYCLIST -- A CANADIAN, 22:14:33 03/27/02 Wed Your technical posts have made me money! Please do not hold back. (one who appreciates you.) Puplava Market Wrap Up -- shadowfax, 20:55:44 03/27/02 Wed Excellent Gold and silver Report plus more http://www.financialsense.com/Market/wrapup.htm  CALVF -- flierdude, 18:38:20 03/27/02 Wed CALVF -- flierdude, 18:38:20 03/27/02 Wed The power of Kitco ............. they believe ya Cherokee ............. hehehe ski of the silver post -- shell, 11:41:21 03/27/02 Wed are you jeff k.? Holiday -- Dave, 06:56:55 03/27/02 Wed Have a good hoiday Nick. I hope you have no internet access and have to spend all your time laying on a beach somewhere catchin fish. @ Nick... Enjoy Your Easter Vacation... -- ThaiGold, 01:17:58 03/27/02 Wed Will try to post here from time-to-time to fill the pages while you relax... Here's a piece I just wrote, that your Forum's readers might enjoy. It relates to Gold and Silver, in a thread we've been discussing relevant to the COMEX Silver short (massive) that Ted Butler's unable to get any action from the CFTC to correct what is apparently a blatant non-enforcement of CFTC rules: @ thmann... CFTC... Catch 22... Loophole 23... Posted by: ThaiGold Date: March 27, 2002 at 00:56 Message id: 7185 Thanks for posting those reference links to the CFTC's rules and criteria used in "enforcing" the CEact. Certainly is a prime example of oversight- gone-amuck if there ever was one. The whole thing stinks. Ever see that comic-strip featuring "Charlie Brown".?. It was called "Peanuts" and written daily for years, by it's author, Charles Schultz, before he passed away a year or more ago. It's been discontinued of course, but will live forever as a Classic. It featured another character, "Lucy", Charlie Brown's sister, as well as other regulars. But what comes to mind in this whole scheme is the similarity to the Classic and oft repeated skit, whereby Lucy is to hold the football in place, while Charlie comes running at it to place-kick it. And she always, at the last instant, pulls the ball to the side; he misses it; yells "AAAArrrggh!" and tumbles into the air, flipping from the inertia etc... Well, you'd think he'd learn his lesson the first or second or third time he was tricked by Lucy, but he never did, and Schultz was able to run the same sequence over and over again for years, always funny, and always the same result. And we, as readers, never tired of it either. So, in a way, COMEX is the same thing. A CFTC (Lucy) promises endlessly and assures the ever trusting brother, she "won't do it this time", but she does. Only here, Lucy promises to enforce stringent COMEX rules, only to revoke or utilize "exemptions" whenever it suits their nefarious needs to thwart those who would attempt to play fairly in those games. It won't happen, never has, and never will. Yet we see the "hapless" traders continue to try to kick the ball day-in and day-out somehow foolish enough to not see or believe what's really going on. You'd think Charlie Brown (Traders) would learn eventually, if they wanted to. So apparently, they prefer things the way the are. Most casinos have the odds stacked against the gambling customers. But they all know that, and flock to the resorts to stuff coins into the slots regardless. Who knows why.?!. Can we blame the CFTC, or should we, after so many years of this nonsense and non-enforcement.?. Technically, the answer is "yes", but realistically, the answer is: It's pointless. No, we can only blame ourselves (if are a trader) for staying in their crooked game. Therein, I think, is the solution: Don't play their game. Go elsewhere... We tend to let these paper futures markets wag the dog. It should not be. The prices (POG/POS/etc) should be set in the cash/spot markets to reflect true reality of supply/demand fundamentals. That dog should be wagging the COMEX tail. Not the other way around. But waitaminute... I believe it does. The spot/cash market for metals is reality. It has to be. That's where metal is exchanged for fiat. Everyday. Make no mistake about it. And those prices inevitably must reflect the stark reality of actual supply and demand. Hence, COMEX prices must also reflect the same reality, else arbitrage (price differences) opportunities would be abundant. Which they are not. So, both markets are reality. So what's wrong with this picture.?. I'm not sure... Let's take another look, a second opinion, so to speak. Let us look at some other physical market: Let's look at a coin dealer. For there, we can at any time exchange our fiat for metal. Gold or Silver. What do we see.?. We see (for example -- at Tulvings) daily prices almost identical to spot/COMEX and we see abundant supply of coins available. Bars too. Sure, there are some infrequent periods when a certain format of bar or coin is N/A. But there are always other substitutes in abundance. It is no less however, a reality market. Supply and demand in equilibrium. Prices accordingly. Set daily... Do you see what I'm getting at.?. Despite all the irregularity and illegalities taking place in the hidden Gold and Silver manipulations at COMEX; LBMA; Etc etc etc, none of it has really changed reality whatsoever. Supply is equal to demand, at any given day's market price. It seems to me that the COMEX is more of a "Hologram" or a vaporware image of the real markets. Those who trade futures seldom take delivery. Why should they. Even in those CFTC rules, they consider if it wouldn't be "better, more cost effective, for a trader (wishing delivery) to buy the equivilent metal in the cash/spot market instead. And so, their rules therefore find that questionable. Suspicious. Perhaps manipultive. "Is this trader trying to corner the market?" "Influence prices?" "or what?" Anyway, the Hologram analogy seems appropriate for a market that appears to exist in 3 diminsions, but in fact is just a transparent casino of no actual substance in setting prices. It's just a bunch of idiotic speculation and manipulation and gambling and cheating, endlessly, amongst participants of an endearing everlasting comic strip. And that's not Peanuts. Is it.?. ...Tai  Why this Gold Bull may have Legs -- Giovanni Dioro, 13:54:16 03/26/02 Tue Why this Gold Bull may have Legs -- Giovanni Dioro, 13:54:16 03/26/02 Tue Really this gold bull shouldn't be surprising because the Fed is practicing negative interest rates. Interest rates are well below inflation levels. The last time this happened was around 1994 with gold making a run at $400. Now we all know that inflation numbers are bogus and that inflation is in fact much higher than the manipulated numbers would have ordinary people believe. The proof is in the puddin'. Gold Bull all the way, at least until the Fed starts raising rates in a significant way. This Bull has legs! what are goodwins gold put warrants? -- shell, 12:13:02 03/26/02 Tue see the post 'goodwin turns back on gold'---what are put warrants--is it a bearish move ie a put or a 'conservative bull play?  Germany's Gold -- Giovanni Dioro, 08:58:09 03/26/02 Tue Germany's Gold -- Giovanni Dioro, 08:58:09 03/26/02 Tue I believe in Germany, the govt actually owns the gold, as opposed to america whose gold was stolen by FDR, given to the Fed banksters, and now is long gone. Germany has gold on its books at low costs from pre-70 levels, and germany can realise capital gains by selling their gold, and can thereby help to keep its budget deficits in the range prescribed by european monetary union. Anyone who thinks germany will hold any more gold than what is prescribed by european monetary protocol is kidding themselves, which is why this stale "news" is such a non-event. Germany's gold will move from weak hands (common Volk) to strong hands (banksters and other billionaires). It's like stealing candy from a baby.  Required Reading @ Shell -- Giovanni Dioro, 08:38:55 03/26/02 Tue Required Reading @ Shell -- Giovanni Dioro, 08:38:55 03/26/02 Tue Nice to talk to a fellow reader of hoskins. Yes, I read War Cycles - Peace Cycles about 3 or 4 years ago. One of the best books I have ever read. I downloaded two or three of the Fetelke articles, but my printer isn't working and I haven't read them yet. Hoskins scenario of credit expansion and resulting deflation are more appropriate to a gold standard economy (or silver or other tangible). However to a inherently-worthless fiat-based monetary system it is less appropriate, and the same thing goes for elliott wave theory, in my opinion. For the normal guy he has to pay back his loans, or the bank takes his stuff. However the Fed just prints and prints, and the govt spends and licenses the Fed to do the printing. The govt doesn't have to pay back the Fed, because in fact the Fed is running a usury-racket and should be found at the end of a rope. Hang'em all!  Holidays -- Sharefin, 06:57:35 03/26/02 Tue Holidays -- Sharefin, 06:57:35 03/26/02 Tue I am going away for two weeks of holidays and there's the chance I'll have no internet access so that will mean no posts here. Happy Easter one and all. Cheers Nick More talking out of both sides of mouth -- Sharefin, 06:28:23 03/26/02 Tue German govt denies initiated Buba plan to sell gold, buy shares The Finance Ministry denied suggestions from the German media that the Bundesbank's plan to sell part of its gold reserves and buy blue chip shares was initiated by the ministry. However, a ministry spokesman said any such Bundesbank move would help contribute to the bank's profitability. The spokesman was reacting to comments by Bundesbank president Ernst Welteke that the bank is considering converting a portion of its gold reserves to buy blue chip shares from end-2004. "Any move to do that would have to be done together with the European Central Bank. Any move to convert the gold reserves would increase its profitability," the ministry spokesman said. Financial Times Deutschland said today Welteke's comments on the gold reserves, made in a newspaper interview published yesterday, came after Parliament approved last Friday a new Bundesbank law which largely met Welteke's wishes. It added that a few weeks earlier, the Bundesbank rejected suggestions from the government to sell part of its gold and currency reserves. Gold -- Sharefin, 06:25:59 03/26/02 Tue Gold miner Ashanti doubles profits  Gold -- Sharefin, 06:12:50 03/26/02 Tue Gold -- Sharefin, 06:12:50 03/26/02 Tue WGC Report - PDF File Japan's leading retailer of gold bullion, has reported a ninefold year-on-year increase in gold sales in February, and company officials have suggested that roughly 80% of the purchasers in February were new to the market, and intending to hold the gold for a long period of time. Tanaka did not give specific figures, but WGC estimates that national retail purchases in Japan in February were in the region of 25 tonnes (803,000 ounces). Gold -- Sharefin, 06:10:11 03/26/02 Tue Aurion wants to help polish up gold image Gold miners hope to revamp gold's image as an adornment for old fogies and attract more young jewellery buyers, Australian mining house Aurion Gold Ltd said on Tuesday. Gold miners needed to help in marketing efforts to boost the appeal of gold as a body adornment, creating more demand for the precious metal, Aurion managing director Terry Burgess said. Of total world gold demand of 3,235 tonnes in 2001, jewellery accounted for almost 88 percent, down two percent on 2000, World Gold Council figure show. "There is a perception among some young people that gold is for older people, that only their parents wear gold jewellery," said Burgess, whose company mines about one million ounces of gold a year, making it one of Australia's largest producers. "That perception needs to be changed," he said. Economic hard times also have cut into jewellery sales. The industry-funded World Gold Council was urging producers to support marketing efforts to make gold a must-have item in more jewellery boxes, Burgess told a briefing. Gold prices have retained little of their lustre since falling to a 20-year low of US$251.70 in 1999 from prices above US$400 an ounce in the mid-1990s. Gold was fetching around $297 an ounce on Tuesday. In the past, miners have left marketing of their commodity to the jewellery fabricators and retailers. "We're looking at more involvement," Burgess said. The world's gold miners dig about 2,000 tonnes of gold a year, while consumption runs at around 3,200, suggesting a supply side squeeze looms. While out of favour as a store of value in some financial circles, the world's central banks still hold around 35,000 tonnes of gold. However most of that bullion remains locked in vaults and is categorised as "official reserves" in the sector. Europe's largest central banks have agreed to sell no more than a total of 400 tonnes a year until 2004. The United States also has indicated it is not a seller of gold reserves. The important jewellery sector was hurt by weak consumer confidence and the reduction in tourist travel that followed the September 11 attacks in the United States. Burgess added he would like to see a campaign specifically marketing gold mined in Australia, the world's third largest producer behind South Africa and the United States.  Gold -- Sharefin, 06:07:02 03/26/02 Tue Gold -- Sharefin, 06:07:02 03/26/02 Tue Goodwin turns back on gold Nick Goodwin, an analyst for SG Securities, is recommending investors take flight into gold put warrants rather than staying in gold shares and risking a potentially ruinous retreat by the Johannesburg gold index. South Africa's gold index finished above 2 800 points beating its previous all time record in February. But Goodwin says gold shares are way over-valued and present significant dangers to investors whom he blames for "unprofessional buying". Goodwin's gold pessimism is based on his view that investors are experiencing a bear market which may continue for another 18 months to two years. He believes signals that gold shares are under-valued may start to come through in 2003 or 2004. Gold -- Sharefin, 06:03:38 03/26/02 Tue Gold index soars to six-year high Mix of factors, including higher gold price and rand weakening against dollar, lifts gold firms' share price The gold price hit its highest level since February 8 yesterday, propelling JSE Securities Exchange SA gold shares and lifting the gold index to a six-year high. Speaking out of both sides of your mouth......... -- Sharefin, 06:01:30 03/26/02 Tue German bank chief considers gold sales Bundesbank President Ernst Welteke signalled yesterday that the bank might consider selling part of its gold reserves and reinvesting the proceeds in shares as well as in bonds, reports Reuters from Frankfurt. It was the second time in just over a month that Mr Welteke had suggested the Bundesbank, which with 3,500 tonnes is the world's second-largest official holder of bullion after the US, would sell some of its gold reserves. But it was the first time Mr Welteke had mentioned investing in a stock market portfolio. "In the medium term, we must consider whether we can sell . . . some gold and replace it with securities," Mr Welteke was quoted as saying in yesterday's Frankfurter Allgemeine Zeitung. He said that besides debt issues the Bundesbank could "turn to a mixed portfolio of Euro Stoxx 50 shares and other blue-chip shares". Several central bankers, speaking on condition of anonymity, said they were taken back by Mr Welteke's words since equities were not normally used as an investment vehicle for official reserves. A Bundesbank spokesman separately said the bank did not plan to sell any gold before the current central bank agreement on gold sales expires. "The gold agreement is still in force and we consider it binding," the spokesman said, adding that only after 2004 could a decision be made on future Bundesbank investments. "We certainly have an opinion on that, but we will not make it public," a finance ministry spokesman told a regular German government news conference when asked about the report. "From our side, and that's the important announce-ment, there are no plans to touch the gold reserves," he added. Anglogold -- Sharefin, 05:59:26 03/26/02 Tue Gold imports from Australia witness big jump "Australia has shifted its traditional gold exports from Hong Kong, China and Singapore to the UAE and Dubai, because the former markets are not growing," said Moaz Barakat, Dubai-based regional director of the World Gold Council. "Secondly, Australia also started manufacturing the ten tola bar (TTB), which has a very high demand in Dubai, specially among the people from India, Sri Lanka, Bangladesh and Pakistan." He added that Australia is considered to be the third largest producer of gold worldwide, and regards gold as the second largest source of its national income. Anglogold -- Sharefin, 05:57:34 03/26/02 Tue An object of affection WILL it be love on the rebound for spurned AngloGold? Having lost Normandy, it is not impossible that another Australian suitor, Newcrest, will soon be the new subject of AngloGold's heady affections. Australian gold miner Newcrest has just announced the trebling of its resource base to 29million ounces after a series of studies upgraded its Telfer Mine in north Western Australia. As a result, Telfer will become Australia's largest gold mine when it reaches its production targets, set for 2004. At that point Telfer will be producing more gold than Normandy, currently Australia's largest producer. If AngloGold was prepared to pay nearly $2bn for Normandy, then it's hard to see why it would not be interested in an equivalent ore body currently valued at about half the price. Gold -- Sharefin, 05:54:44 03/26/02 Tue Mahathir proposes gold dinar as currency for international trade Prime Minister Mahathir Mohamad proposed Tuesday that the gold dinar be used for international trade to prevent a repeat of the currency crisis which devastated Asia in 1997-98. The veteran Malaysian premier, who blames "greedy" currency traders for Asia's downfall in the crisis, said paper currency had no intrinsic value, making the exchange rate "arbitrary and subject to manipulation as we saw during the Asian financial crisis." In comparison, the gold dinar had a definite value based on world demand for gold and any fluctuations were minimal, he said. According to Islamic law, the dinar is a specific weight of gold equivalent to 4.3 grams. "The proposal is to make this dinar a currency for international trade only. It is not meant to replace the currency of any country," he said when launching a two-day conference on Islamic capital markets. "The risk of speculation can be reduced to almost nothing. World trade can actually expand because the cost of business will be much reduced as the need to hedge will practically disappear." Outlining details, Mahathir, who is also finance minister, said local gold prices would determine the exchange rate for the local currency against the dinar. "The dinar can be held as central bank reserve. Trade need not be paid in actual dinar but the imports and exports of a pair of trading nations can be balanced and only the difference paid in dinar," he said. To further minimise the need to move the dinar, he said trade surplus or deficit can be credited or debited against future imports or exports. Southeast Asia's longest-serving leader urged developing nations to press for more balanced globalisation and "a check on economic bullying practices" made in the name of free markets and portfolio flows. Mahathir said Islamic countries, which were left behind in the industrial revolution, must now "move with the tide into the information age" to keep pace with advanced nations. "Islam is not and has never been synonymous with conservatism. Islam does not call for rejection of technology or modernity," he said. In Malaysia, the premier said, deposits in the Islamic banking sector had surged to 35.9 billion ringgit (9.5 billion dollars) in 1999, from only 4.9 billion in 1995. Islamic banking assets accounted for only 6.9 percent of total banking assets in 2000 but the sector was targeted to capture at least 20 percent of the banking market share by 2010. Three-quarters of stocks listed on the Kuala Lumpur Stock Exchange are sharia compliant, meaning that they do not offend Islamic principles against such things as gambling and alcohol. Mahathir said Islamic capital markets must introduce indigenous financial products to remain competitive, and not only imitate and adapt from the conventional financial system. He also called for more Islamic financial portals to broaden online trading to keep up with the new economy. Securities Commission chairman Ali Abdul Kadir earlier told the conference that there was a need to woo more investment from more than 100 Islamic equity funds operating globally. Global Islamic investment was estimated to be expanding by 12-15 percent annually, with some one trillion dollars of Middle East funds presently invested in banks worldwide, he added. Predominantly Muslim Malaysia aims to be the key Islamic financial centre in Asia and has drawn up plans to develop the Islamic system under a 10-year capital market blueprint unveiled last year. Thaigold - thanks - couldn't resist snipping this one -- Sharefin, 04:57:54 03/26/02 Tue Silver - Medium term price prediction - Ski I have been following the evolving silver story for the past 19 years or so. Being curious about how high silver prices might go, I began making a list of major market forces that will come to bear on the future POS. The first time I did this exercise I came up with 29 approaching forces. The list has now grown to 44. At the end of this post I will have my conclusion for the medium-term (3 to 7 year time period) POS. Making investment predictions and projections is usually a huge waste of time because almost no-one is ever right. But on the other hand, virtually all investment buying and selling is an exercise in price prediction. We only buy when we expect a price increase and sell when anticipating a general price decrease. No one knows the future POS. However, one can study the individual approaching forces and then make an educated guess as to its impact on the future price. Anyone can make price predictions. However, IMHO supplying the actual data that the prediction was based on is far, far more important. In the spirit of "show me the data" that my prediction is based on, see below: 1. The same PROFESSIONAL DEALERS and INSIDERS that have made so much and done so much structural damage on the downside will surely be positioned to capitalize on the upside. At the least, their personal accounts will be properly positioned. Their activities have not simply been analogous to holding a lifejacket underwater but rather to holding a helium filled balloon underwater. It not only wants to break to the surface but wants to fly to the moon. 2. In a rapifly rising price environment, the process of metal coming to market will SLOW. Why? A DELAYED SHIPMENTwill stand an excellent chance of being worth even more. 3. In a free market, the amount of metal coming to market will have to "overshoot" demand to create at least some SURPLUS. The words "silver deficit" will have to be removed from current literature. A permanent silver deficit is economically impossible in a free market. 4. The practice of "just-in-time" or zero inventory techniques will give way to the old STOCKING-UP MENTALITY for distributors and end users. Why? Survival and price protection. 5. Due to such a long period of low prices there has been a decrease in silver SUBSTITUTION RESEARCH than would otherwise have been the case. 6. Since silver cannot be created, it can only originate from 3 sources: ABOVE GORUND SUPPLIES, re-cyled silver, and mine production. Above ground supplies are apparently nearing exhaustion, leaving only two remaining sources. 3 minus 1 leaves us with only 2 future sources of silver. 7. Silver MINES open and silver mines close. More are CLOSING than opening (usually due to depletion). 8. Beause silver has been priced below its all-in production cost for so long, silver EXPLORATION has practically ceased. The net result is that there are almost no silver projects in the pipeline to activate. Rather than just re-opening shuttered mines, the industry will have to sart from ground zero exploration. I have attended a large mining show for several years running. Gold mining projects are a "dime a dozen" but true silver projects are rare at these shows. 9. Once a discovery is made, a mining project must advance through a series of pre-production steps before the first ounce is produced. In-fill drilling, feasibility studies, permitting, project financing, infrastructure construction and the like. Because silver has been priced below its production cost for so long, DEVELOPMENT and ADVANCEMENT phases of silver projects has practically ceased. 10. Around 75% of mined silver originates from by-product base metal mining. A deepening RECESSION, particularly in manufacturing, will dampen the demand for base metals resulting in decreased overall silver production. (I have yet to see any sustained data that supports the end of the recession/depression.) 11. Any ANXIETY BASED CRISIS that comes along will boost demand. Stock market, holy war, oil shock, civil unrest, defaults, currency crisis etc. Our war on terriorism has just begun. When, where, and how will THEY strike next? 12. Higher ENERGY PRICES and OTHER PRODUCTION COSTS are here stay. The process of mining, smelting, transporting and refining require huge amounts of energy and effort. Higher production costs necessitate higher commodity costs. 13. Presently the PAPER COMMODITY PRICE is determining physical silver price. A price jolt will occur when prices begin to be set by physical availability. 14. Large quantities of silver have been LEASED into the world market. During this process, silver that is BORROWED (leased) is actuall SOLD into the physical market, depressing prices. As falling prices reverse or the supply of lease silver evaporates, this prevailing negative counterforce will end. Leasing, while the POS is rising is like holding your hand in a fire. 15. In most cases there will be a legal and/or contractual obligation to RETURN LEASED SILVER to the lenders. This force will ADD to the demand side of the equation. 16. Metal LEASE RATES have averaged near historically low levels. A sustained period of rising lease rates will increase the incentive to return borrowed metal from an ever-shrinking physical pool. 17. A huge PAPER SHORT POSITION has depressed prices. When prices begin to rise in earnest, many short sellers will switch to becoming buyers. To close out a short position, a short must deliver physical silver or buy out their contracts if so allowed. 18. A percentage of FORWARD SELLING MINERS will repay their metal loans with phsical silver thus removing those ounces from the grasp of the marketplace and increasing the shortage. 19. A percentage of UNDERWATER HEDGED INERS may slowproduction, close down, or go bankrupt. Because they will owe so much while being denied the profit from higher prices, they will have little remaining incentive to produce silver. 20. LEGAL attacks and LAWSUITS by a wide range of parties will be launched that will effectively curtail some production. Lawsuits by two or more of the following parties will be commonplace. Auditors, bankers, bullion banks, central bankers, commodity houses, counter parties, depositors, employees, government agencies, hedge funds, individuals, insurance companies, lessees, lessors, management, mining copanies, regulators, shareholders, speculators, third parties, and users. 21. When the STRONG DOLLAR falls as expected, it will take more dollars to buy the equivalent amount of silver from foreign producers. 22. When supplies are exhausted and prices skyrocket, GOVERNMENT will be expected to "do something". The usual, counerproductive answer is to interfere and regulate. In economic circles, it is a well-established fact that when anything is regulated, you get less of it. 23. The RULES that the COMEX and Commodity Futures Trading Commission (CFTC) presently operate by could be described as liberal to the exteme and have contributed to depressed metal prices. More rigid and restrictive RULE CHANGES should be anticipated. 24. In a free market, INFLATIONARY FORCES are enevenly manifest in different economic sectors. One day it's Nevada land prices. The next day it's the price of milk. The long term price of silver has gone nowhere for several years which seems to indicate that price inflation has not yet been properly priced into the commodity. 25. For eons the US GOVERNMENT has been a silver supplier. They are now apparently at the cusp of being out of supply and will how have to enter the market as buyers; an effecive double whammy for silver price. 26. During most market conditions, ASTUTE INVESTORS do not try to pick bottoms. Rather, the preferred technique is to wait until an apparent bottom can be observed before big positions are initiated. With silver fundamentals as well known as they are, you can be assured that there are huge amounts of investment money poised to enter this arena once a technical turnaround is apparent. 27. A certain percentage of investors will be attraced to silver for only one reason, BECAUSE ITS GOING UP. Like a moth attracted to light, these momentum investors will want to jump on the bandwagon. 28. Because of the INTERNET etc., the world will quickly be alerted to what is happening and why. They will want their piece of the action. 29. The total silver MARKET IS TINY. It would take perhaps $10 billion to buy all the remaining physical silver and silver mining stock in the world at today's prices. 30. Mutual funds and other institutional players are grossly underrepresented in ownership of PM socks and physical. If and when these investors simply REBALANCE their PORTFOLIOS to include silver, it will result in a tidal wave of demand for this tiny market segment. 31. Virtually every US and world citizen already has a WORKING KNOWLEDGE of what silver is. We're not talking semiconductors, megabites, export quotas, or quasars where the learning curve is extreme. When silver begins to get world attention, this residual, in-place knowledge will grease the skids for the novice participation. 32. In the coming economic environment, precious metals may be one of the few investment areas making established up-trends. Individuals, businesses, mutual funds, pension funds and hedge funds who WOULD NOT DREAM OF INVESTING IN METALS today may have few other choices. 33. Silver may be the most versatile metal of all. NEW USES are constantly being discovered in a very immense range of applications. 34. SUPERCONDUCTIVITY technology as applied to electricity transmission efficiency will increase silver demand. (On one hand this is just a repeat of "new uses" for silver being discovered. However the amount of silver that this area may use is so relatively high, that it merits ts own place on this list.) 35. Increased use in automobile battery manufacture as they evolve into ELECTRIC GAS HYBRIDS for mandated greater fuel efficiency. 36. The % of SILVER BULLS is historically low. When prices begin to rise, newsletter writers and their readership will join the party by buying. 37. The more taxes rise (the overall trend has always been up), the more people will seek ways to keep the govenment out of their pockets. Silver is one of the few remaining alternatives left in this area. 38. In a growing environment of envy & financial distress, the NON-REPORTABILITY advantages of silver will enhance its demand. 39. If a mineral is found in great abundance in the earth's crust, depletion will never be a real issue. But a silver occurrence is an extremely rare event. Therefore, every day that a silver mine is in production it is one day closer to its closing date due to REAL DEPLETION. "They ain't making any more." 40. In broad geologic terms, the deeper you go in a gold mine, the richer the ore deposit becomes. Silver is the opposite. The deeper you go in a silver mine, the lower the grade of ore. To state this PERCENTAGE DEPLETION another way, because silver deposits are found near surface, they have already been found and mined out. 41. At this point in the business cycle, there is a very high level of conidence in paper or fiat, especially the US dollar. This cycle can be expected to change. The result will be INCREASED TRANSFER OF PAPER WEALTH to PM'S. 42. There are presently no PM backed currencies in the world. Yet, the history of currency shows us that all paper currencies eventualy crash. A SILVER BACKED CURRENCY is ust a matter of time. The discussion phase has already begun in some quarters. 43. For many reasons, we have not had a pure and free market in world silver since the US began supporting the price and supply in the late 1800's. This artificial intervention is finally coming to an end. 44. In world markets, virtually all stocks and commodities go from being under priced to being overpriced and back again. There is no reason to believe that the POS will stop rising when it reaches its EQUILIBRIUM PRICE. What forces might contribute to lower silver prices? 1. In a high price environment, some jewelry, tableware, silver coins and the like will come out of hiding. Is thought that much of this silver is long gone. Most people don't own any silver to sell and have never seen a real silver coin. 2. With higher prices, STERLING SILVERWARE and TABLE ITEMS will be too costly and many potential buyers will be priced out of the market. 3. Sales of silver JEWELERY that is now being sold at your local shopping mall and flea markets will practically vanish. However investment demand can be expected to take its place. 4. High prices will cause end users to attempt to MINIMIZE USAGE by any means available. 5. A RECESSION or DEPRESSION will result in less industrial silver demand. (This force may be off-set by decreased by-product mining.) 6. During a silver shortage, fewer and fewer retail outlets (coin shops) will have avaiable silver for distribution. If some potential buyers are not able to satisfy their demand, potential maximum demand will be reduced. So there you have the data that I have used to make my MEDIUM-TERM SILVER PRICE PREDICTION. I believe that in the 3 to 7 year time frame, the price of silver will exceed the price of gold.[end] Comment: I seem to remember saying the same thing a few days ago, that the price of silver will exceed the price of gold [for a window of time] . . . . friends just contemplate that scenario for a moment. Ooops... That Ted Butler Link may not work... -- ThaiGold, 21:23:40 03/25/02 Mon ...if your browser has javascript enabled, you'll get a "404" not-found error message. Try this Link instead, and read note about the java quirk.. http://OS2Eagle.Net/r.htm Silver -- Ted Butler's Latest... -- ThaiGold, 20:09:19 03/25/02 Mon Nick, here's a scoop for all your Silver Enthusiasts... Ted Butler just posted his latest complaint letter to the CFTC at EagleRanch. The link below, is that post. There followed some additional posts that may be of interest to SilverBugs too... Tai http://216.234.182.183/members/eagleranch/index.php?read=7101 Gold -- Sharefin, 18:18:39 03/25/02 Mon Prophesies of Mahendra Sharma ------------------- Seems that Mahendra is a new convert to the goldbug religion. Isn't he claiming the same thing that goldbugs have claimed these last few years? Gold columnists are doubling their prices as new ones are attempting to go to print. Seems like ever trick will be coming out of the woodwork. Profits for the shady..... giovanni -- shell, 18:15:54 03/25/02 Mon i agree as to probable actual outcome--private deflation, gov't. inflation when you said 'babylonian' reminded me i just read 'war cycles, peace cycles' by hoskins; and fekete's articles---curious whether you had too Gold -- Sharefin, 18:15:24 03/25/02 Mon COMEX gold holding in new higher range early COMEX gold was was holding firm above $295 an ounce early on Monday but lost momentum from Friday's New York rally, as top German central banker Ernst Welteke revived the worrisome topic of Bundesbank gold sales. But gold was capped after Welteke, the Bundesbank president and a council member of the European Central Bank, was quoted in an interview with newspaper Frankfurter Allgemeine Zeitung saying he could not rule out the Bundesbank converting some of its 3,500 tonnes of gold reserves into other securities. "Everyone was so bullish on Friday, now it seems this Bundesbank announcement has kind of taken out some of the steam, some the air beneath the wings," said a bullion dealer. "You've got to think in this dead market $295-$300 will be the range, particularly with that announcement," he said. Welteke's comments echoed his remarks five weeks ago and dealers say that the Bundesbank's hand are tied by the 1999 agreement among European central banks to sell no more than 400 tonnes a year at least until September 2004. Britain recently wrapped up its disposals program under the so-called Washington Agreement on Gold, leaving Switzerland and the Netherlands as the main sellers. It is not clear if Switzerland -- which is quietly selling about 1 tonne of bullion per day as it slowly reduces its reserves by half to about 1,300 tonnes -- will increase its sales to fill the void left by Britain or if another nation will take up the slack. Some see no scope for the Bundesbank to start selling until after Sept 2004, when the agreement will either expire or, more probably, be extended in some form. Gold -- Sharefin, 17:59:40 03/25/02 Mon Local gold miners (SA) are on the prowl in Australia Gold -- Sharefin, 17:58:15 03/25/02 Mon Gold nears $US300 again |